Harlequin_FX

@t_Harlequin_FX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Harlequin_FX

28 Aug - Risky

I am still bullish but trust that a pullback will happen. This is risky Updated plan BUY: near 3385 BUY: near 3374 SELL: near 3409 SELL: near 3420

Harlequin_FX

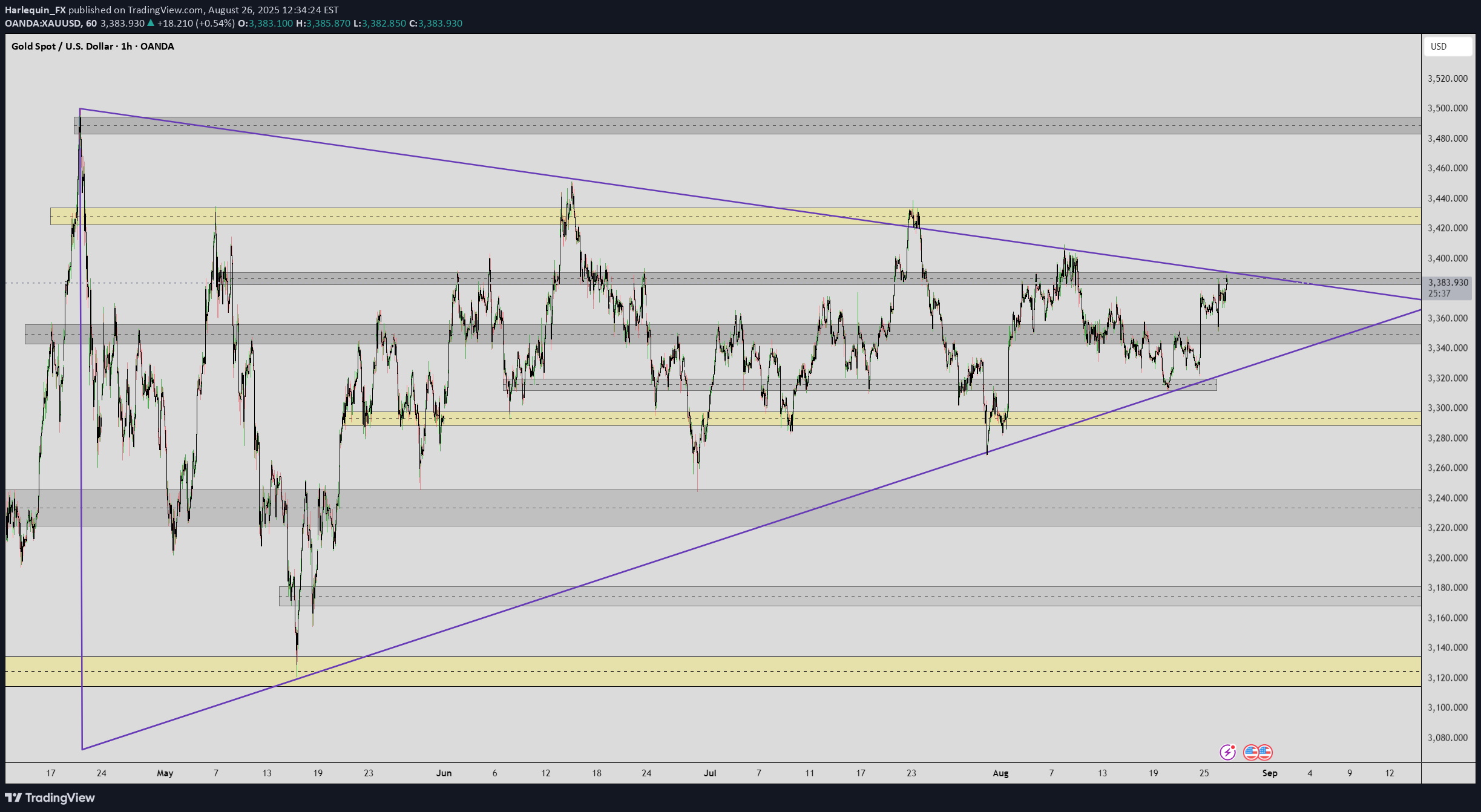

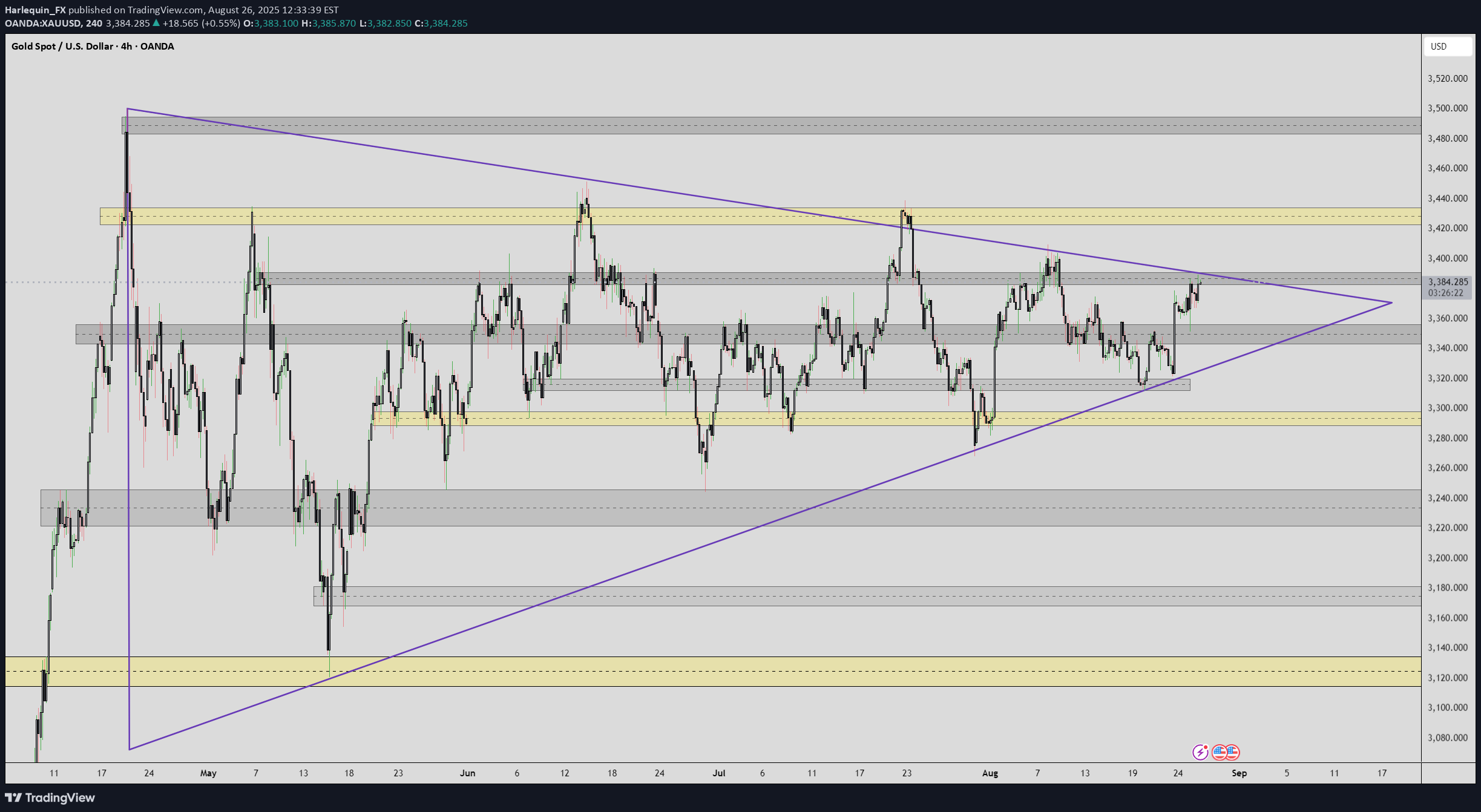

26 Aug

Gold is still running the pattern, waiting for something to trigger it. Possible breakout coming

Harlequin_FX

26 Aug

Gold is still running the pattern, waiting for something to trigger it. Possible breakout coming

Harlequin_FX

14 May - Bullish

The blue line is possible, but my current plan is the orange line. I believe we will see bullish movement, and I will then be looking for sells near 3270 & 3285

Harlequin_FX

12 April - Still Bullish

Movement is still very bullish, and there is no reason price will not continue going up. I do see the need for a retracement. This is not a prediction, but technical analysis possibility.

Harlequin_FX

12 April - Still Bullish

Movement is still very bullish, and there is no reason price will not continue going up. I do see the need for a retracement. This is not a prediction, but technical analysis possibility.

Harlequin_FX

12 April - Still Bullish

Movement is still very bullish, and there is no reason price will not continue going up. I do see the need for a retracement. This is not a prediction, but technical analysis possibility.

Harlequin_FX

01 Apr - Sell then buy

I am selling, and will be looking for buys at the indicated levels

Harlequin_FX

25 March - Levels

These are my buy and sell levels for today. I shows the critical levels, but NY session will determine the movement between these levels460pip day so farTrade is still running to predictionNo volume left

Harlequin_FX

23 March - Long

There is still a 1D GAP that needs to be filled. I trust the GAP will get filled and then bullish momentum will continue to 3075Still going as planned. But 3000 level is my short term target, and hoping for 2986

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.