GoldenEdge

@t_GoldenEdge

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Gold buyers are still in control.

Good buying action between 2605 and 2035. Buyers are consolidating in this zone. I am looking to go long once it breaks above 2627, with a stop loss at 2580, targeting 2720 and above 2780. XAUUSD XAUUSD GC1!2660 was another strong resistance, with persistent sellers at this level. Yet, it was easily broken through by the constant demand from the buyers. These are not just some institutions that are buying; there are countries involved in pushing the price this high and fast.Anything can happen in this market. Remember to lock in some profits along the way.This will be the last time that I share my live trade on TV. In the future, I will only share my thought process and analysis of where the market might be heading.I will sell 1/4 at 2657.Moving my stop loss to 2630.Left 3/4.I forgot to update here. I exited 2/4 at 2720 and left the last 1/4 to run to my final profit target at 2780. I'm moving up my stop loss to 2665.Moving my stop loss to 2715.I've exited my remaining 1/4 at 2775.

Gold is Running Hot!

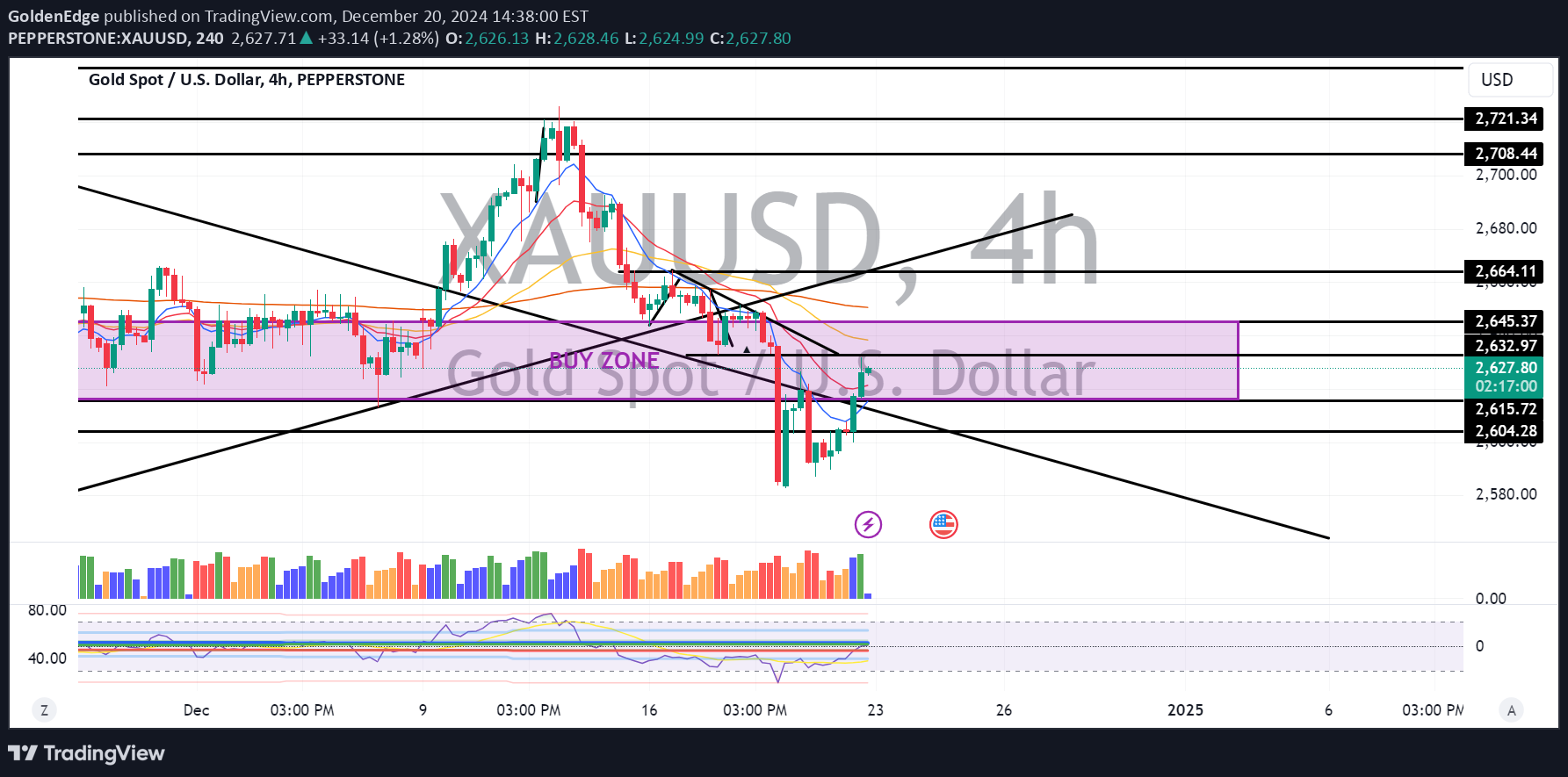

The market experienced two consecutive days of selloff following the FOMC Chairman Powell's rate announcement. This reaction is reflective of heightened uncertainty and bearish sentiment immediately after the announcement. However, today marked a shift in momentum as the price finally stabilized, signaling potential exhaustion of the selling pressure.Buyers have stepped back into the market with conviction, pushing the price back into the buy zone. This area coincides with a prior consolidation zone, suggesting that it holds significant technical importance as a support level. The re-entry into this zone indicates renewed interest from buyers, possibly setting the stage for a rebound or further bullish momentum in the near term. XAUUSD GOLD XAUUSDI have an open position at 2615, risking 2600, and targeting 2055 and 2075.The prior support level at 2633 is now acting as strong resistance. I will watch closely to see if prices continue to hold below the buy zone and will exit the trade.On the contrary, if price pushes back into the Buy Zone. I am looking to add into the 2620 price level if it holds.Price action on the 4-hour chart doesn’t look good. There’s an absence of buyers to push the price back into the buy zone.Amazingly, right after I mentioned this, buyers suddenly pushed the price back into the strong buy zone. I will only add at 2620 once the price stabilizes, supported by the buyers at that level.I exited my trade at breakeven.The reason for my exit is that the price stayed below the buy zone for too long. This does not mean I am turning bearish on Gold. Once it proves that the buyers are in control, I will revisit Gold on the long side again.

GOLD Buy Zone

Good day, traders.A significant buy zone for large institutional traders lies between 20 and 40, aligning with the prior 9-day consolidation period before the breakout above 2665.Analysis Details:The 20-40 range reflects strong accumulation by major players, supported by increased volume and reduced volatility during consolidation.The breakout above 2665 highlights this zone as a critical support level for future price action.Implications: The 20-40 range will likely act as strong support during pullbacks, offering potential entry points for traders.Monitor this zone for bullish signals and build positions with stops slightly below. XAUUSD GOLD XAUUSDI currently have an open position at 2636. My short-term targets are 2656 and 2665. I will monitor the position and reassess if those levels hold.I forgot to drag my BUY ZONE box down to the 2620 level. Please use your own visualization on your chart.Got stopped out for my 2nd position. I reenter the trade at 2615.Back into the buy zone above 2620.Stopped out at 2610.

Is gold poised for a short-term retracement again?

Hi all,This is my first post on TradingView.I’m here to share my thoughts on market movements. I’m still a student of the market (and always will be), and I look forward to learning from the experienced traders out there.BRICS dollarization isn't going anywhere, as the group disagreed on using a single country’s currency. The dollar strengthened after President-elect Donald Trump won the US election. Gold remains a safe haven for many investors, and countries are heavily invested in it. The current indecisive market direction could lead to a short-term downside for gold if the dollar remains strong.XAUUSD GOLDI initiated a short position at 2640, risking 20 pips with a stop loss at 2660. This is a short-term swing trade, and my take-profit target is 2540.I will move my stop to breakeven if Monday's opening prices remain stagnant between 2660 and 2620. I may even close my trade entirely.Some action is happening with Gold today during the Asian session. I'm widening my risk for this trade, with a new stop loss set at 2673. I’m not opening any new positions in Gold.The reason for this is that I feel it might pop above 2660 and then experience a sell-off right after.Stopped out of my trade.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.