George_Martin

@t_George_Martin

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Golden Wednesday trend analysis and trading signal sharing

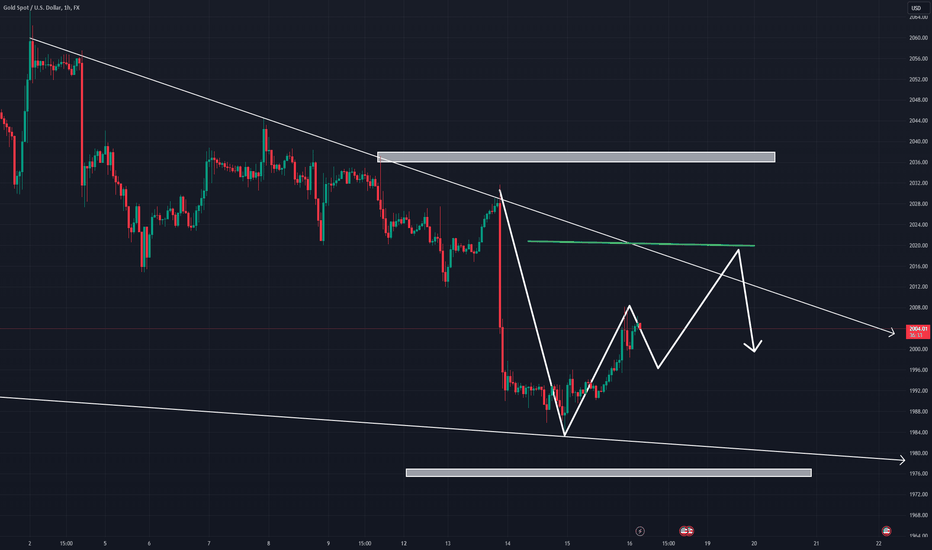

Gold is currently volatile for many days. If gold rebounds in the 2028-2032 range again today, then I think gold will first rise to 2037. After breaking this range, it will continue to rise to 2048. If gold fails to rebound in 2028-2032. Then gold will form a double-determined trend and fall all the way to the 2018-2022 range. So the trading strategy I am currently giving you is to wait for the trend to form before trading. Trading straregy: 1.sell2037-2041/2045-2048 tp2035-2030 sl2051.5 2.buy2018-2022 /2026-2029 tp2033-2038-2042 sl2016 The given trading range is relatively large, and we can choose appropriate trading signals based on today's specific trends. Hope everyone can make a profit. I will continue to help you analyze trends and share trading signals. If you are interested in my trading strategies, please join meTP1/2036. The current price is 2036. If you buy according to my strategy in 2026, you have now made a profit of 100pips. Every day is perfect analysis. If you need sustained profits, please contact me immediately. I provide account management and signals.

Gold trading signals and analysis for next Monday

Gold rose to the 2037-2041 area on Friday as I judged. My analysis successfully helped traders who saw the analysis win gold trades on Friday Gold fell to near 2016 on Friday, then began to rebound, and finally rose to 2041, closing at 2035 in the evening. The whole trend fits my judgment perfectly. Next Monday I think gold will test the 2028-2032 area and then continue to rise. Test the 2048 high again. If it breaks, the possible trend is 2055/2063. I would first recommend everyone to buy. Trading straregy: BUY:2028-2032 tp2038-2042-2047 sl 2022 SELL:2044-2048 tp2036-2032-2028 sl 2051.5 If you follow my analysis for a long time, you will find that my analysis has always been very accurate. If you like my analysis, please join. I will update my thoughts in real time.

Golden Friday Trading Strategies and Signals Sharing

Gold had a false breakout today at 2034. It then fell to around 2019. Although gold is showing a downward trend today, I think gold will still retest the upper price 2028-2032 tomorrow. If it breaks through this area, a triangle pattern will be formed. Rising to around 2037. So I think the trading strategy for everyone is 1If gold rebounds in 2019-2022, then buy2019-2022 tp2028-2032 sl2014 2 If gold rises above the 2032 area. Then wait to sell gold sell 2037-2041 tp2032-2028-2025 Of course I will update my thoughts based on tomorrow's trends.If you are interested in my analysis, please join meAfter gold fell briefly, the situation in 1 occurred. A rebound occurred in the 2019-2022 area, reaching 2028. The take-profit price was successfully reachedtp2039.Perfect analysis, perfect charts

Gold Thursday trend analysis and signal sharing

Gold has broken through the 2032 area. We can wait for the next area 2038-2041/2044-2048. This is a better selling range. So the trading strategy I gave is: sell 2038-2041 tp2033-2028 add position 2044-2048 If you are interested in my analysis, please join meMy daily trading strategy is very accurate

Golden Wednesday Trading Strategies and Signals Sharing

I bring good analysis to my followers every day, and I accurately judge the trend almost every day. Gold broke through 2022 today, rose to near 2030, and then fell to near 2024. Once gold falls back to the 2019-2022 area tomorrow, it is recommended to continue buying, because the current lows of gold have been increasing. So we can still wait for gold to break through further. Near target 2038. Trading strategies for everyone: buy2019-2022 tp2028-2033-2038. sl2016.5 sell2038-2042 tp2033-2029 sl2048.5 If you like my analysis and if you want to make money trading every day, please join me. ↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓Gold rises from 2022 to 2029, if you followed my trading signals to buy in the 2019-2022 area, now you have earned 70pips, if you have made a profit, please stop trading.

Gold Tuesday Trading Strategy

Today’s gold still needs to observe further trends. I think a safe trade needs to focus on the key price of 2022. The gold price is currently testing 2022 above and breaking 2022. We can choose to sell gold in 2032-2034. If it cannot break through 2022, it will fall back to 2022. Near 2007, we can try to buy near 2007.

Gold trading strategy sharing for next Monday

My buy signal on Friday perfectly verified the gold price trend on Friday. Once again helping my fans win in trading. Gold has strong support near this week's low of 1996. If it wants to continue falling, gold needs to break 1996. I think gold will continue last week’s upward trend, and I suggest everyone’s trading range: Gold trading strategy: 2003.5-2008 tp2019-2024.sl 1995.5 This is a relatively broad trading strategy, so I suggest that on Monday, we first observe the trend of gold. I will update my analysis if there are other changes in gold trends. If you are interested in my analysis, please follow me.follow meGold went up as I judged. Prices increased from 2009 to 2023. Later we will continue to look for opportunities to sell

Friday gold strategy

Today gold rebounded from 1990 to 2008 and was blocked. Tomorrow I think gold will continue to rise after breaking through 2012 for the first time. It will then fall to around 2010. If gold falls back to around 1996 in early trading, consider buying. Trading straregy: buy1996-1999 tp2012-2018 sl1992 If you need live signals please join mePerfect trading signal for Friday. Why don't you like me?

Gold Thursday operation strategy

Gold fluctuated slightly yesterday. Although the US market has broken down, it is still brilliant for a while. It is just a piercing test. The support below is also the 70 line we proposed in the early stage. This position is also short in the near future. The primary support and target point is, and the top-bottom transition and suppression level above is also divided into two stages. One is near the integer level of 2000. This position is also an important area for shorts. After all, it is also a support point many times in the early stage. At present, It is also near the point of the daily lower track. If the short position continues to be established, the lower the magnitude of the counterattack, the more beneficial it will be for the short sellers. Once there is a large-scale counterattack, it is likely to form a range-bound oscillation pattern. The second suppression point will also be the position near 2010 mentioned yesterday. This position is also the top and bottom position in the early stage. It is also the suppression position of the short-term moving average of the daily line in the short term. In the short term, we will first go short around 1998-1999. , the target is around 1985-1980, with a loss of 2005.5. It is still necessary to try short selling. If it remains above 2000 for a long time, adjust the price of the short selling point! xauusd Thursday operations: SELL1997-2000 tp1985-1980 SL2005.5 If you are interested in my analysis, you can join me

Golden Tuesday trend analysis and signal sharing

The strategy I gave yesterday for gold was to go short on rallies. Yesterday's gold price trend also confirmed my view. Although gold returned orders in the evening, gold orders fell multiple times in 2027 yesterday. So I think the resistance of gold is below 2028, and I recommend still selling gold. The target is looking towards 2010-2005. So my initial trading strategy suggestion today is: SELL2025-2021 tp2012-2007 sl2028 I will update my analysis in due course. If you are interested in my analysis, please join me.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.