GTradeTN

@t_GTradeTN

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Bullish Channel Detected on DASH/USDT

Analyzing the DASH/USDT pair reveals a promising bullish scenario. The price action has formed a clear bullish channel, presenting a favorable opportunity for potential gains. Trade Setup: Buy Zone: 32-30.5 USDT Stop Loss: 29.5 USDT Take Profit: 38 USDT Rationale: The price is currently within an upward channel, indicating a bullish trend. Entering the market within the specified buy zone aligns with the trend, providing an attractive risk-reward ratio. Risk Management: A stop-loss at 29.5 USDT is set to mitigate potential losses in case the market doesn't follow the expected trajectory. It's crucial to adhere to risk management principles to protect the trading capital. Profit-Taking: The take-profit level is set at 38 USDT, representing a reasonable target within the bullish channel. Adjustments can be made based on individual risk tolerance and market conditions. Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always conduct your research and consider your risk tolerance before making trading decisions. Past performance is not indicative of future results.

DEGO/USDT Potential Long Position Opportunity

Description: Analysis Overview: The DEGO/USDT trading pair is presenting a potential buying opportunity based on technical analysis. Here's a detailed breakdown of the analysis: Entry Point: Consider entering a long position between the price range of 1.69 and 1.715 USDT. Stop Loss: Set a stop-loss order below 1.62 USDT to manage risk and protect the investment. Profit Targets: Objective 1: Aim for a profit target at 1.8 USDT. Objective 2: Secondary target set at 2 USDT.

ILV/USDT Opportunity with 3.6% Risk-Reward Ratio

Analysis by SK System Current Price: $111 The recent correction from the vague B-C has reached the ideal level for a bullish reversal, pointing towards a potential upswing to $117 or even $119. The price is currently positioned at $111, and historical data suggests that a turnaround is imminent. Key Points: Correction Level: The correction of the vague B-C has reached a significant level, indicating a potential shift in market sentiment. Upside Potential: Anticipating a bullish reversal with a target range of $117 to $119. Risk Management: Implementing a stop-loss at $109.2 to mitigate potential losses and adhere to a disciplined risk management strategy. Trade Details: Entry Point: Current market price ($111) Target Price: $117 to $119 Stop-Loss: $109.2 Risk-Reward Ratio: 3.6%

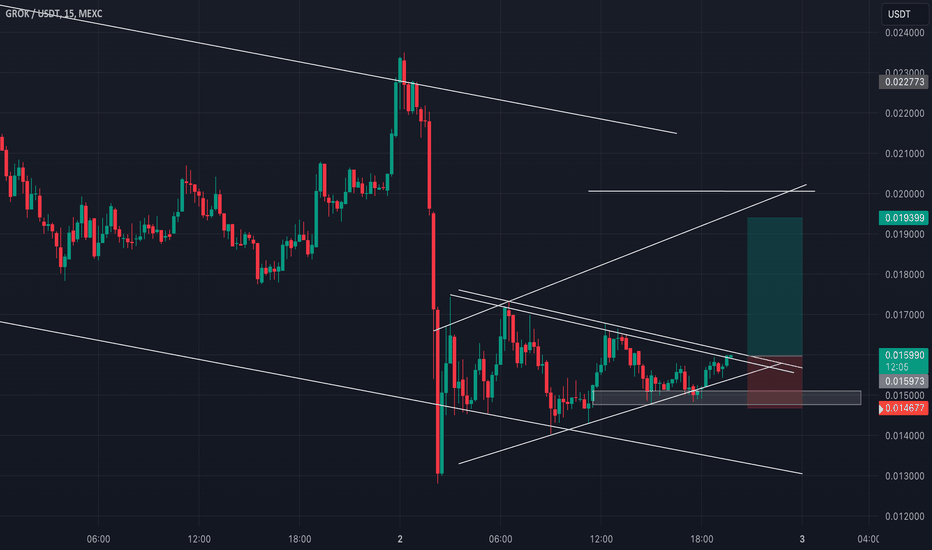

Technical Analysis for Grok/USDT Long-Term Trend: Bullish

Analysis Overview: Strong bullish trend observed on higher time frames. A correction on the 1-hour chart has formed a descending channel. Short-term correction seen on the 15-Min chart, presenting a symmetrical triangle. Confirmation: Symmetrical triangle confirmed with a breakout above its resistance. Trade Setup: Entry Price: Market price or breakout confirmation. Target Price: 0.193 USDT. Stop Loss: Positioned to mitigate risk, with consideration of H15 candle closure under the triangle's former resistance, now acting as support. Rationale: The grand time frames show a prevailing upward trend. A correction in the form of a descending channel on the 4-hour chart. Short-term consolidation within a symmetrical triangle on the 1-hour chart. Execution: Consider entering the trade upon a confirmed breakout of the symmetrical triangle. Set a profit target at 0.193 USDT. Implement a stop loss to manage risk, triggered by a 15-Min candle closing below the previous triangle resistance, now acting as support.

BETA/USDT - Bullish Channel and Reversal Candlestick Pattern

Technical Analysis: A bullish channel is evident on the BETA/USDT pair. The price is currently experiencing its third touch on the support level within this channel. Notably, a bullish engulfing candlestick pattern, indicative of a potential reversal, has formed at this crucial support level. Trading Opportunity: This presents a compelling buying opportunity. Entry Point: Consider entering a long position. Target: Set the target at the previous high of 0.639. Stop Loss: Place a stop loss just below the recent low at 0.607 to manage risk effectively. Rationale: The bullish channel suggests a prevailing uptrend. The third bounce off the support, coupled with the bullish engulfing pattern, strengthens the case for a potential upward reversal. By entering at this point, traders can aim to ride the upward momentum toward the previous high. Risk Management: Utilize a stop loss to mitigate potential losses. The stop loss at 0.607 is strategically placed below the recent low, providing a reasonable buffer. Conclusion: A favorable risk-reward ratio and the technical confluence of a bullish channel and reversal candlestick pattern make BETA/USDT a promising trade. Exercise caution, adhere to risk management principles, and monitor the trade closely for optimal results.

Potential Buying Opportunity for SUSHI/USDT - SK System Analysi

Analysis: Using the SK System, we've identified a promising buying opportunity within the shaded region between $1.96 and $1.176 for SUSHI/USDT. This area aligns closely with the Fibonacci retracement zone, specifically between 0.5 and 0.667. Key Points: Fibonacci Confluence: The highlighted zone represents a convergence of Fibonacci levels, particularly between 0.5 and 0.667. This suggests a potential reversal or strong support in this region. Wave B-C Correction: The correction in the B-C wave has been substantial, providing a favorable risk-reward setup. This correction sets the stage for a potential bullish move. Price Targets: Our analysis indicates an upside target around $1.272. This level is derived from the Fibonacci extension and signifies a possible upward trajectory. Tight Stop Loss: To manage risk, we recommend setting a tight stop loss just below $1.17. This level acts as a safeguard in case the market doesn't align with our anticipated scenario. Trade Details: Buy Zone: $1.96 - $1.176 Target: $1.272 Stop Loss: Below $1.17 Risk-Reward Ratio: Considering the potential upside and the controlled risk with a tight stop loss, the risk-reward ratio appears to be favorable for traders looking to capitalize on a potential bullish movement.

Op/USDT SK System Analysis

Description: In this analysis, we'll be looking at the Op/USDT pair using the SK System. Key Points: Point B as a Reversal Signal: Point B is identified as an ideal reversal point according to the SK System, signaling a potential shift in the market dynamics. The retracement at this point is approximately 0.669%. Validation of the Second Condition: The second condition of the SK System has been met, with Point C surpassing Point A. This confirms a corrective wave (bc) on the 0.669% level, indicating a strong buying opportunity. Trading Opportunity: This analysis suggests a favorable buying opportunity Target around 1.9, considering the completion of the corrective wave. It is recommended to set a tight stop loss just below 1.82 to manage risk effectively. Trade Strategy: Entry: entry around 1.853. Stop Loss: Set a tight stop loss just below 1.82 to mitigate potential losses. Profit Target: Aim for profit-taking as the price progresses, adjusting based on further market developments. Risk Management: Always use risk management strategies, such as setting stop losses, to protect your investment. Stay updated with market movements and adjust your strategy accordingly. Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always conduct your research and consult with financial professionals before making any investment decisions.

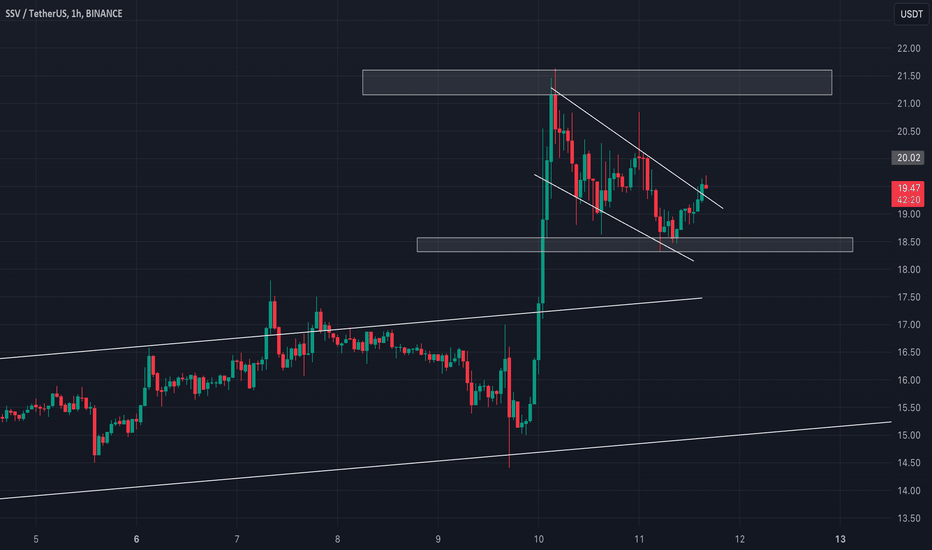

📈 SSV/USDT - Bullish Flag on 1H TF! 🚩

🔍 Pattern: Bullish Flag Formation 🎯 Target: $25 ⚠️ Invalidation: Close below the pattern on 1H TF 🛡️ Stop Loss: Below the pattern on 1H TF 📊 Analysis: The SSV/USDT pair is showing a promising bullish flag pattern on the 1-hour timeframe. Consider this a strong buying opportunity with a target set at $25. To maintain the validity of the pattern, exercise caution and set a stop loss just below the pattern's closing point on the 1-hour chart. Stay vigilant and happy trading! 🚀💹 #SSVUSDT #BullishFlag #CryptoTrading #TechnicalAnalysis

BCH/USDT Analysis - Bullish Channel and Reversal Signal

Description: We have identified a compelling trading opportunity on the BCH/USDT trading pair. Here are the key aspects of this analysis: Trade Setup: Pair: BCH/USDT Pattern: Bullish channel with three confirmed contacts on the support Breakout: The price has broken above a secondary white trendline resistance Confirmation: The crossing of moving averages adds strength to the buy signal Bullish Reversal: A hammer candlestick, followed by a green candle, confirms a bullish reversal Trade Parameters: Entry Price: As the price breaks above the white trendline resistance Stop Loss (SL): Set the stop loss at 292.4 to manage risk Take Profit (TP): Aim for a target price of 262 Rationale: The BCH/USDT pair is forming a clear bullish channel with three significant bounces on the support level. The recent breakout above the secondary white trendline resistance suggests a potential upward movement. The crossing of moving averages further reinforces the bullish bias. A hammer candlestick pattern, followed by a green candle, provides confirmation of a bullish reversal. Important Considerations: Maintain risk management by setting the stop loss at 292.4. Target a take profit level of 262. Monitor the trade and make adjustments as needed. This analysis outlines a potential buying opportunity in the BCH/USDT pair, supported by a bullish channel, moving averages, and a bullish reversal candlestick pattern. Always conduct your research and exercise proper risk management. #CryptoTrading #BCHUSDT #TradingOpportunity

Bullish Double Bottom on CRV/USDT

Pattern: Bullish Double Bottom Pair: CRV/USDT Entry Point: Breakout above the neckline at 0.5376 Trade Parameters: Entry Price: Buy once the price closes above 0.5376 Stop Loss (SL): Set the stop loss just below the neckline (approx. below 0.5376) Take Profit (TP): Target a price level of 0.66 Rationale: The bullish double bottom pattern, characterized by two consecutive price troughs followed by a breakout above the neckline, indicates a potential trend reversal from bearish to bullish. We'll initiate the long position once the price closes above the neckline (0.5376), which serves as our entry trigger. To manage risk, we'll place our stop loss just below the neckline to protect against adverse price movements. The target price (TP) for this trade is set at 0.66, which is determined by measuring the vertical distance between the lowest point of the pattern and the neckline and adding it to the neckline's breakout point.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.