Brielle_patrick_22

@t_Brielle_patrick_22

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BTCUSD — Bearish Trade Setup

BTCUSD — Trade Setup 📉 Bias: Bearish 🎯 Entry: 89,104 🛑 Stop Loss: 89,744 🎯 Target: 86,472 📊 Technical Reasoning: BTCUSD is reacting near a key resistance zone, showing signs of potential downside continuation. The entry is positioned at a technically valid level where selling pressure is expected to step in. The stop loss is placed above the invalidation point to control risk, while the target is aligned with a logical downside objective based on recent structure and liquidity. 📌 Execution Plan: • Sell at the marked entry level • Maintain disciplined risk management • Monitor price action as it approaches the target ❌ Invalidation: A strong break and close above 89,744 would invalidate this bearish setup. 💬 Do you expect rejection from this level, or a push higher first? ⚠️ This analysis is for educational purposes only. Not financial advice. 📉 Bias: Bearish 🎯 Entry: 89,104 🛑 Stop Loss: 89,744 🎯 Target: 86,472 📊 Technical Reasoning: BTCUSD is reacting near a key resistance zone, showing signs of potential downside continuation. The entry is positioned at a technically valid level where selling pressure is expected to step in. The stop loss is placed above the invalidation point to control risk, while the target is aligned with a logical downside objective based on recent structure and liquidity. 📌 Execution Plan: • Sell at the marked entry level • Maintain disciplined risk management • Monitor price action as it approaches the target ❌ Invalidation: A strong break and close above 89,744 would invalidate this bearish setup. 💬 Do you expect rejection from this level, or a push higher first? ⚠️ This analysis is for educational purposes only. Not financial advice.

XAUUSD / GOLD — SUPPLY ZONE

XAUUSD / GOLD — Trade Setup 📉 Bias: Bearish 🎯 Entry: 4355 🛑 Stop Loss: 4370 🎯 Target: 4280 📊 Technical Reasoning: Gold is facing selling pressure near a key resistance area, suggesting potential downside continuation. The entry is positioned at a technically valid level where sellers are expected to step in. The stop loss is placed above the invalidation point to manage risk effectively, while the target is aligned with a logical downside objective based on prior structure and liquidity. 📌 Execution Plan: • Sell at the marked entry level • Maintain disciplined risk management • Monitor price reaction as it approaches the target ❌ Invalidation: A clear break and close above 4370 would invalidate this bearish setup. 💬 Do you expect rejection from this zone, or a deeper pullback first? ⚠️ This analysis is for educational purposes only. Not financial advice.

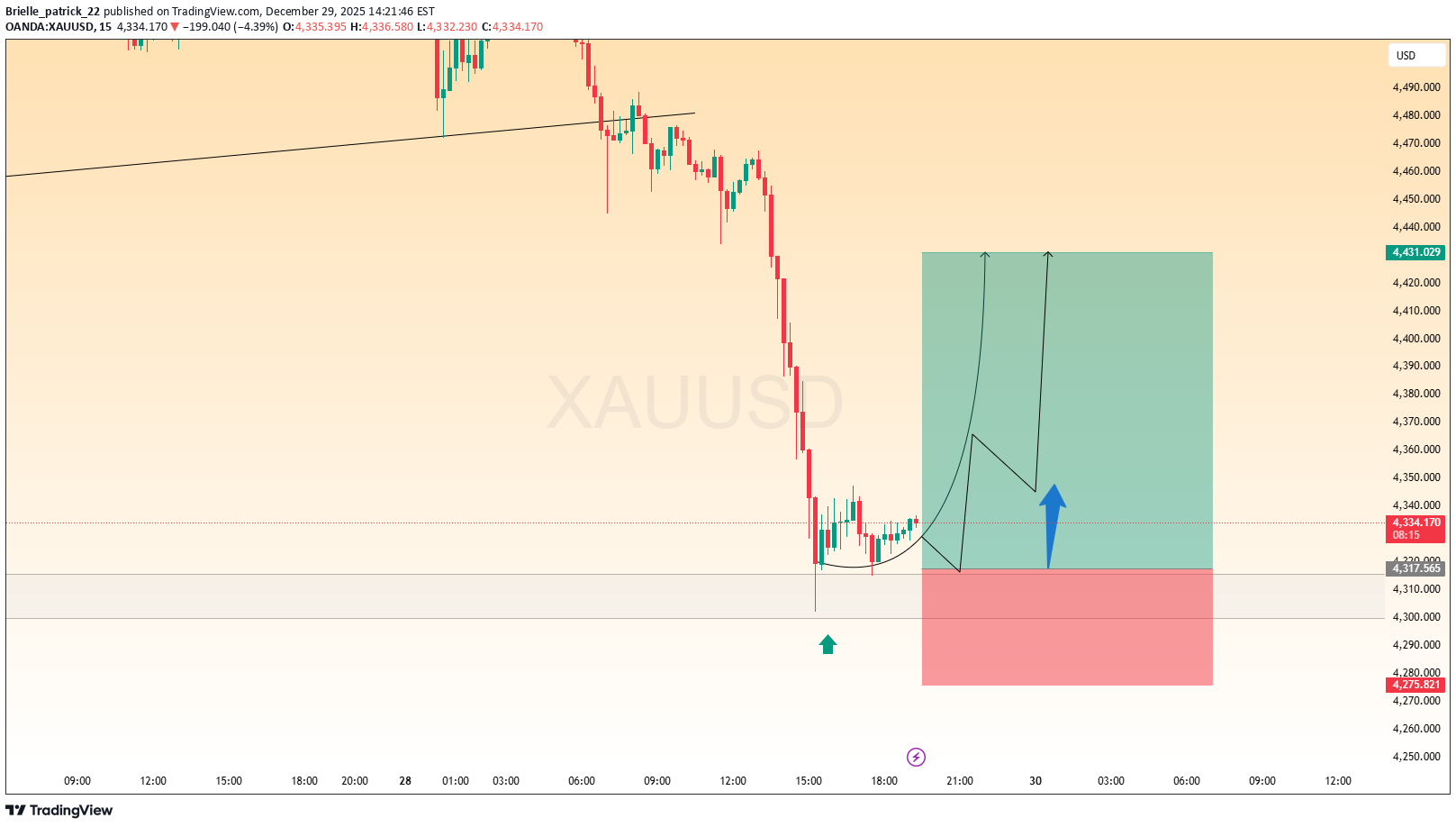

XAUUSD / GOLD — Trade Setup

📈 Bias: Bullish 🎯 Entry: 4317 🛑 Stop Loss: 4300 🎯 Target: 4431 📊 Technical Reasoning: Gold is trading in alignment with a bullish market structure and holding above a key support level. The entry is positioned at a technically valid area where buyers are expected to step in and continue the move higher. The stop loss is placed below the invalidation point to manage downside risk, while the target is aligned with a logical upside objective based on structure and momentum. 📌 Execution Plan: • Buy at the marked entry level • Maintain disciplined risk management • Monitor price action as it approaches the target ❌ Invalidation: A clear break and close below 4300 would invalidate this bullish setup. 💬 Do you expect continuation toward 4431, or a pullback before the next leg up? ⚠️ This analysis is for educational purposes only. Not financial advice.

ETHUSD — Trade Setup

ETHUSD — Trade Setup 📈 Bias: Bullish 🎯 Entry: 2923 🛑 Stop Loss: 2888 🎯 Target: 3013 📊 Technical Reasoning: ETHUSD is trading within a bullish structure and holding above a key support zone, indicating continuation potential. The entry is positioned at a technically valid level where buyers are expected to step in. The stop loss is placed beyond the invalidation point to manage downside risk, while the target is aligned with a logical upside objective based on recent momentum and structure. 📌 Execution Plan: • Buy at the marked entry level • Maintain disciplined risk management • Monitor price action as it approaches the target ❌ Invalidation: A clear break and close below 2888 would invalidate this bullish setup. 💬 Do you expect ETH to continue higher toward 3013, or consolidate first? ⚠️ This analysis is for educational purposes only. Not financial advice.

BTCUSD — Trade Setup

📈 Bias: Bullish 🎯 Entry: 87,107 🛑 Stop Loss: 86,042 🎯 Target: 89,790 📊 Technical Reasoning: BTCUSD continues to trade with bullish momentum, holding above a key support zone and showing continuation strength. The entry is positioned at a technically valid level where buyers are expected to step in. The stop loss is placed beyond the invalidation point to manage downside risk, while the target is aligned with a higher liquidity objective and overall bullish structure. 📌 Execution Plan: • Buy at the marked entry level • Maintain disciplined risk management • Monitor price behavior as it approaches the target ❌ Invalidation: A clear break and close below 86,042 would invalidate this bullish setup. 💬 Do you expect continuation toward 89,790, or consolidation before the next leg up? ⚠️ This analysis is for educational purposes only. Not financial advice.

Buy Setup Active

🔥 Buy Setup Active Entry Level: 4360 🎯 Target Level: 4462 ❌ Stop Level: 4340 Bullish momentum building — price holding above a strong support zone, and buyers may attempt to push the market upward toward the next resistance level! ⚡ ⚠️ Disclaimer: This is not financial advice, just my market outlook.

Buy Setup Active

🔥 Buy Setup Active Entry Level: 4407 🎯 Target Level: 4485 ❌ Stop Level: 4395 Bullish momentum building — price holding above a key support zone, and buyers may attempt to push the market upward toward the next resistance level! ⚡ ⚠️ Disclaimer: This is not financial advice, just my market outlook.

XAUUSD / GOLD — PREMIUM Trade Setup

🔥 Buy Setup Active Entry Level: 4433 🎯 Target Level: 4500 ❌ Stop Level: 4412 Bullish momentum strengthening — price holding above a strong support zone, and buyers may attempt to push the market upward toward the next resistance level! ⚡ ⚠️ Disclaimer: This is not financial advice, just my market outlook.

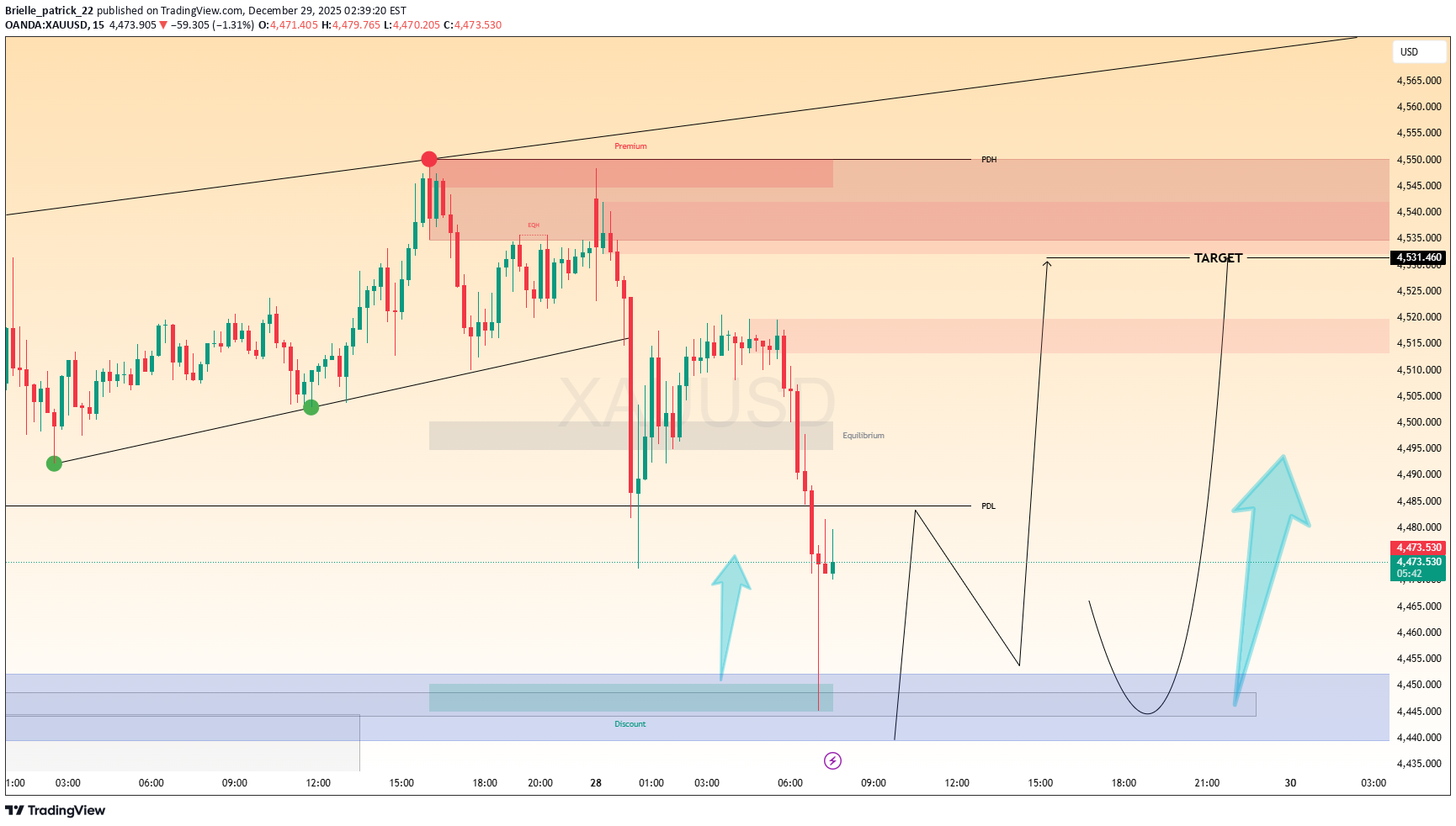

سیگنال طلای امروز: فرصت خرید در قیمت ۴۴۵۰ با هدف ۴۵۳۰!

XAUUSD / GOLD — Trade Setup 📈 Bias: Bullish 🎯 Entry: 4450 🛑 Stop Loss: 4430 🎯 Target: 4530 📊 Technical Reasoning: Gold continues to trade within a bullish structure and is holding above key support levels, indicating strong upside momentum. The entry is positioned at a technically valid level where buyers are expected to step in for continuation. The stop loss is placed below the invalidation point to manage downside risk, while the target is aligned with a logical upside objective based on recent price structure and momentum. 📌 Execution Plan: • Buy at the marked entry level • Apply disciplined risk management • Monitor price action as it approaches the target ❌ Invalidation: A clear break and close below 4430 would invalidate this bullish setup. 💬 Do you expect a clean continuation toward 4530, or a brief pullback first? ⚠️ This analysis is for educational purposes only. Not financial advice.TRADE IS ACTIVE FROM 4452

BTCUSD — Trade Setup

BTCUSD — Trade Setup 📈 Bias: Bullish 🎯 Entry: 86,552 🛑 Stop Loss: 86,000 🎯 Target: 88,500 📊 Technical Reasoning: BTCUSD continues to trade with bullish momentum, holding above a key support area. The entry is positioned at a technically valid level where buyers are expected to step in and continue the upward move. The stop loss is placed below the invalidation point to manage downside risk, while the target is aligned with a higher liquidity objective and continuation structure. 📌 Execution Plan: • Buy at the marked entry level • Maintain disciplined risk management • Monitor price behavior as it approaches the target ❌ Invalidation: A clear break and close below 86,000 would invalidate this bullish setup. 💬 Do you expect continuation toward 88,500, or consolidation before the next leg up? ⚠️ This analysis is for educational purposes only. Not financial advice.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.