FFXchartlord

@t_FFXchartlord

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Gold reactions to FOMC

This analysis is strictly leaned on fundamental analysis I've carefully studied fed watch tool and there will be no rate cuts So since inflation is at 3%+ We are expecting no rate cuts or even worst a rate hike So we should expect 5.5 as FXbook concensus states or 5.7, 5.8 Which will be bullish for the us dollar So let's make sure to have this in mind while making trading decisions

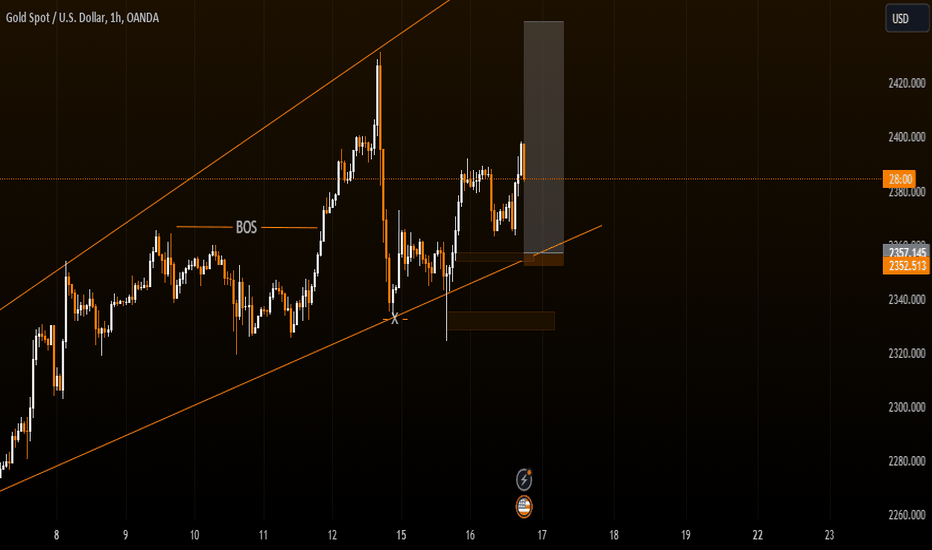

XAUUSD: Bulls continues to thrive

we can see clear structure in both price action and SMC. Price broke 1hour struture andgave a pull back which is our inducement and now price is looking for the new high Also trendline confirmation for the Buy Image clearly shows how we can enter HAPPY TRADING!!!

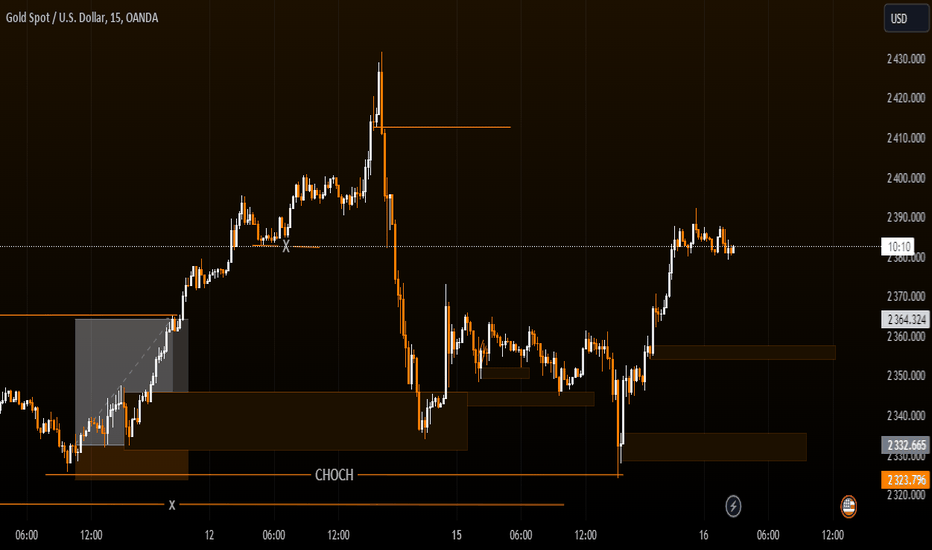

Xauusd further move

Gold couldn't break CHOCH level so we expect more bullish move until proven otherwise We have two POI's to enter the buys from One seasonal POI and the extreme POI Happy Trading

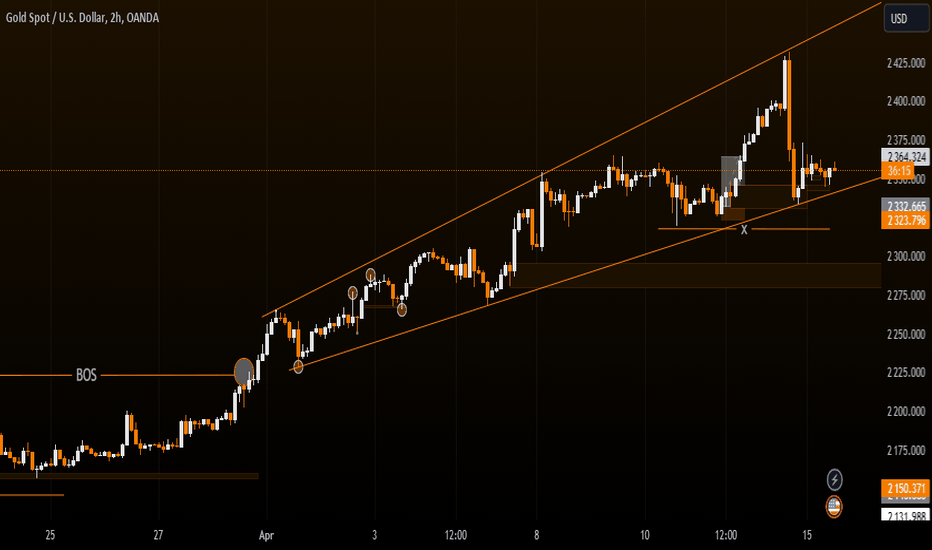

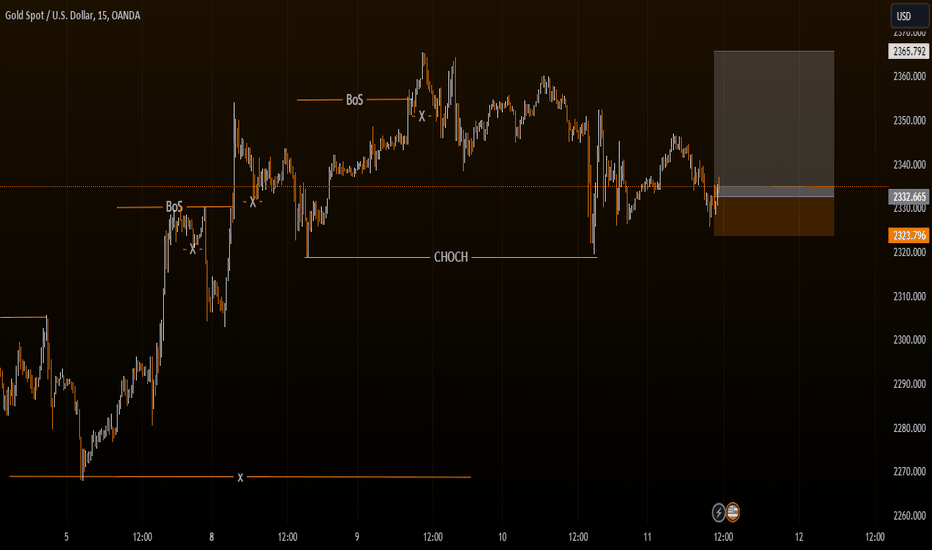

XAUUSD: Will we see more buys from here??

Looking now from 2hours views has a trendline liquidity and the probability of price to break this trend line is 60% Reasons; 1. Inducement sits below and price always takes out the inducement and mitigate a POI before going for a new High 2. The previous pullback has bearish momentum signaling bearish strength 3. price has made a three legs move and possible reversals could be eminent We keep an eye on DXY cause weaker DXY will give gold further bullish sentiment from here Happy trading

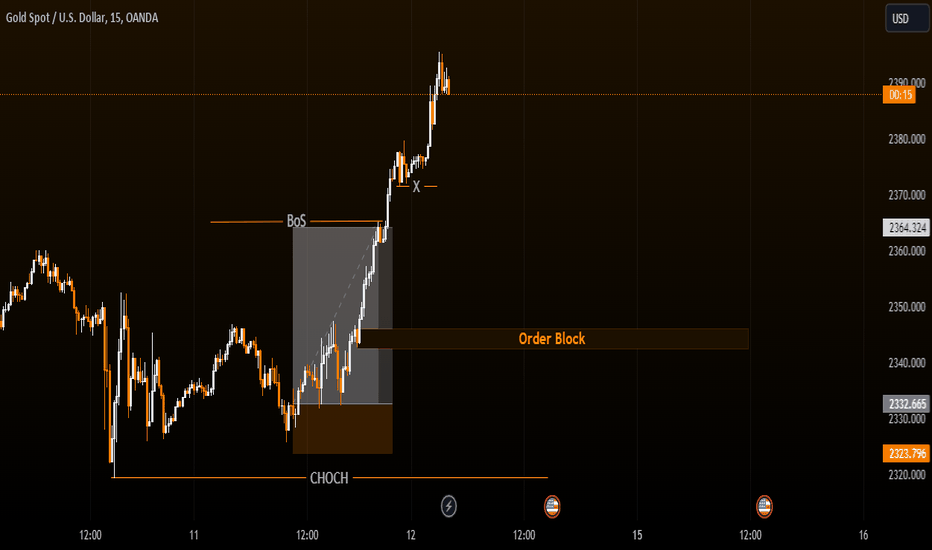

XAUUSD on a BULL RUN

As we knew yesterday Price hit target gracefully and we expect more Buys After taken out our Inducement(X) and mitigate our POI. Bullish direction remains consistent until a change of character (CHOCH Level) is broken Happy trading Guys

XAUUSD TODAY

Giving the expectations that PPI and Jobclaims are gonna be negative for the USD, A buy is eminent Trend is bullish Inducement levels taken out and Poi's are mitigated A break below could signify higher timeframe reversals.

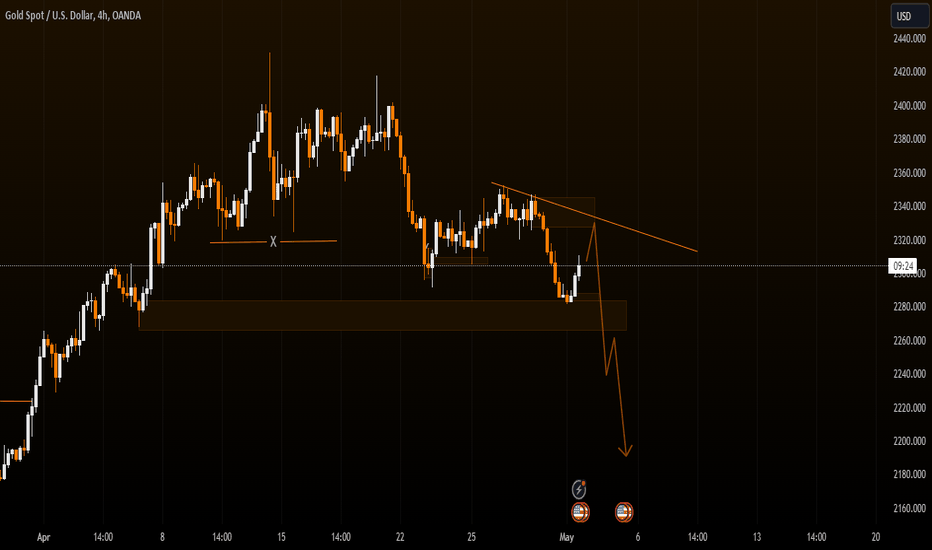

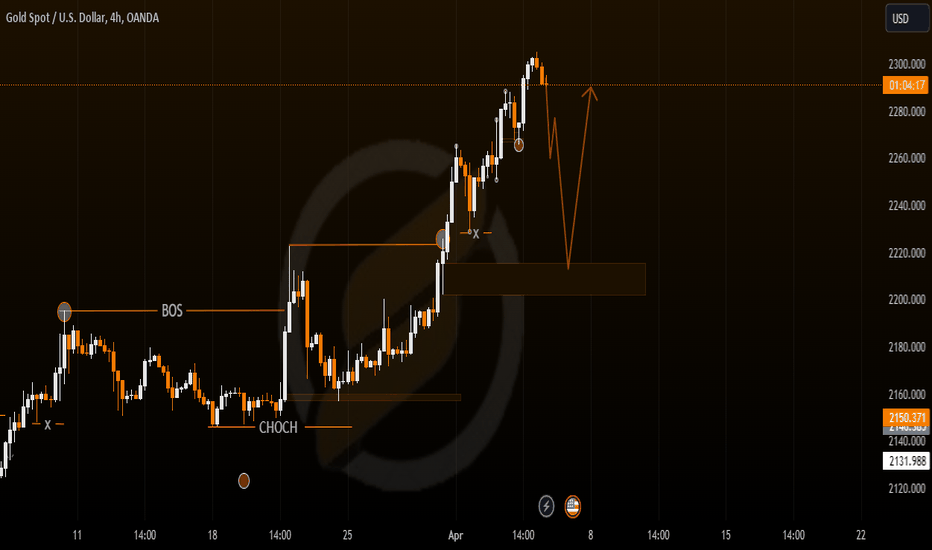

Where do we go from here!!!

Looking at the upwards rally within the fast few weeks, Our precious metal might be going for a quick reversal in the coming week. For now i suggest being neutral and just observe to get the best criteria. We can again after taken out inducement(X) Happy trading

Bulls still rallying

Despite the fact that most traders sentiment is bearish, Gold still rallies Upwards It is advised to stick to the trend until velid Change of character or structure shift (Whatever you may call the end of trend) has taken place. Manage money well Happy trading #XAUUSD

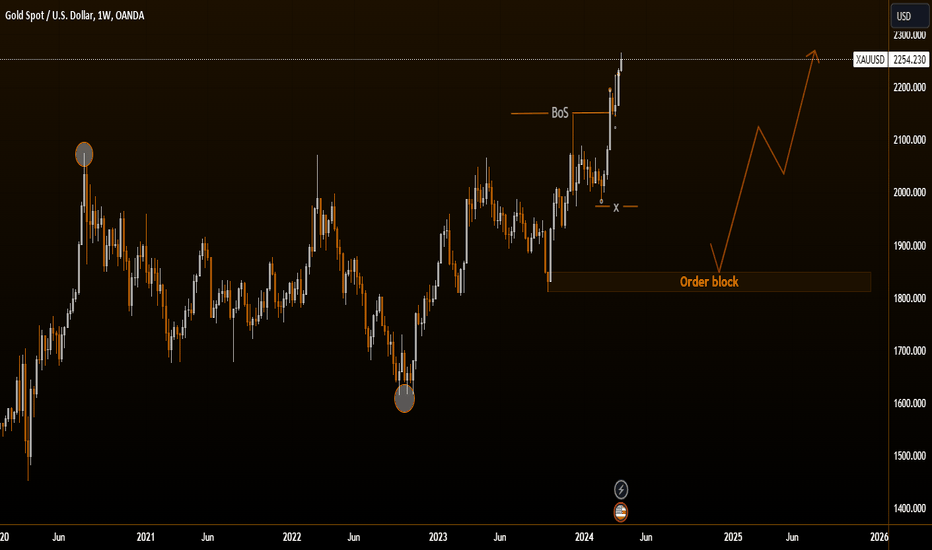

Gold movement in the Long term

Looking at Gold from the Weekly timeframe, Everything is bullish and Price is currently heading for the reversal. 1981.84 Sits the inducement level and price is likely to head below that level except the market gives us a new Inducement level. After taking out the inducement then we can buy again from 1851.83 region where there's a perfect order block sitting below. Happy trading week!!

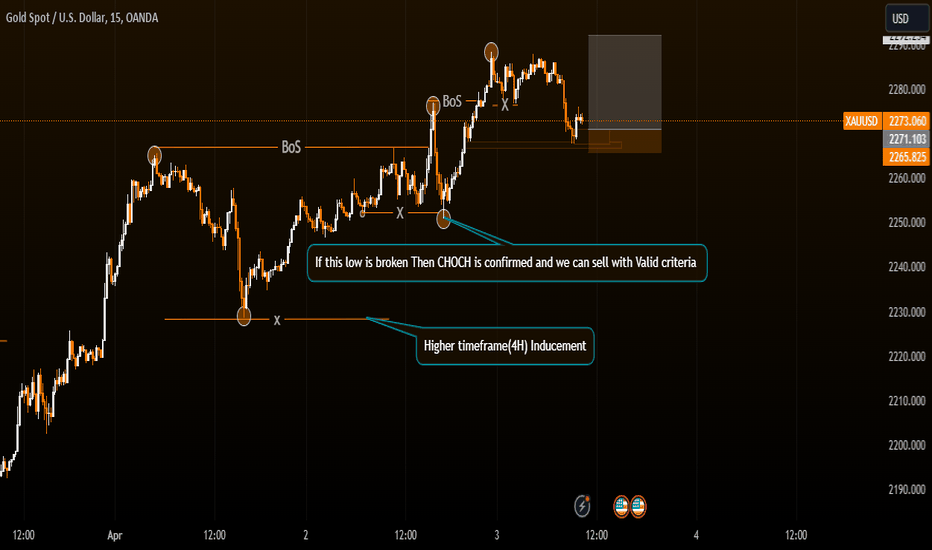

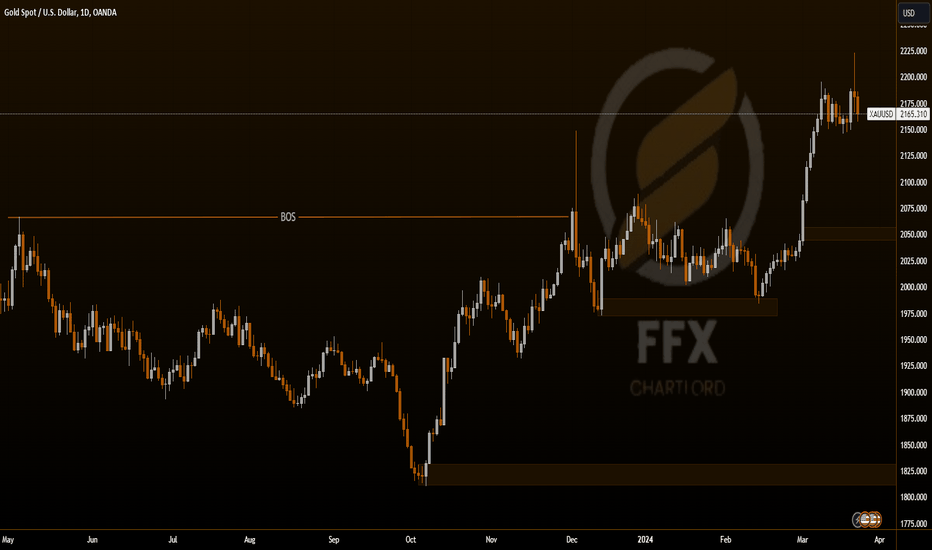

Weekly Gold Forecast: Analyzing Candlestick Patterns

Observing daily candlestick movements, we consider selling opportunities in Gold when it breaks the recent low marginally and shows a reversal, indicating bearish momentum on lower timeframes. If the low at 2146.80 is breached convincingly with a full-body candle and confirms a bearish point of interest (POI), we can initiate short positions. Otherwise, Gold may sustain its upward rally. Patience is key as we monitor market reactions around the 2146.80 region.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.