EG-FOREX

@t_EG-FOREX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

EG-FOREX

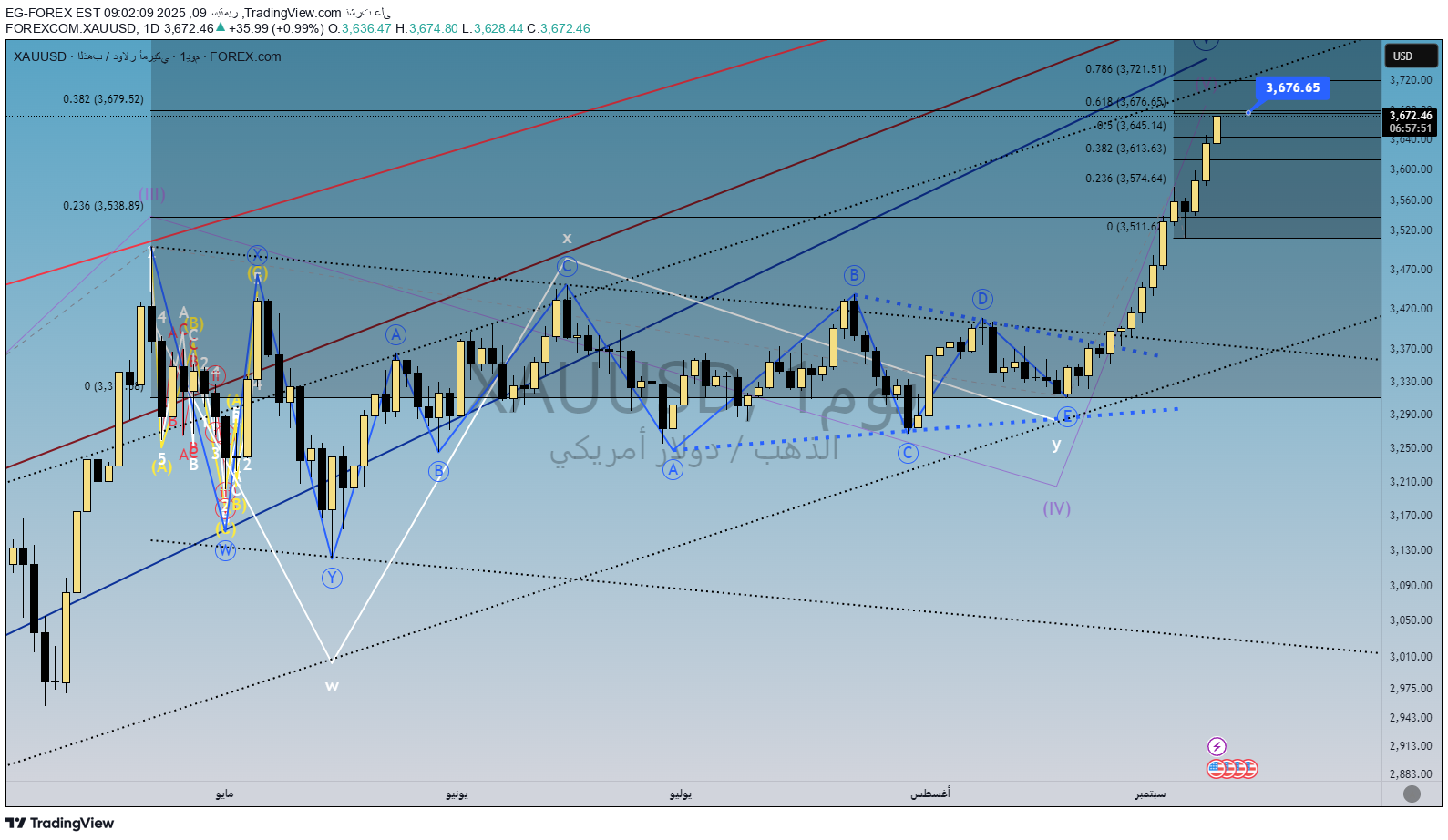

الذهب الموجة (4) على الأبواب أم صعود إلى 3803 دولار؟

Gold wave (4) on the doors or up to $ 3803? 1️⃣ Basic Screenplay: ☑️ Gold rose in parallel with silver at the end of the session on Friday, but he did not confirm the new silver summit and remains the maximum modern gold level at 3707.65 dollars, which is the highest level during the day Wednesday, September 17. ☑️ The graph shows that Wednesday's summit represents the wave 5 of (3). In this scenario, the gold is supposed to remain without the summit of Wednesday, and start to decline next week with the beginning of the wave (4). ☑️ The wave (4) will be a partial correction of the wave (3), which will lead to a decline in gold in the coming weeks and the short -term goal for the decline is around 3556 dollars, with the possibility of a greater drop after that. 2️⃣ Alternative scenario: ☑️ The wave 4 ended at 3268.18 dollars on July 30, instead of August 20. ☑️ In this scenario, the summit of $ 3707.65 on Wednesday is the summit of the wave of 3 sub -branches, while the bottom represents 3627.97 dollars on Thursday, September 18th, the 4 sub -wave of the wave 5, and it is expected to push gold to the range of 3775 - 3803 dollars before it ends. ☑️ As long as the gold price does not exceed 3707.65 dollars, the alternative scenario will remain less likely

EG-FOREX

الذهب بعد الفيدرالي.. إلى أين؟

✨ Gold after the federal ... to where? Gold rose to $ 3707.65 during yesterday's trading, which may complete the fifth wave and wave (3) referred to by ascending in September 1 analyzes. The first goal of the decline is near the level of 3613.77 dollars. While the other short -term goal is near the level of 3556.03 dollars. If the gold drop is part of the 4 -referred wave (IV), it is expected that the prices will last to lower levels, If the price is closed with a strength above 3707.65 dollars (yesterday's summit), this will indicate that the wave 5 of (3) has not been completed yet, in which case the prices are likely to turn to the range of 3775-3803 dollars before the formation of a summit. The alternative probability is that the current wave 5 is the 1 wave of the 5 wave in the completion phase, Be both interpretations referring to a coming landing, whether in the wave (4) or in the corrective wave. 📉 Conclusion: Gold is a filter to drop to 3613.77 - 3556 levels ✅ Condition: Not closing above 3707.65

EG-FOREX

الذهب عند مستوى قياسي جديد!

💎 Gold at a new standard! ⚡️ Gold today rose to $ 3699.54, confirming its short -term rise. 📌 The next goal: a scope of 3775-3803 dollars for a 5 out of (3) wave, where technical analysis indicates that the upper limit of the wave channel (3) is between these two levels. ⏳ After that, a partial correction will begin that may last for weeks or months. We had indicated in September 1 analyzes that gold is up to 3673 levels and has already achieved this target a few days ago, you can decline the analysis from here ⬇️ t .ME/C/1431871074/41320 💰 Conclusion: Gold continues to climb, and an opportunity for followers to monitor developments closely and there is no room for sale currently.

EG-FOREX

الذهب ما زال داخل نطاق متذبذب

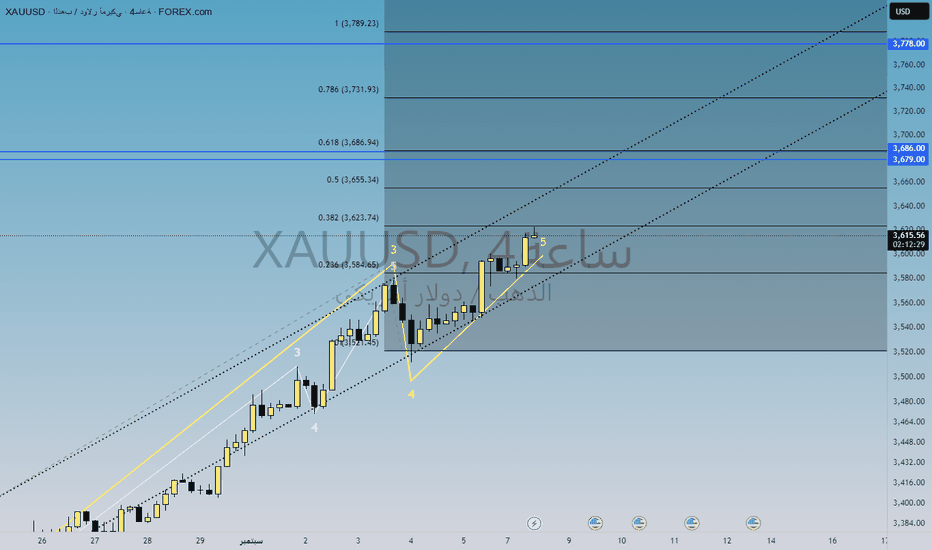

Gold is still within a volatile scope Gold prices increased during instant trading to record the level of $ 3674.80, which is the upper limit of the target range between 3600 and 3673 dollars. This rise came on Tuesday, September 9, and this rise was indicated in September 1 analyzes. Fifth waves are usually strong in precious metals, which enhances upscale expectations, and analyzes indicate that the top channel for the third wave passes the range of 3775--3803 dollars during the next two weeks. At the level of $ 3778, the fifth wave will equate the first wave, which is the most common pattern in impulsive movements. 2️⃣ An alternative scenario: If the fourth wave took the form of a traditional triangle ending on July 30, the registered summit on Tuesday may represent the third wave 3 of the fifth wave 5, after which a short -term decline (the fourth wave 4) is expected about 3592 followed by a new rise (the fifth wave 5) towards the mentioned goals.

EG-FOREX

تحليل الذهب – تحديث

Gold analysis - update Gold rose on Tuesday to 3674.80, achieving the target range summit of $ 3600 - $ 3678 referred to in September 1 analyzes ✅ The fifth wave may be at a current top or may extend about 3775 - 3803 in a week and a half, as the upper direction line pass (3). At $ 3778 the wave will be 5 equal to the 1st wave, which is the most common relationship in wave impulses. In the short term: The internal momentum index reached its climax on September 3, and the new gold peaks did not confirm on September 5, 8 and 9 until now, which may make it difficult to continue as the index is confirmed. 📊 We follow developments first to confirm the next scenario. ⚠️ Conclusion: Despite the arrival of gold to the top of the target scope at $ 3673 referred to in the September 1 analysis, the momentum indicators did not confirm the last rise. 🔑 Please beware of buying now until a new confirmation signal becomes clear. The 3605 - 3608 region is a good area to climb to the summit again if it is not penetrated down and closed below.

EG-FOREX

الذهب يواصل صعوده ويقترب من القمة المستهدفة

📈 Gold continues to climb and approach the target summit Gold continued its recovery to the middle of the target range between 3600 and 3676 dollars an ounce, recording the highest level during today's session at 3667.67 dollars. Gold prices were closed high in 21 out of the last 30 days, which is rare. The last time we saw a similar series was on February 17-18 this year, when the prices were closed on 22 out of 30 days. At that time, the gold recorded a short -term top, and then fell slightly before the climb resumed until early April. It is worth noting that we expected gold to rise from $ 3311, and he has already succeeded in reaching the first specific goal at 3600 dollars, recording an important achievement in the current climbing wave. 💰📊 Currently, the third wave in its last stages, and this wave is likely to end within the target range of $ 3676, or the prices reach the upper limit of the emerging canal since early 2023, which intersects with levels of 3775-3803 dollars during the next two weeks as a maximum. Summary: Gold achieves strong altitudes and enters a crucial stage of the third wave that may push it to the average correction in the very close range.

EG-FOREX

تحليل الذهب: اقتراب الموجة الثالثة من نهايتها مع احتمالية تصحيح

Gold analysis: The third wave approaching its end with the possibility of a close correction Gold rose to a level of $ 362.57 during daily trading, achieving the scope of our previous goal at $ 3600. The price was closed up in 8 of the last 9 sessions. Gold is expected to complete the third wave within the scope of the target (3679 - 3686 dollars), or to achieve an additional summit near $ 3778 as a maximum of ascension. 🔑 Conclusion: The third wave approaches its end, followed by the start of the fourth wave, which will be a correction that extends for several weeks as a partial repulsion for the third wave.

EG-FOREX

الذهب يواصل قوته الصعودية مع أهداف جديدة تلوح في الأفق

Gold continues its upward strength with new goals looming on the horizon ✨📈 The bullish momentum of gold is still standing, as the price ended the Double Three (Zozaj - X - Triangle) at the level of $ 3311.59 on August 20. On September 1, we referred to the rise of gold towards the target levels (3600-3673 dollars) and the price at the time was at $ 3477. Today, gold reached $ 3578, which means a profit exceeding $ 100, meaning that the possible profit for the investor that entered September 1 is $ 100 per 💸✨ 💸✨. The next emerging goal is between 3600 and 3673 dollars, with the possibility of a higher target of $ 3778. As usual, gold and silver are often witnessed by a strong rush in the fifth wave, which is likely to be a bullish surprise. Gold will enter from tomorrow in a new period of time that will continue until the beginning of next week, followed by another session between 19-23 September, and it is likely that the formation of the fifth wave will be completed during one of these two windows. Conclusion: Since September 1, gold rose from 3477 to $ 3578, achieving a $ 100 profit per ounce, with a continued rise of about 3600-3673 dollars 📊💰.

EG-FOREX

استمرار الزخم الصاعد للذهب نحو قمم تاريخية

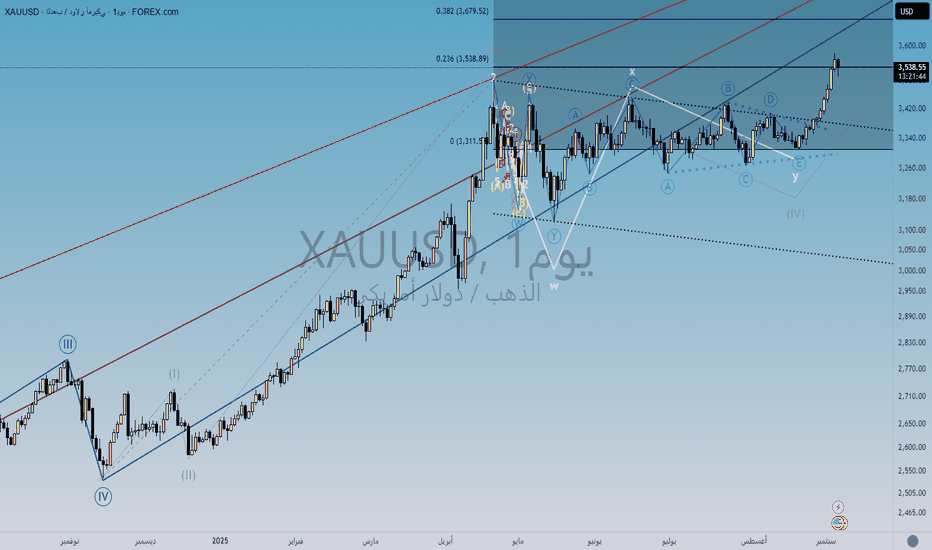

✨ Continuing the rising momentum of gold towards historical peaks ✨ The emerging trend is still existing; The price has made a compound model (double wave: zaghajj + X + triangle) since the summit $ 3500.17 on April 22, and the triangle at the bottom ended 3311.59 dollars on August 20. From there, gold began a new boarding journey towards historical peaks. The next goal is between 3600 - 3673 dollars, with several wave relations converging, with a higher -higher goal at 3778 dollars. As usual in the fifth waves, gold may be surprised by strong impulses at the end. However, breaking the level of 3268.18 dollars (the bottom of July 30) will nullify this rising scenario. And on the time frame for one hour, the current reading indicates that gold may have ended the first emerging wave (1), and now it is included in the framework of the second wave correction (2) descending, which is a natural correction within the greater emerging direction that we still emphasize. 🔑 Conclusion: The general trend of gold remains ascending with targeting levels of more than $ 3,600, but in the short term we may witness a temporary desired correction before resuming the rise.

EG-FOREX

تحديث الذهب

✨ بهروزرسانی طلا 📉 به نظر میرسد طلا موج (۲) را به عنوان یک اصلاح "سهگانه دوبل" در سطح ۳۱۲0.۹۹ به پایان رسانده و صعود خود را در قالب موج (۳) آغاز میکند 🌀.📈 دیدگاه کلی صعودی است، مادامی که قیمت بالاتر از سطح بازگشتی فیبوناچی ۰.۶۱۸ باشد و انتظار میرود قدرت خرید همچنان ادامه داشته باشد. 🟡 سناریوی جایگزین: ممکن است طلا در حال تکمیل موج (a) از یک زیگزاگ دوبل در قالب موج ۴ باشد. در این سناریو، صعود فعلی موج (b) از موج y در شمارش جایگزین موج ۴ است. 🎯 اهداف احتمالی: پایان موج (b) میتواند در بازه ۳۲۴۰.۹۴ تا ۳۳۱۵.۰۶ باشد.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.