GoldenZoneFX

@t_GoldenZoneFX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

GoldenZoneFX

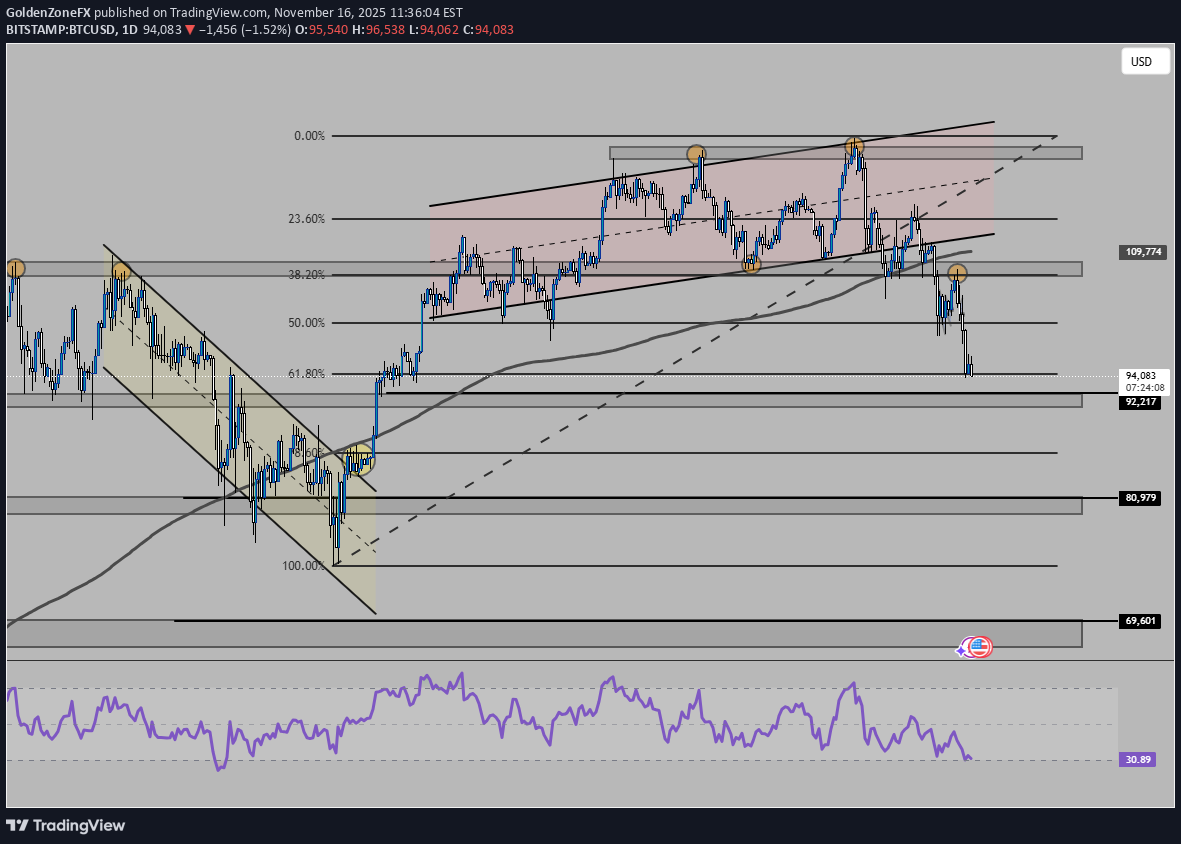

تحلیل فنی بیت کوین (نوامبر ۲۰۲۵): رمزگشایی حرکتهای بزرگ بازار!

Follow for more content and valuable insights about financial markets.

GoldenZoneFX

ادامه صعود طلا (XAUUSD): سیگنالهای جدید و تحلیلهای دقیق!

Follow GoldenZoneFX for more content and valuable insights about financial markets.

GoldenZoneFX

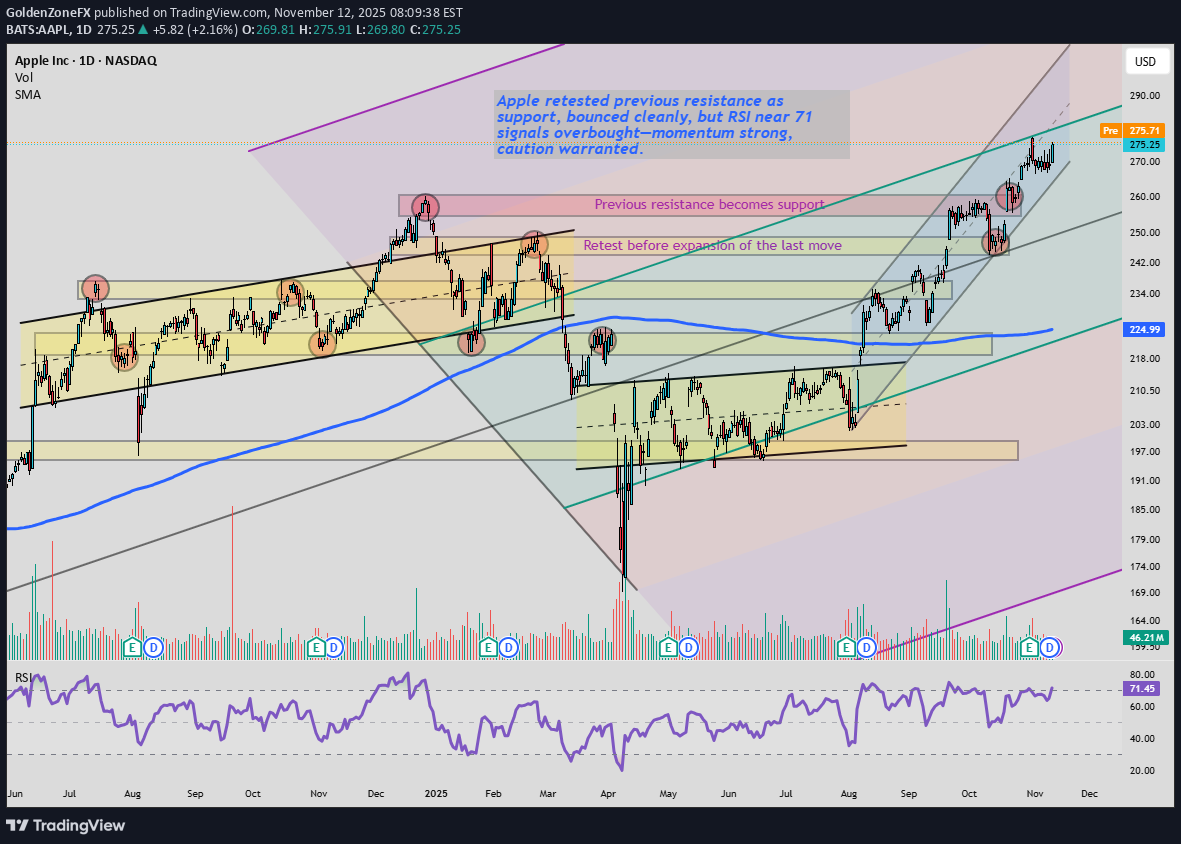

تحلیل تکنیکال اپل (AAPL): آیا حمایت شکسته میشود یا بازار صعودی ادامه دارد؟

Follow GoldenZoneFX for more content and valuable insights about financial markets.

GoldenZoneFX

شکست چنگال تسلا (TSLA): آیا زمان ورود یا خروج است؟ (تحلیل RSI و حجم معاملات)

Follow GoldenZoneFX for more content and valuable insights about financial markets.

GoldenZoneFX

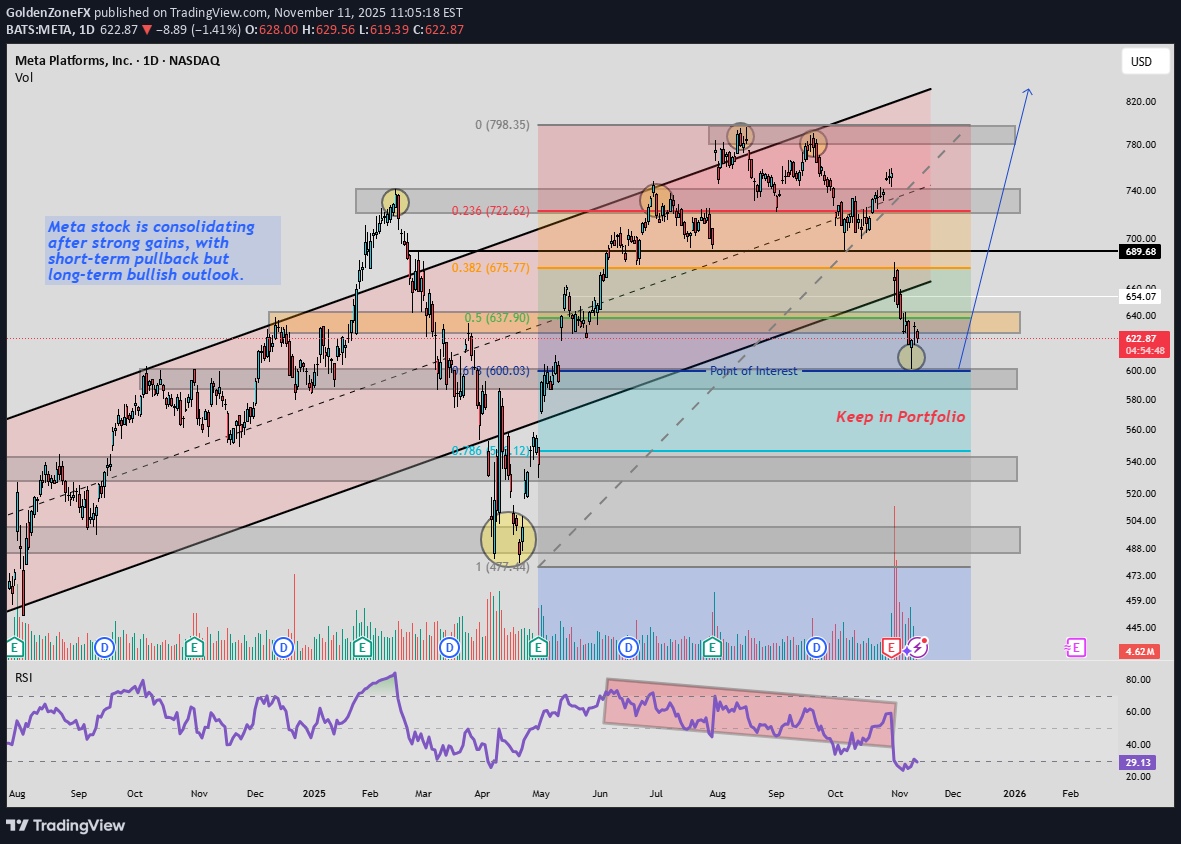

کنسالیدیشن متای: افت کوتاهمدت، قدرت بلندمدت در بازارهای مالی!

Follow GoldenZoneFX for more content and valuable insights about financial markets.

GoldenZoneFX

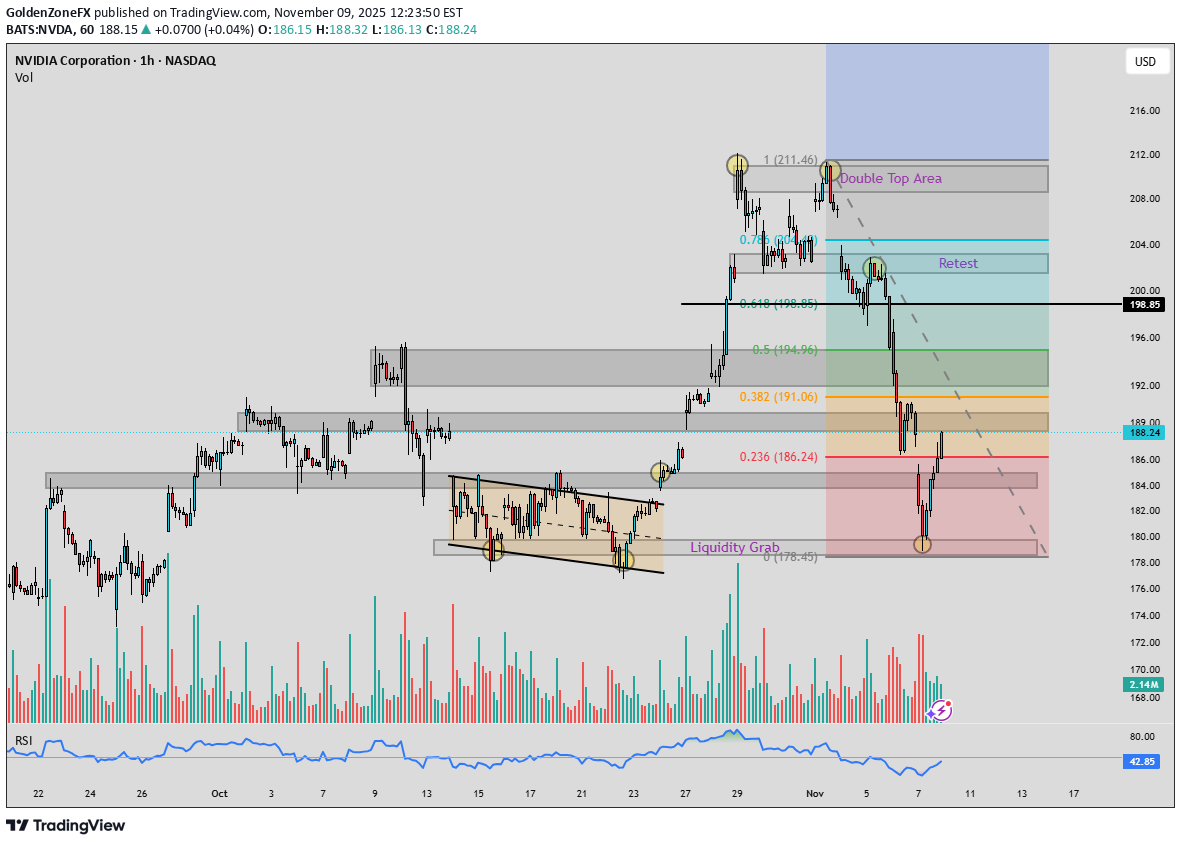

تحلیل تکنیکال انویدیا (نوامبر ۲۰۲۵): آیا قیمت سقف دوقلو را میشکند؟ (سناریوهای صعود و نزول)

Structure : Price broke out of a descending channel, retested the breakout zone, and is now hovering near a double top resistance. Fibonacci Confluence: Price is reacting near the 50–61.8% retracement zone, a key decision area for continuation or rejection. Liquidity Grab: A red-marked zone below shows where stop-losses were likely triggered before reversal — classic accumulation behavior. Volume & RSI: Volume faded post-breakout, and RSI shows early signs of divergence — momentum is slowing, but not yet reversing. Scenario Planning: Bullish: Break and hold above double top zone with volume → target $206–$214. Bearish: Rejection + RSI divergence → pullback to $183–$178 support. Watching for confirmation above the double top zone. Liquidity grab + fib confluence suggest potential continuation, but momentum needs to align. Follow GoldenZoneFX for more content and valuable insights.

GoldenZoneFX

آیا قیمت در دام مثلث نزولی میافتد؟ نشانههای هشداردهنده از ادامه ریزش!

Price action is compressing within a descending triangle structure: Lower highs reflect increasing seller aggression. Horizontal support is being tested repeatedly, signaling buyer exhaustion. Volume is tapering near the apex — classic pre-breakout behavior. Follow GoldenZoneFX for more content and valuable knowledge.

GoldenZoneFX

Bullish confirmation signal Gold

Follow GoldenZoneFX for more content and valuable insights.

GoldenZoneFX

Retest means a Reversal will steps in?

Follow GoldenZoneFX for more content and valuable insights.

GoldenZoneFX

Gold Just Broke Structure – Are You Ready for the Next Move?

Today’s price action on Gold presented a textbook structure shift: Break of Structure occurred after price respected the Demand Zone around the 3,315–3,320 region, showing strong buying interest and a volume spike confirming bullish intent. Price surged past the key resistance near 3,340, breaking above the 200 SMA and reclaiming a prior consolidation zone. This move invalidated recent bearish pressure and confirmed a bullish reversal. Supply Zone around 3,370 has been retested with rejection, causing a minor pullback. Price is now consolidating in a bullish flag pattern just above the 200 SMA, suggesting a potential continuation. Outlook: If price holds above the gray demand/flip zone and breaks out of the flag, we could see continuation toward the supply zone highs. RSI remains neutral, giving room for momentum to build. This is a clean example of structure-driven trading combined with zone analysis and volume confirmation. Follow GoldenZoneFX for more content and valuable insights.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.