Goldminer10

@t_Goldminer10

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Goldminer10

ریزش قریبالوقوع؟ فرصت فروش در نزدیکی ۴۰۰۰ دلار و اهداف پایینتر!

The price has reached a previously tested supply zone between 3990 – 4000 USD, where multiple rejections have occurred. After a sharp rally, the momentum weakened, and the price is now showing signs of exhaustion at the top of the range. Volume also decreased during the last upward move, suggesting that buyers are losing strength. The most recent candle structure shows rejection wicks and a potential shift in market control toward sellers. A short-term pullback toward the 3980 → 3950 zone seems likely if price continues to hold below the 3995 level. A confirmed break and close below 3980 could trigger further downside continuation. Trade Plan: Entry: Below 3990 (after confirmation candle close) Stop-Loss: Above 4005 Take-Profit Targets: TP1: 3965 TP2: 3940 TP3: 3915 Summary: The market is currently testing a strong resistance/supply area. Unless bulls reclaim 4000 with high volume, sellers have the advantage for a short-term correction. Watch for a decisive reaction in this purple zone before entering.

Goldminer10

the bears didn't succeed!

nice try bears.. But now it is the turn of the bulls to conquer a new H.H.The price correction was very deep, I doubted that it was a ABC wave and probably it would soon have a strong downward trend...so i have no postion

Goldminer10

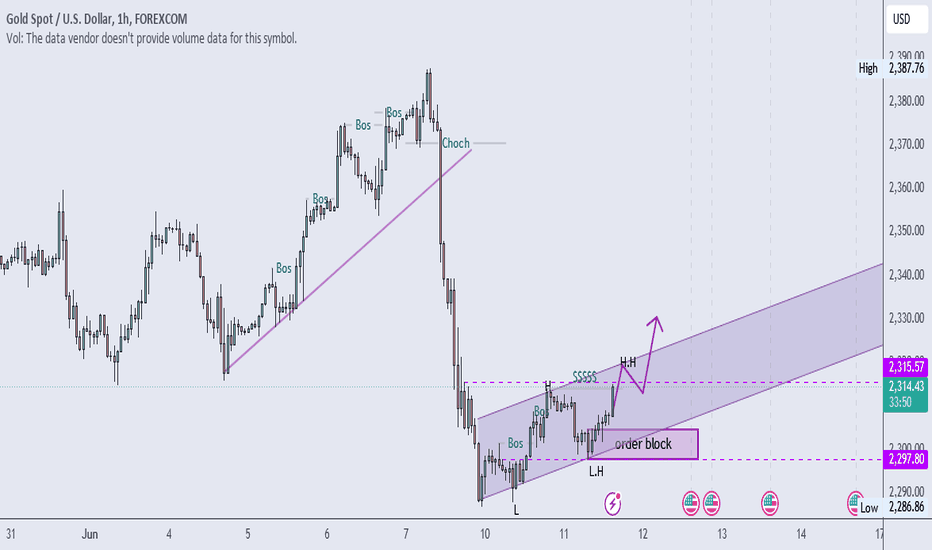

wave iii(gold rush)

The chart below shows gold trading lower since 7 June 2024. I believe the bottom is in at 2291 - we have started a gold rush to new highs above 2390. im looking for a pullback around 2310 to 2300 as our key, support this coming week. Once in that zone and it holds we can start looking for reversal patterns as an entry point for a long position. The next target would be 2291to complete the extended wave iii and an early exit position before the market moves lower.Don't be in a hurry to enter long position, let them collect liqudity wellDon't be in a hurry to enter long position we have another correction....Well, the holidays caused the trend dont move forward according to the channel and the growth phase started with a delay.The reversal pattern has not been seen yet, it seems that it will grow to the top of the channel tomorrow.

Goldminer10

long term down trend is over?

It seems that the increase in demand for gold does not allow a lower low to be formed. We should wait for a while and patiently enter into long postion, if we will sure of the weakness in the formation of lower low.A new lower low was formed.

Goldminer10

Bull Trap!

still think we have room to go higher,Resistance at the mentioned level and we'll test the short. Waiting for the price to revisit 2291.13 We want to see support here, based on the price resisting we'll take a action price will decrease today or tommorow this level must be retest first...my plan for tonight and tommorow looking for best short postion, where can i put near stop loss.. it seems I had guessed correctly that the price increase was a trap!Yesterday we were looking for price to fall near the levels of 2291.. Now 2 scenarios may happen: 1- The price breaks this level and forms a lower low. 2- It is possible that near this level, the bulls will take control again, in which case it should be said that the long-term down trend is over.Bulls running... senario 2 it will happen i looking for long setup

Goldminer10

trend reversal

the price fails to make a new lower low his signals a potential shift in the balance of power between buyers and sellers,,New H.H

Goldminer10

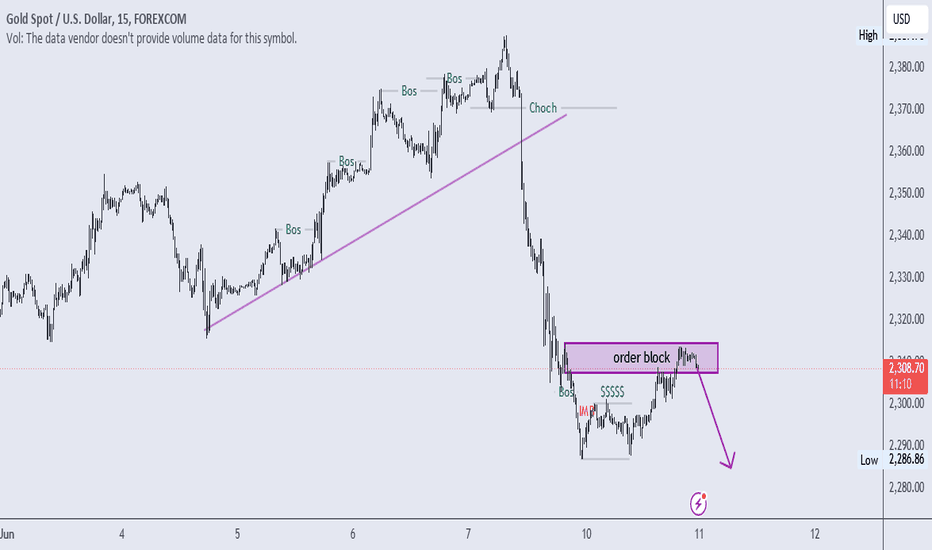

bearish opportunity

price already touch zone of order block. keep watching this. always trade with plan witth proper risk management.bears running..

Goldminer10

Bullish Opportunity

price break CHOCH as a confirmation of market to change direction. first of all price will double cheak the lower price. keep watching this alwaays trade with plan with proper risk managementIt still has to test lower prices and then the main growth start.target reacher! but not for me :)

Goldminer10

Good bearish opportunity

I look for breakouts in candlestick patterns,A series of lower highs indicate that the price of a stock will break the support.

Goldminer10

Xauusd bullish forecast

wait untill price toch 1H order block. entry point:2336 take profit:i will told you stop loss:2323Sitting in front of your screen for hours while attempting to force a trading set up might end badly.I think if I am patient, I will got a better entry point

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.