CatalystEdge

@t_CatalystEdge

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CatalystEdge

XAUUSD Scalping

Scalping on XAU (Gold) due to its recent volatility and short-term bullish signals. The current market conditions indicate potential quick profit opportunities through rapid, small-scale trades. Target entry: (refer BOX). Stop-loss set at (own preferences).

CatalystEdge

Solana

Due to its strong fundamentals and recent bullish momentum. With ongoing network upgrades, increasing adoption of its blockchain technology, and a robust ecosystem of decentralized applications (dApps), SOL is well-positioned for significant growth. Target entry: $10X.XX, with a short-term target price of $170.XX, reflecting a potential gain of 60%.

CatalystEdge

XAUUSD SHORT

Gold gained traction and turned positive on the day above $1,920 after falling toward $1,910 earlier in the day. The benchmark 10-year US Treasury bond yield holds above 4.7% ahead of US data, making it difficult for XAU/USD to gather bullish momentum. Next support on 1877 R/R ratio 1:5

CatalystEdge

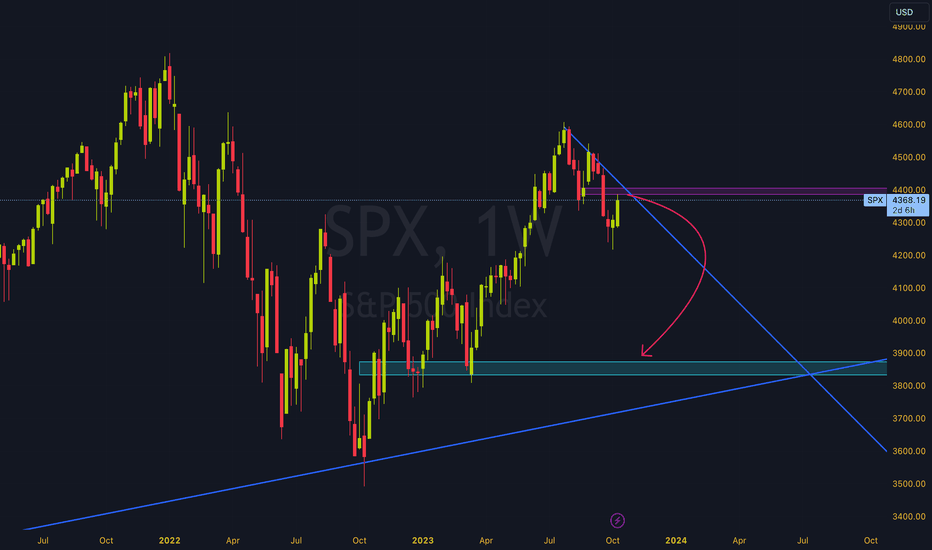

SPX500 Bearish BET 🔕

The bank said in a Monday note that trend-following traders on Wall Street, also known as commodity trading advisers (CTAs), are short a record $47 billion of US stocks. The extreme positioning comes after they sold $88 billion worth of stocks over the past 15 trading sessions. "(businessinsider.com)"

CatalystEdge

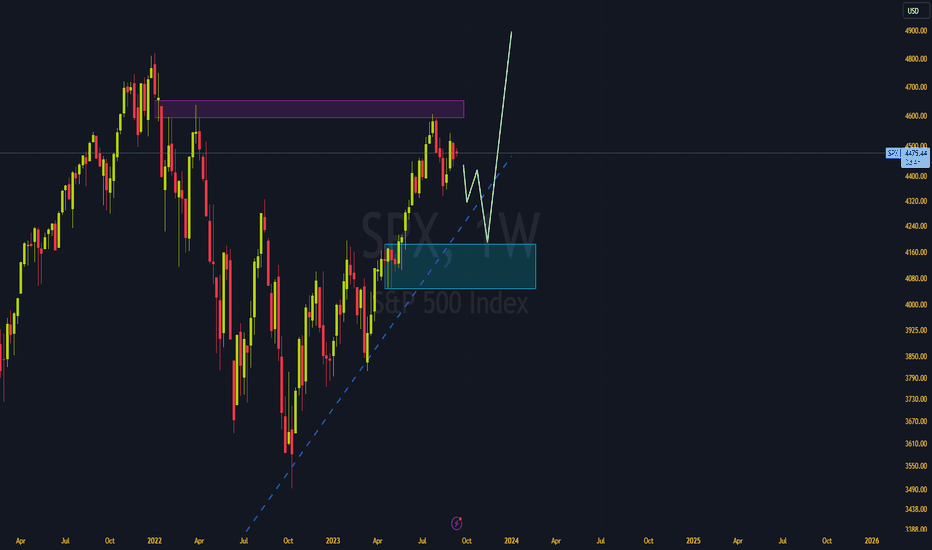

Big Short or BIG NO? Inflation is the new RESET era

Big Short or BIG NO? Inflation is the new RESET era Much attention is focused on key inflation data , with the consumer price index expected and the producer price index.

CatalystEdge

XAU stubborn 🤞

According to the most recent Fed Fund Futures probabilities, US interest rates have a 40% chance of being raised to 550-575 this year in either November or December. As expected, headline and core inflation will diverge.

CatalystEdge

GOLD Short Near Term Daily Level

The US dollar is flat as Jerome Powell provides no fresh important information. The DXY Currency Index support breakout has been unimpressive thus far, and the Australian dollar is now looking ahead to the local monthly inflation indicator.

CatalystEdge

GOLD Near Term Bearish

Slide to my previous Ideas. GOLD prices still projected to the downside as Fed's denial on interest cut for this year 2023.Here are the refinementPrice reacted previous level and continue to the upside. Here is the next resistance potential to continue traded to the southRefer to my new idea on GOLD price. As of 11th Jan 2023.

CatalystEdge

GOLD PRICES 2023

Expecting on bearish for 2023. Prices will slightly traded higher in the meantime since weakened in USD (refer DXY).

CatalystEdge

BITCOIN (3rd UPDATE)

Please consult from my previous analysis. Bearish trend on weekly basis still in effect.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.