EVOLUTIO

@t_EVOLUTIO

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ETHUSD Weekend Bounce Setup (15m)

Following a sharp liquidity sweep into lower intraday demand, ETH is now positioned for a potential weekend rebound. Price tapped into a cluster of overlapping demand levels between 3,045–3,067, an area that has historically produced strong reactive moves on lower timeframes. Momentum is beginning to stabilize after the selloff, and the current structure favors a corrective bounce toward the nearest inefficiency and reclaimed levels above. 🔹 Entry: CMP 🔹 Target (TP): 3,230.40 🔹 Stop-Loss (SL): 3,045.89 This setup targets a short-term relief rally into the mid-range imbalance, with a clean 5% upside if weekend activity provides enough volatility. A break and hold above 3,180 would further validate the bounce, opening the door toward the white liquidity band overhead. A decisive breakdown below 3,045 would invalidate the idea and signal continuation into the next demand block below 3,020. As you can see there are plenty of targets bellow, be wise on risk management ⚠️ Financial Disclaimer (fun version): Not financial advice. Just chart gymnastics. If you trade this with no stop-loss because “it’s the weekend,” ETH may personally teach you what volatility really means. DYOR and stay safe out there.

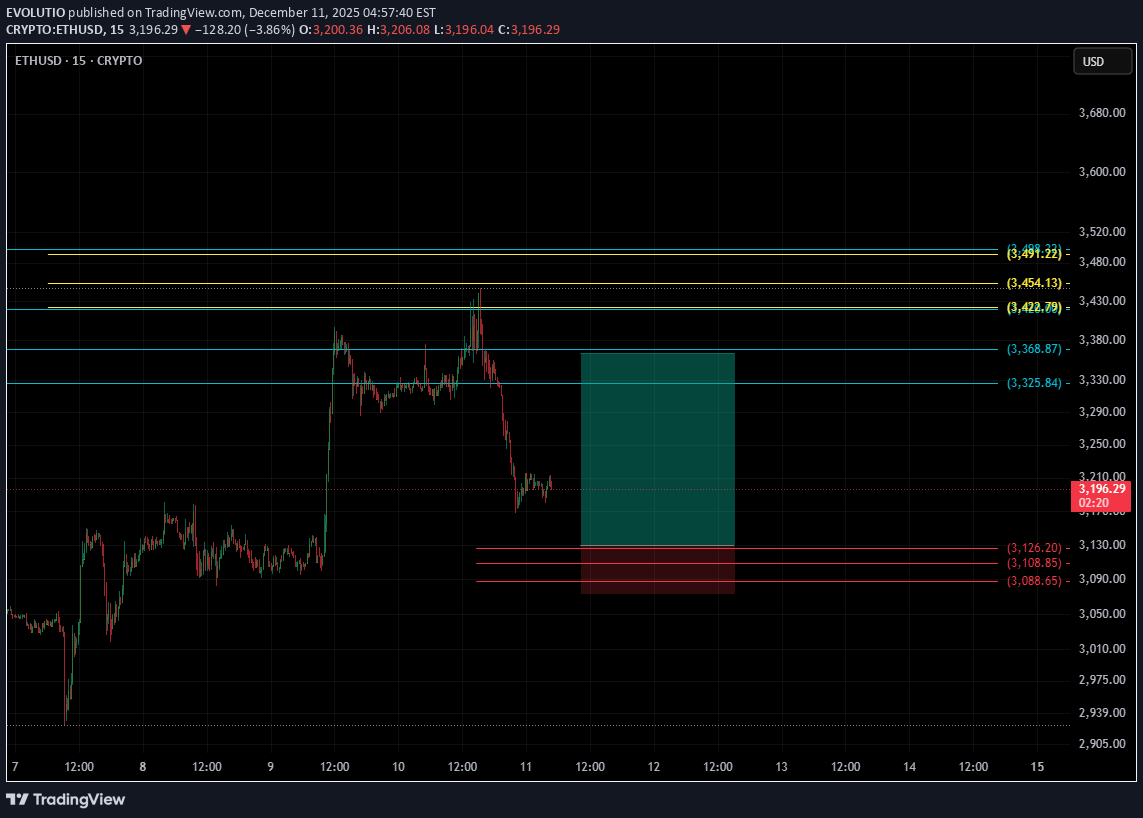

ETHUSD TF15min – Technical Setup Update

After a sharp pullback from the recent local high, ETH is stabilizing above short-term demand on the 15-minute chart. Price has begun to compress just beneath the mid-range, hinting at a potential rebound toward the upper liquidity bands if buyers step back in. 🔹 Entry: 3,130 🔹 Target (TP): 3,363.99 🔹 Stop-Loss (SL): 3,074.40 This setup presents a clean continuation-long opportunity, supported by confluence from prior reclaimed structure and unmitigated inefficiencies above. A push past the 3,325–3,330 pocket would likely trigger acceleration toward the target zone. However, a decisive break below the red demand band would invalidate the bullish thesis and open the door to deeper retracement. ⚠️ Financial Disclaimer (the funny one): This isn’t financial advice — it’s just chart scribbles on the internet. If you decide to trade using only vibes and screenshots, your balance may achieve price discovery… to the downside. Always DYOR and manage your risk like a civilized degen.SL breachded. That´s why I had a small (2%) SL.

ETH, again

Yesterday I thought about extending the SL lower, I wasn´t liking 100% the sideway movement it was making... so obsviously it went to hell today, just now. I´m making a new attempt, 15% up or 2% down.6% profit so far. Moving SL to 3026.12% now, moving SL higer!!Nice One !!!!!!!!!!

تحلیل جنجالی لونا/دلار: شانسی که یا شما را میلیونر میکند یا بیکار!

Ladies and gentlemen, gather around — because I may have just discovered the setup that will either send me to Valhalla… or straight back to my 9–5 job. Behold this absolute masterpiece of chaos: multi-year order blocks, forgotten liquidity, Fibonacci levels drawn with the precision of a sleep-deprived squirrel, and a reward-to-risk ratio so ambitious it should probably be illegal. Will price go to the moon? Will it nuke to zero? Will it just… stay sideways for 3 years because it hates me personally? Yes. But hey — sometimes you don’t follow the chart… the chart follows you. 😎📈 (Or it doesn’t. It usually doesn’t.) ⚠️ Financial Disclaimer: This post is not financial advice. I am not your financial advisor, your life coach, or your legally responsible adult. Trading involves risk, including the risk of shouting at your screen, heavy coping, and the sudden urge to become a monk. Always do your own research and never trade based solely on internet comedy.40% profit, moving SL above BE !!!

فرصت خرید پرریسک اتریوم: ورود به معامله لانگ با ریسک به ریوارد عالی (1:4)

Spotted a potential long opportunity on ETH after a clean pullback into a demand area. Price is currently retracing after a strong bullish leg, showing signs of slowing momentum on the way down. 🔹 Entry: 3049 🔹 Stop-Loss: 2974.72 🔹 Take-Profit: 3326.79, giving roughly a 1:4 R/R 🔹 Risk: ~2.4% 🔹 Reward: ~9.1% Why I like this setup: Clear bullish structure on the higher timeframes Liquidity grab below previous lows Price pulling back into a strong demand zone Good risk-to-reward for a continuation play Waiting for confirmation before full entry — a change of character (CHoCH) or bullish rejection wick would strengthen the setup. Let’s see how it plays out. 🚀

خرید اتریوم: فرصت ترید با ریسک کم و سود ۳ برابری!

Trade Setup: Entry Point: Enter at the price level of 3,020 only. Stop-Loss: Set the stop-loss at 2,965.86 (below the recent low), a 1.79% risk. Target: The target for this trade is 3,208.39, providing a potential upside of 5.17% (around 156.23 points). Risk/Reward Ratio: The setup offers a 3.01 risk/reward ratio—great potential for reward compared to risk. 📈 Why This Setup? This trade has a solid risk-to-reward profile, with a clear entry point, stop-loss, and target. The entry zone aligns with current market structure, and the target is based on key price levels. 💡 Trading Tip: Stick to your risk management plan. Adjust the trade if market conditions change. Always be ready for any market movements! Let’s see how this setup unfolds! 🔥 #ETHUSD #Crypto #Trading #TechnicalAnalysis #CryptoTraders #ETH #TradeSetup #RiskManagementIt didn´t went to our entry point, almost, but it didn´t.

سیگنال خرید اتریوم: احتمال بازگشت قوی پس از جارو کردن نقدینگی (نقطه ورود و حد ضرر اعلام شد)

After an extended sell-off during the session, ETH formed a sharp liquidity sweep near the $2,720 – $2,730 zone, followed by a strong bullish reaction. Price has broken short-term structure to the upside and is now forming higher lows on the 15-minute timeframe. 📌 Entry: around $2,800 📌 Stop-loss: below the liquidity sweep zone (~$2,725) 📌 Take-profit: targeting $2,960 – $2,970 zone from previous imbalance / inefficiency ➕ Confluences Rejection from higher-timeframe demand Aggressive selling exhausted after liquidity grab Bullish market structure shift (MSS) on M15 Increasing volume on upward candles ⚠️ What invalidates the setup? A clean break below $2,725 with strong selling pressure would invalidate the reversal bias and open space for continuation to the downside.Perfect! Let´s wait for the next entry! Keep tuned

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.