ImpulsiveWaveTrading

@t_ImpulsiveWaveTrading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ImpulsiveWaveTrading

ImpulsiveWaveTrading

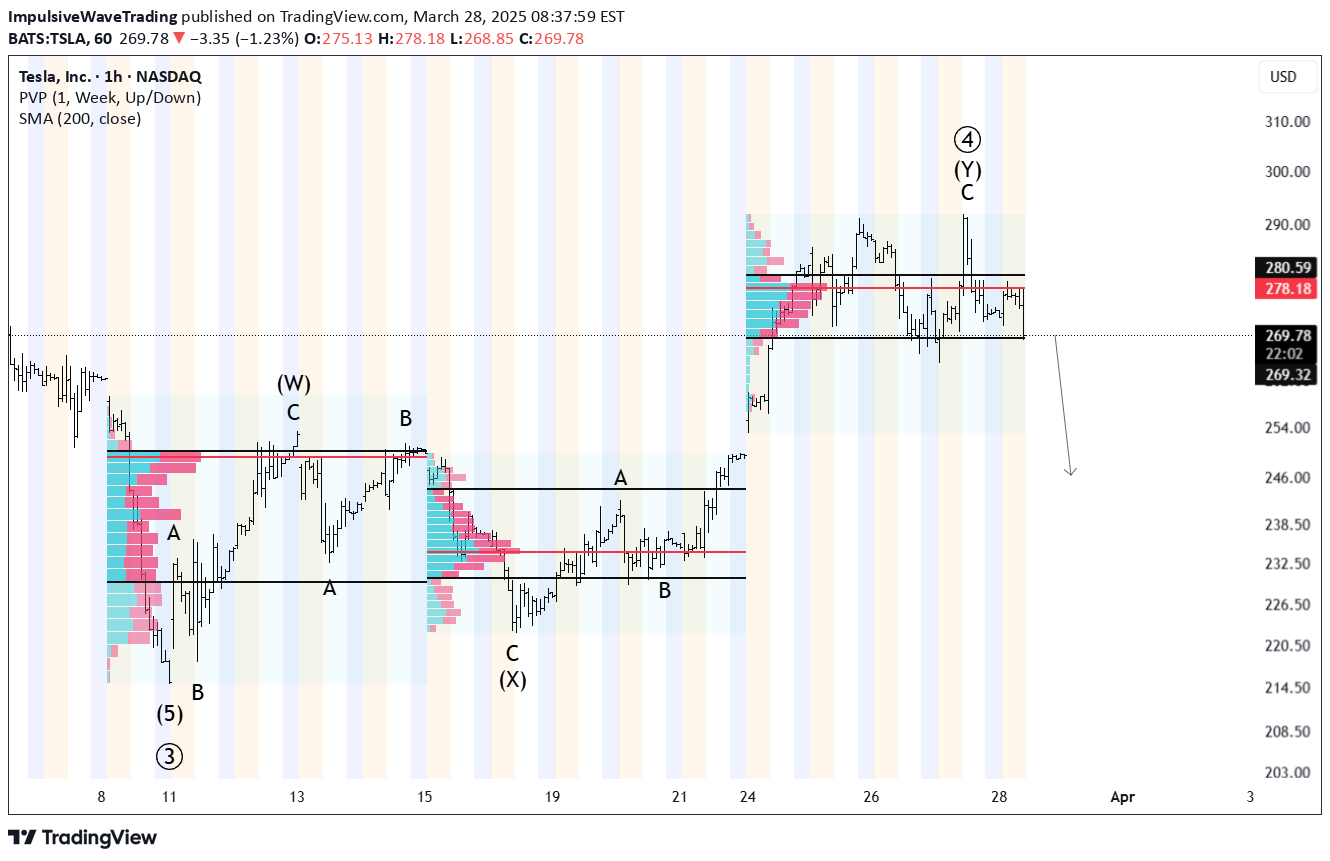

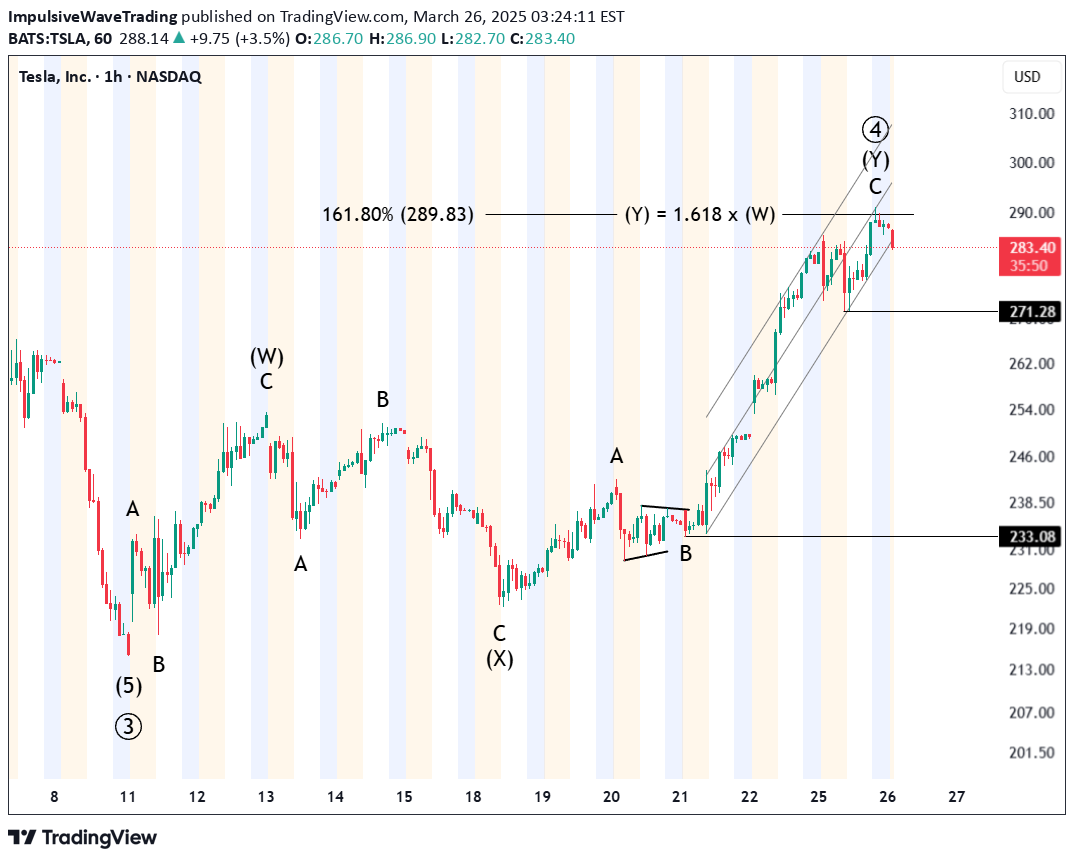

$TSLA - Weakness Persists Ahead of Earnings.

TSLA : The stock failed to recover last week and registered consistently lower swing highs. Unless we see a decisive breach of $250, lower lows are on the table.TSLA - Must print above 274.68 to rule out this bearish triangle scenario. The post-earning move will clear out the picture. Whatever rallies we get in the past days will be short-lived and not the start of a new uptrend.

ImpulsiveWaveTrading

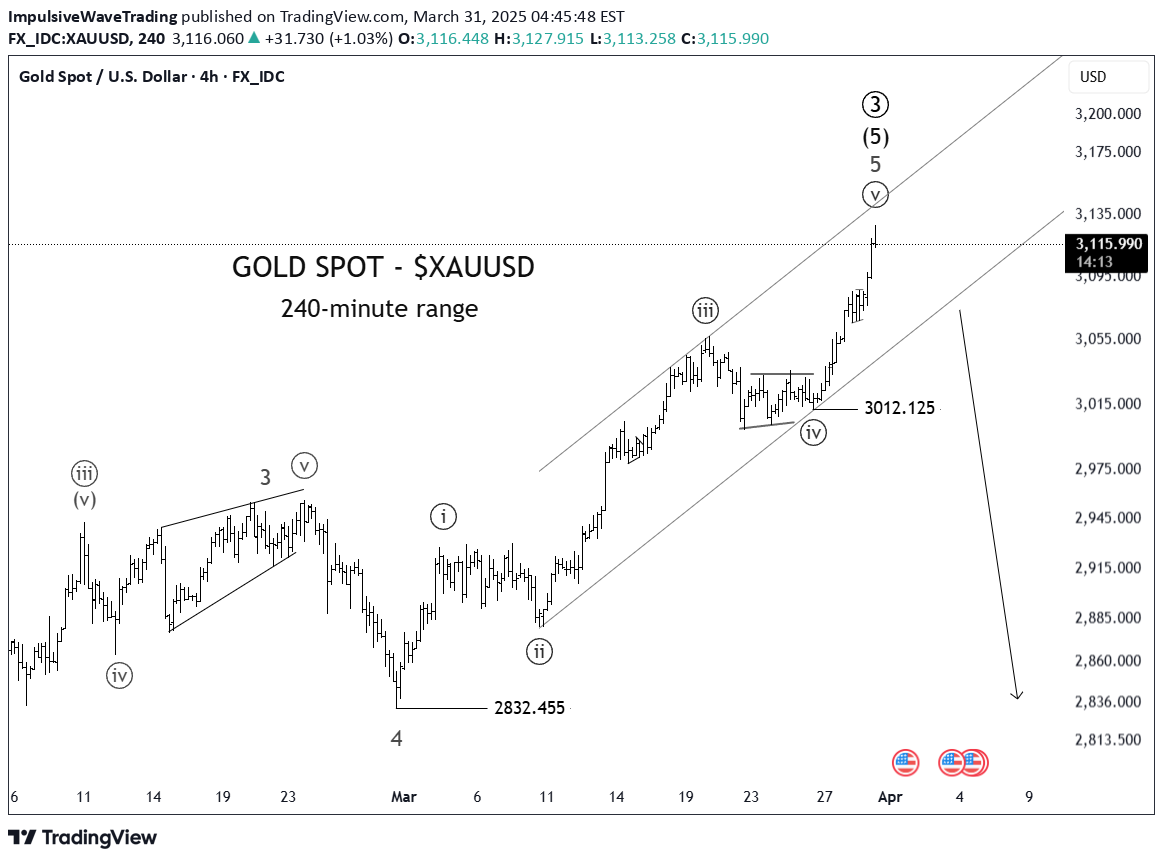

$XAUUSD - An Ending Diagonal Pattern..

Potential Peak in place following a completed five-wave advance with an ending diagonal in the fifth-wave position. The uptrend has indeed entered its mature stage.The short-term pattern invalidated however the mature uptrend reached its peak and the current pullback is satisfactory. We expect a corrective rebound to set the stage for a one more leg down towards 3000 - 2800 range.

ImpulsiveWaveTrading

$XAUUSD - Peaked; Ready For a Pullback!

XAUUSD - The higher degree wave ((3)) from the weekly timeframe has peaked. Trading out of the channel's lower boundary and then below 3012 will be additional bearish evidence a larger wave ((4)) is in play.XAUUSD - Trading below the channel's lower boundary will be additional evidence a larger correction in wave ((4)) is underway.

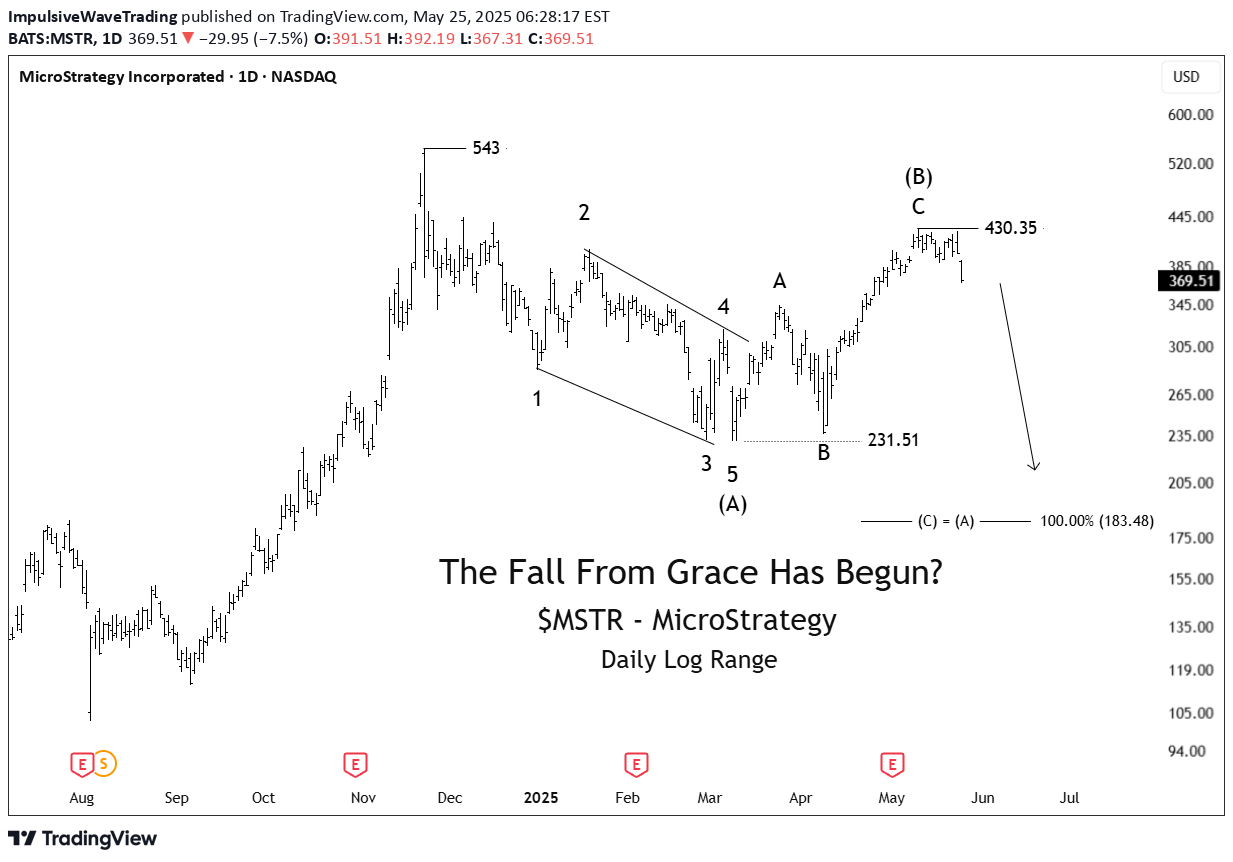

ImpulsiveWaveTrading

$TSLA - A Sustained Breach of $269 Opens the Path for A Gap Fill

TSLA - TSLA - A sustained breach of $269 opens the path for a gap fill towards 250-244.TSLA - 269 is taken out and price is trading below. If we get a 4-h / D close below this level that Tesla will aim for gap fill at 250 next.TSLA - Gap is filled. Bearish outlook will continue against 290 but the scope of the analysis was to show the gap-fill goal.

ImpulsiveWaveTrading

$XAUUSD - Real-Time Wave Counting Analysis

XAUUSD - Quick discussion on the post-triangle thrust rally; ideal target and the line in the sand.#Disclaimer - This analysis is for educational purposes only and should not be construed as trading or investing advice.

ImpulsiveWaveTrading

$QQQ - All eyes on the $472.88 Low

QQQ - The rally off of the lows has been in three waves thus far. For the downtrend to continue, price must take out 472.88 . If not, the market could unfold a double zigzag or a more bullish scenario, i.e. a 1-2/i-ii setup.QQQ - With 472.88 taken out, we have confirmation the rally was in three waves. Lower lows next unless it turns into a larger Flat or Double Zigzag which will simply prolong the inevitable.QQQ - Lower lows remains the goal as long as 472.88 stays intact and act as resistance.

ImpulsiveWaveTrading

$XAUUSD - Net Volume Observation

XAUUSD - In a nutshell, the net session volume should stay above the 0 line for the buyers to continue pushing prices higher.

ImpulsiveWaveTrading

$XAUUSD - A Text-Book Post-Triangle Thrust In Play..

XAUUSD - A barrier triangle wave ((iv)) likely done at 3012. The post-triangle thrust will see price above the previous high.XAUUSD - Looking for at least 3076 which is the 61.8% Fibo relationship between ((v)) and ((i)).XAUUSD - With 3076 being tested, the trade is nearing its end. Current pullbacks must avoid overlap with 3058 to keep the wave ((v)) going for another run close to 3100. Should the overlap occur then expect larger drops over the coming days.XAUUSD - A beautiful thrust that has reached the ideal target at 3116. Done for now.

ImpulsiveWaveTrading

$TSLA - Lower against 290

TSLA has completed an ideal double zigzag rally from the lows. Breaking below 271.28 will open the path for a larger down move; however, lower lows will be confirmed upon a breach of the 233 handle.TSLA - 271.28 is taken out. Next up we've got the gap at around 250.TSLA - The strong rebound from circa 271 requires us to remain on the sidelines. Trade is partially successful.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.