Dr_Bazigu_Rodgers

@t_Dr_Bazigu_Rodgers

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Ladies and gentlemen, fellow traders, Whether you've just opened your first trading account or you’re already seeing consistent returns, I want to speak directly to your journey — The Trader’s Journey. It’s a path filled with hope, confusion, pain, breakthroughs, and ultimately, mastery. Trading is not a get-rich-quick scheme — it’s a mirror. It shows you your discipline, your patience, your weaknesses, and your potential. Let me walk you through six powerful stages that every successful trader must face. Stage 1: The Beginner This is where the fire is lit. You’ve just discovered trading — maybe you saw a video of someone making thousands in minutes, or a friend introduced you. You’re excited. You dream of quitting your job, making money in your sleep, living free. You don’t know much, but your heart is in it. And that’s okay. Every trader starts here — driven by curiosity and ambition. But beware: this is where most get trapped in illusion. Stage 2: The Gambler Without knowledge, the beginner becomes the gambler. You enter trades without analysis. You chase signals from Telegram channels. You over-leverage, revenge trade, and your emotions run the show. You win once, lose three times, and still believe the next trade is “the one.” At this stage, you’re not trading — you’re hoping. There’s no edge. Only chaos. The gambler loses money, but gains the most valuable asset: humility. Stage 3: The Sponge Now that you’ve felt the pain of gambling, you decide to get serious. You become the sponge. You buy courses. Watch endless YouTube videos. Download PDFs. Join mentorships. You’re learning — and learning — and learning. But here’s the danger: information overload. You start to believe more knowledge equals better results. But unless that knowledge is applied, tested, and internalized, it’s just noise. The sponge must eventually learn to filter, to focus, and to practice. Stage 4: The Fighter You’ve gained skills. Your chart looks cleaner. You can explain concepts now. You win some trades. You lose some. Sometimes you even feel like you’ve cracked it. But you’re still fighting. You jump from one strategy to another. You change your system after one bad week. You second-guess yourself. You're in the emotional trenches — and it’s exhausting. But this stage is crucial. Because it’s here that most quit. To move forward, the fighter must develop emotional control, patience, and a trading plan they can trust. Stage 5: The Climber Now, you're becoming a climber. You’ve found your edge. You follow your rules. You journal your trades. You’re no longer driven by thrill, but by execution. You’ve stopped chasing profits — now you chase process. You start seeing consistent returns. Risk management is no longer optional — it’s your oxygen. And trading is no longer about proving yourself — it’s about preserving and growing. The climber is building the foundation of long-term wealth. Stage 6: The Oracle And finally, the oracle. This trader has mastered not just the charts — but themselves. They understand that trading is 80% psychology and 20% execution. They know when not to trade. They know when to rest. Their results speak, but their ego is silent. They don’t need to be right — they need to be disciplined. They live by probabilities. They’ve seen every market condition. And they’ve turned trading into a business — not a hobby. This is mastery. This is where the journey leads. In Conclusion My fellow traders — wherever you are in this journey, honor it. Don’t rush the process. Each stage has its purpose, and each stage will shape you. You’ll lose trades. You’ll doubt yourself. You’ll feel like giving up. But if you stay committed — not just to profits, but to growth — you will climb. Remember: The market doesn’t reward perfection. It rewards consistency. It rewards discipline. It rewards self-awareness. So I ask you: 🔥 Are you willing to fight through frustration? 🔥 Are you willing to outlast the noise? 🔥 Are you willing to master yourself before mastering the market? Because if you are… then one day, you won’t just be another trader. You’ll be a professional. An oracle. Thank you — and trade well.

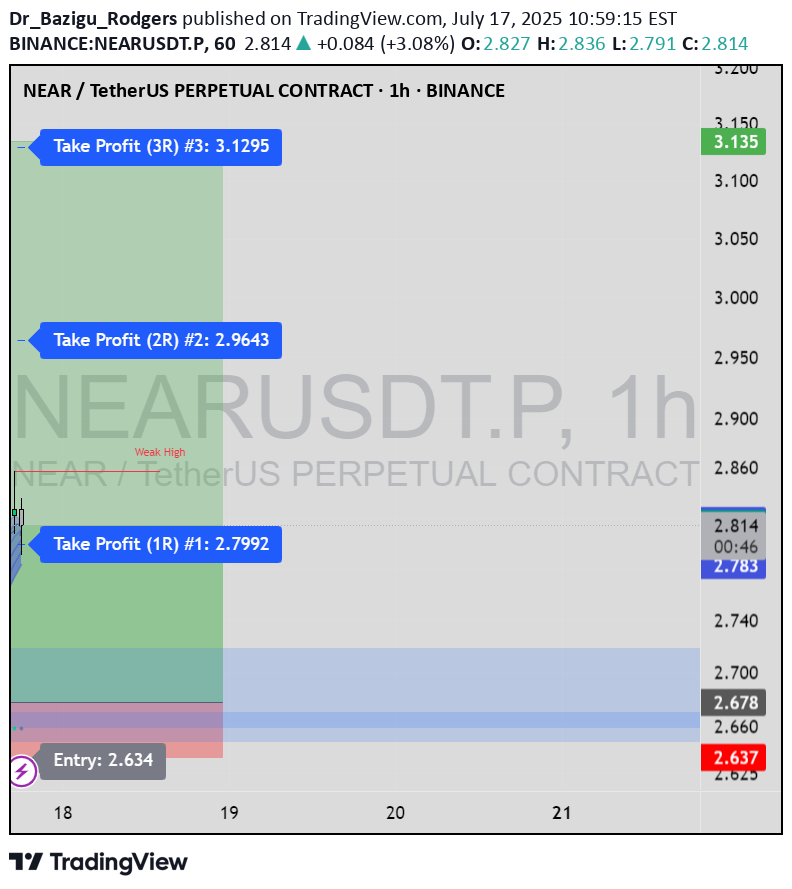

I'm going long on NEARUSDT.P after spotting a clear change of character (CHoCH) on the 1-hour timeframe, confirming a shift from bearish to bullish structure. 📍 Entry: 2.678 🎯 Target: 3.135 🛡️ Stop-loss: 2.637 This setup formed at a peak formation low, with price tapping into a well-defined bullish orderblock, which acted as a strong demand zone. The CHoCH was the final confirmation for the entry, signaling smart money involvement. This trade idea is suitable for: 🔹 Beginners – to learn how CHoCH + orderblocks provide high-probability entries 🔹 Intermediate traders – to refine entry/exit precision using market structure 🔹 Pro traders – for smart money confluence and risk-reward optimization 📈 Watching for price to respect the order block and push toward the target. RR is favorable. Manage risk accordingly!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.