Goldviewfx

@t_Goldviewfx

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Goldviewfx

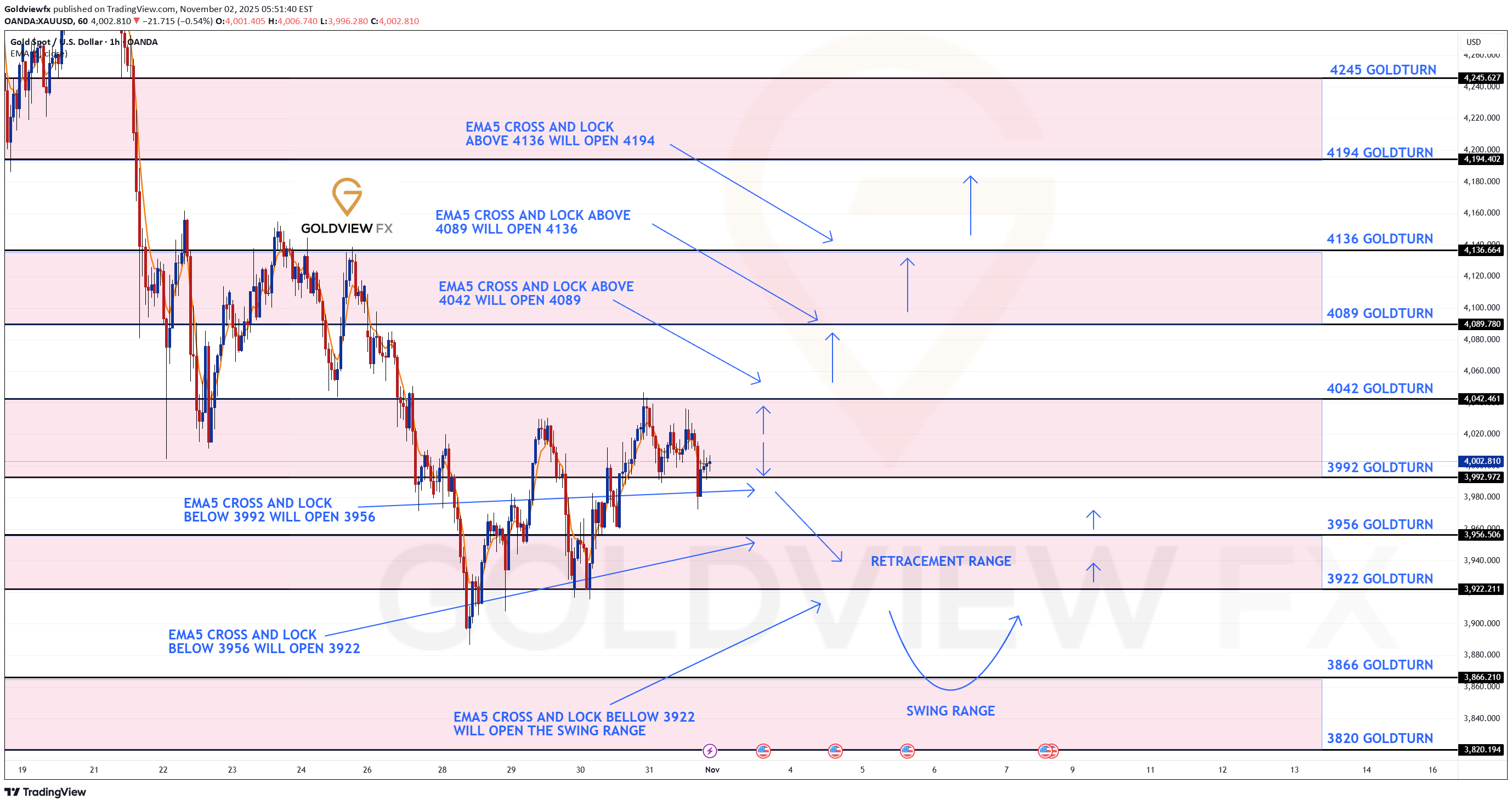

نقشه راه طلا (XAUUSD) یک ساعته: برنامه معاملاتی هفته جدید با اهداف صعودی و نزولی دقیق

Hey Everyone, Please see our updated 1h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4114 and a gap below at 4057. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4114 EMA5 CROSS AND LOCK ABOVE 4114 WILL OPEN THE FOLLOWING BULLISH TARGETS 4175 EMA5 CROSS AND LOCK ABOVE 4175 WILL OPEN THE FOLLOWING BULLISH TARGET 4232 EMA5 CROSS AND LOCK ABOVE 4232 WILL OPEN THE FOLLOWING BULLISH TARGET 4289 EMA5 CROSS AND LOCK ABOVE 4289 WILL OPEN THE FOLLOWING BULLISH TARGET 4361 BEARISH TARGETS 4057 EMA5 CROSS AND LOCK BELOW 4057 WILL OPEN THE FOLLOWING BEARISH TARGET 4006 EMA5 CROSS AND LOCK BELOW 4006 WILL OPEN THE FOLLOWING BEARISH TARGET 3965 EMA5 CROSS AND LOCK BELOW 3965 WILL OPEN THE SWING RANGE 3923 3861 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFXHey everyone, Please see update on our 1H chart idea. Price is ranging between 4114 Goldturn resistance and 4057 Goldturn support. We started the week with completing our bearish target without an EMA5 lock, which is why we’ve seen multiple weighted bounces off this level. As long as this support holds and we don’t get a cross and lock below it, we should expect the bullish gap to complete as well. I’ll keep you all updated as the chart continues to develop. Mr Gold

Goldviewfx

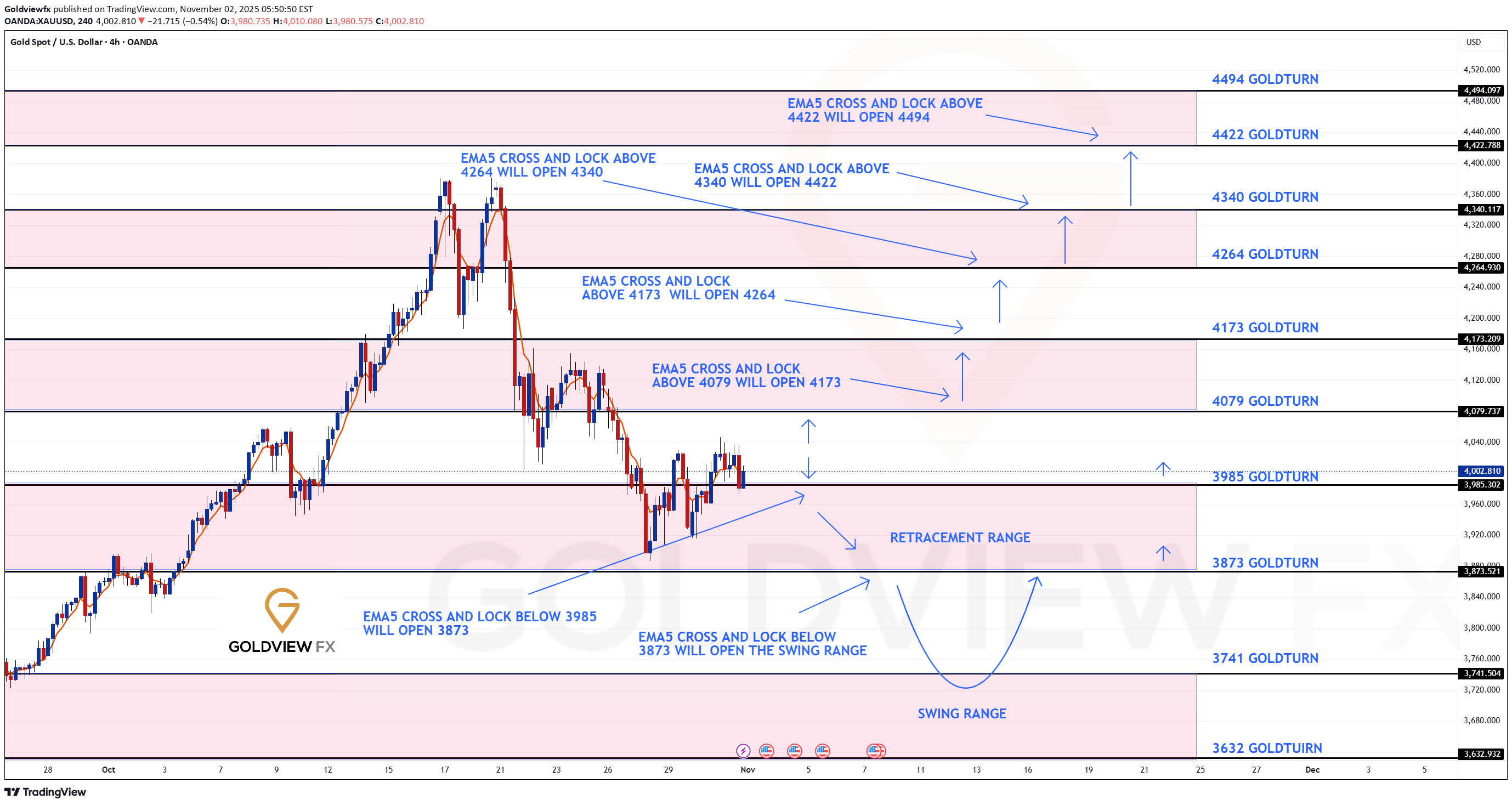

نقشه راه طلا (XAUUSD): تحلیل 4 ساعته و برنامه معاملاتی هفتگی (حمایت و مقاومت کلیدی)

Hey Everyone, Please see our updated 4h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4124 and a gap below at 4042. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4124 EMA5 CROSS AND LOCK ABOVE 4124 WILL OPEN THE FOLLOWING BULLISH TARGETS 4212 EMA5 CROSS AND LOCK ABOVE 4212 WILL OPEN THE FOLLOWING BULLISH TARGET 4328 EMA5 CROSS AND LOCK ABOVE 4328 WILL OPEN THE FOLLOWING BULLISH TARGET 4422 EMA5 CROSS AND LOCK ABOVE 4422 WILL OPEN THE FOLLOWING BULLISH TARGET 4422 EMA5 CROSS AND LOCK ABOVE 4422 WILL OPEN THE FOLLOWING BULLISH TARGET 4494 BEARISH TARGETS 4042 EMA5 CROSS AND LOCK BELOW 4042WILL OPEN THE FOLLOWING BEARISH TARGET 3964 EMA5 CROSS AND LOCK BELOW 3964 WILL OPEN THE FOLLOWING BEARISH TARGET 3873 EMA5 CROSS AND LOCK BELOW 3873 WILL OPEN THE SWING RANGE 3767 3646 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFX

Goldviewfx

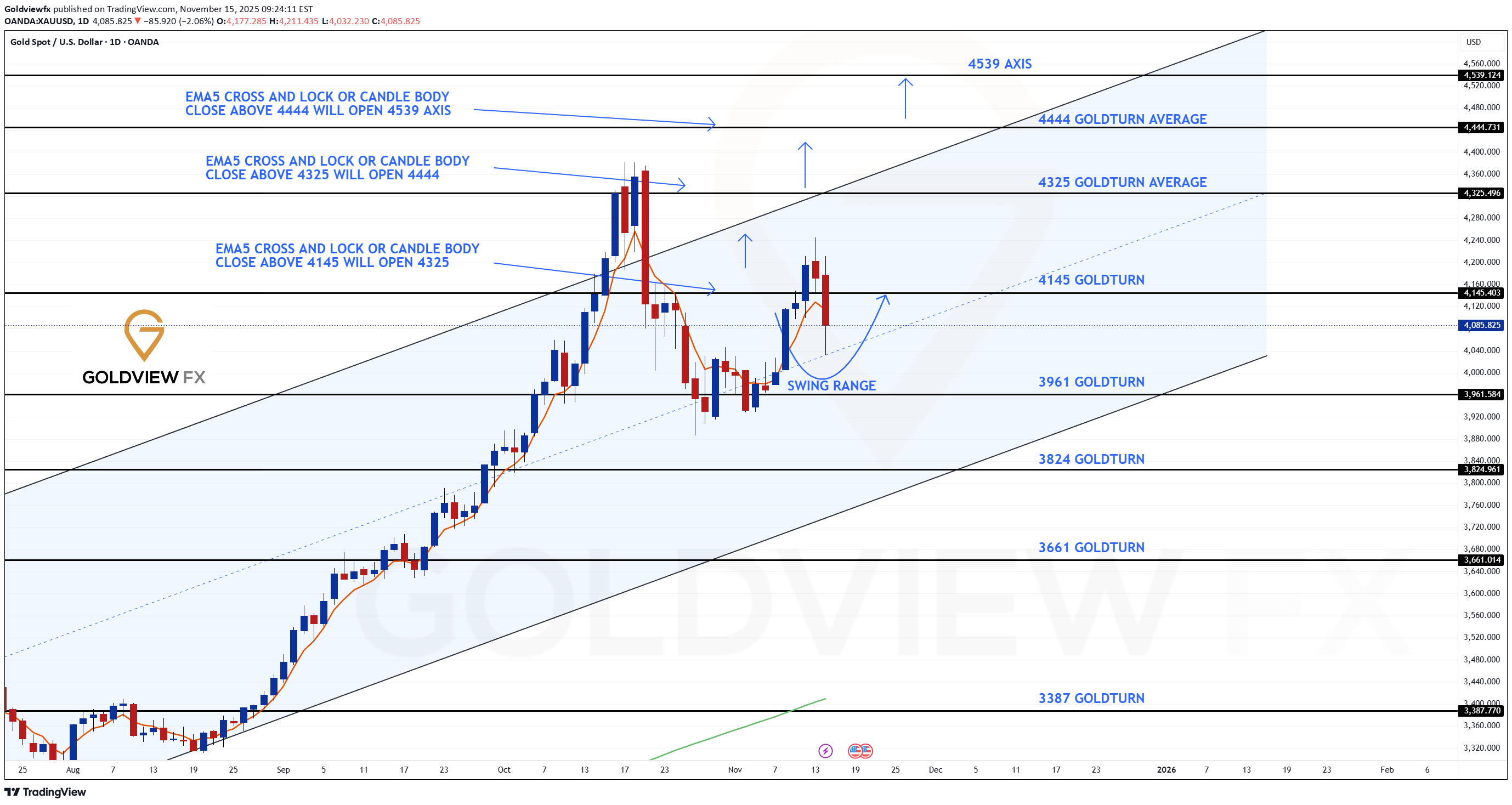

نقشه راه روزانه طلا: کلید فتح قله ۴۳۲۵ کجاست؟

Hey everyone, Here’s the Daily Chart idea we’ve been tracking. The swing move into 4145 has now produced a candle body close above that level, which keeps the long term gap open toward 4325. We also saw a rejection with a candle body close below 4145, leaving 3165 open beneath. However, note that this rejection touched the channel half line, which based on our uniquely drawn goldturn channel typically provides strong support. We’re seeing that support play out now with a bounce off the half-line. At the moment, our key levels are: Primary support: Channel half-line Secondary support: 3961 Primary resistance: 4145 Long range gap target: 4325, which becomes more significant if we see the EMA5 cross and hold above 4145. We’ll keep everyone updated as the week progresses. Mr Gold GoldViewFX

Goldviewfx

نقشه راه هفتگی طلا: از کف حمایتی تا قله مقاومت (بررسی میانمدت و بلندمدت)

Hey everyone, Please see our weekly chart timeframe Routemap and Trading plans for the week ahead. After securing 4059 last week, we now have a long range candle body close gap above at 4294, with 4059 acting as support. We can expect price action to play between these two levels. A further EMA5 cross and lock above 4059 will strengthen the gap toward 4294. Conversely, a candle body close back below 4059 would reopen the broader retracement range. We’ll keep these long timeframe structures in mind as we continue with our plan to buy dips. We will keep you all updated as this chart idea unfolds. Mr Gold

Goldviewfx

نقشه راه و استراتژی معاملاتی هفتگی طلا (تحلیل 1 ساعته بهروز شده)

Hey Everyone, Please see our updated 1h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4027 and a gap below at 3992. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4027 EMA5 CROSS AND LOCK ABOVE 4027 WILL OPEN THE FOLLOWING BULLISH TARGETS 4073 EMA5 CROSS AND LOCK ABOVE 4073 WILL OPEN THE FOLLOWING BULLISH TARGET 4114 EMA5 CROSS AND LOCK ABOVE 4114 WILL OPEN THE FOLLOWING BULLISH TARGET 4151 EMA5 CROSS AND LOCK ABOVE 4151 WILL OPEN THE FOLLOWING BULLISH TARGET 4199 BEARISH TARGETS 3992 EMA5 CROSS AND LOCK BELOW 3992 WILL OPEN THE FOLLOWING BEARISH TARGET 3956 EMA5 CROSS AND LOCK BELOW 3956 WILL OPEN THE FOLLOWING BEARISH TARGET 3922 EMA5 CROSS AND LOCK BELOW 3922 WILL OPEN THE SWING RANGE 3866 3820 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFXHey everyone, Great start to the week with our 1H chart idea playing out exactly as analysed. We began with our bullish target of 4027, which was hit, followed by the EMA5 cross and lock opening 4073 Goldturn, also achieved today, completing this range perfectly. Now we’re seeing a cross and lock above 4073, leaving 4114 open as the next potential target. We’ll continue to track the movement and use lower Goldturn supports to buy dips in line with our trading plan. Stay tuned, we’ll keep updating you throughout the week as our chart ideas unfold across all timeframes. Mr GoldHey Everyone, Please see the follow up update on our 1H chart idea, which has been playing out beautifully. After completing our bullish targets earlier this week at 4027 and 4073, we confirmed an EMA5 cross and lock, opening up the 4114 level. This target was hit perfectly, followed by another cross and lock above 4114, which opened the 4151 target, which was completed today. We are now aiming for the final gap at 4199 to complete this chart idea. Absolutely smashed this one! We will now move to our 4H chart idea to continue tracking the movement for the remainder of the week. Mr Gold

Goldviewfx

نقشه راه طلا (4 ساعته): استراتژی معاملاتی هفته آینده و اهداف کلیدی صعودی/نزولی

Hey Everyone, Please see our updated 4h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4042 and a gap below at 3964. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4042 EMA5 CROSS AND LOCK ABOVE 4042 WILL OPEN THE FOLLOWING BULLISH TARGETS 4147 EMA5 CROSS AND LOCK ABOVE 4147 WILL OPEN THE FOLLOWING BULLISH TARGET 4264 EMA5 CROSS AND LOCK ABOVE 4264 WILL OPEN THE FOLLOWING BULLISH TARGET 4340 EMA5 CROSS AND LOCK ABOVE 4340 WILL OPEN THE FOLLOWING BULLISH TARGET 4422 EMA5 CROSS AND LOCK ABOVE 4422 WILL OPEN THE FOLLOWING BULLISH TARGET 4494 BEARISH TARGETS 3964 EMA5 CROSS AND LOCK BELOW 3964 WILL OPEN THE FOLLOWING BEARISH TARGET 3873 EMA5 CROSS AND LOCK BELOW 3873 WILL OPEN THE SWING RANGE 3741 3632 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFX

Goldviewfx

نقشه راه نمودار روزانه طلا: سطوح کلیدی حمایت و مقاومت جدید طلا را اینجا ببینید!

Hey everyone, Please review our Daily Chart Route Map, now featuring updated levels for tracking Golds movement. We continue to track our refreshed proprietary Goldturn Channel, our unique method for constructing ascending channels. Price action is now testing the swing range and the swing range seems to be holding support as expected. This swing range support also falls inline with the channel half line providing stronger support. As long as ema5 remains above the swing zone we expect price to play between this range until the full updated long term swing is completed into 4145. An ema5 break below the swing range will open the lower channel floor for test, currently sitting at 3824 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFXHey everyone, After completing our 1H chart idea please now see update on our Daily chart idea. In this chart, we highlighted the swing range and noted that we would look for the swing into 4145. This played out perfectly, with the EMA5 staying above the swing range, confirming the support and the bounce all the way into 4145 just as we expected. We now have a candle body close above 4145, opening the gap to 4325. We will need an EMA5 cross and lock to further confirm this move. As always, we will keep you all updated as the chart ideas unfold. Mr Gold

Goldviewfx

فلسفه معاملهگری: چطور فقط با خرید در موجهای اصلاحی سود کنید؟

Hey Everyone, Here at GVFX, we are currently buying dips. What that means is that we buy on the dips and therefore only concentrate on long positions/buys. As mentioned before, having both sell and buy positions open in your account will affect your psychology and in turn, your trading decisions. Now a question that typically arises here is why would it still be advisable to buy when the market is pushing down? Firstly, let me assure you that the same algorithms, experience and strategies that we use with our bullish directional bias also gives us the heads up, or down if you will, on when the market is going down. Don't think for a moment that we only know how to analyse a bull market or up trends. We share trade ideas for both Bullish and Bearish moves but choose not to hedge out of choice. In my experience, it is much safer to get out of a stuck buy position than a stuck sell position. That's not to mention the clean PSYCHOLOGICAL PROFILE that is achieved when trading in just one direction. And although hedging can in theory work, it requires years of experience and in the end, is simply not worth the effort and psychological stress. Let us look at an example of the current short/mid term trend to further highlight this point. When you have short-term bearish momentum down, we take buys from key supports or MAs which act as dips. Remember that the market does not go up or down in a straight line (with the rare exception of short-lived parabolic moves). So, when the market is going down and hits one of our key levels, a buy from that point will go back up for 30 to 40 pips (this number of pips has been calibrated based on back testing) before resuming back down. You can think of it like this. The market moves in a zigzag manner. The zig is that part of the leg which is going down to create lower lows (if the downward trend is continuing). The zag is that part of the leg which takes a breather and pushes back up with momentum for our entry and quick pip-take range to create a lower high (if the downward trend is continuing) before heading back down again. We catch the right and safest waves (buys) in and out and surf to success. When price hits a key structural support or stops creating lower lows and lower highs, we then reassess for entries with a wider range of pip capture. Hope this post helps our followers to understand how we ride waves by staying committed to one direction in order to always fall naturally into the wave rather then chasing a wave!! GoldViewFX

Goldviewfx

نقشه راه طلای هفتگی: سطوح کلیدی، اهداف صعودی و نزولی جدید (تحلیل 1 ساعته)

Hey Everyone, Please see our updated 1h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4042 and a gap below at 3992. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4042 EMA5 CROSS AND LOCK ABOVE 4042 WILL OPEN THE FOLLOWING BULLISH TARGETS 4089 EMA5 CROSS AND LOCK ABOVE 4089 WILL OPEN THE FOLLOWING BULLISH TARGET 4136 EMA5 CROSS AND LOCK ABOVE 4136 WILL OPEN THE FOLLOWING BULLISH TARGET 4194 BEARISH TARGETS 3992 EMA5 CROSS AND LOCK BELOW 3992 WILL OPEN THE FOLLOWING BEARISH TARGET 3956 EMA5 CROSS AND LOCK BELOW 3956 WILL OPEN THE FOLLOWING BEARISH TARGET 3922 EMA5 CROSS AND LOCK BELOW 3922 WILL OPEN THE SWING RANGE 3866 3820 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFXHey everyone, Quick update on our 1H chart idea: We started with the bearish target, which was hit at 3992, followed by an EMA5 break, opening up the retracement range. The move down came just short of a full test, where we found support before moving back into 3992. Now, 3992 appears to be acting as support, keeping in mind, we still have an open bullish gap left at 4042. We’ll continue to update you all, as the week unfolds Mr GoldHey everyone, Quick update on our 1H chart idea: After completing the bearish target yesterday, we had the EMA5 cross and lock opening 3956 - This was completed today with no further cross and lock confirming the rejection and bounce, inline with our plans to buy dips. We will now look for ema5 cross and lock below 3956 to open 3922 or failure to lock below will see price find support above 3956 with a continuation into 3992 We’ll continue to update you all, as the week unfolds Mr Gold

Goldviewfx

نقشه راه طلا (XAUUSD): سطوح کلیدی و استراتژی معاملاتی هفته جدید

Hey Everyone, Please see our updated 4h chart levels and targets for the coming week. We are seeing price play between two weighted levels with a gap above at 4079 and a gap below at 3985. We will need to see ema5 cross and lock on either weighted level to determine the next range. We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range. We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up. We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends. The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges. BULLISH TARGET 4079 EMA5 CROSS AND LOCK ABOVE 4079 WILL OPEN THE FOLLOWING BULLISH TARGETS 4173 EMA5 CROSS AND LOCK ABOVE 4173 WILL OPEN THE FOLLOWING BULLISH TARGET 4264 EMA5 CROSS AND LOCK ABOVE 4264 WILL OPEN THE FOLLOWING BULLISH TARGET 4340 EMA5 CROSS AND LOCK ABOVE 4340 WILL OPEN THE FOLLOWING BULLISH TARGET 4422 EMA5 CROSS AND LOCK ABOVE 4422 WILL OPEN THE FOLLOWING BULLISH TARGET 4494 BEARISH TARGETS 3985 EMA5 CROSS AND LOCK BELOW 3985 WILL OPEN THE FOLLOWING BEARISH TARGET 3873 EMA5 CROSS AND LOCK BELOW 3873 WILL OPEN THE SWING RANGE 3741 3632 As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it! Mr Gold GoldViewFX

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.