BA_Investments

@t_BA_Investments

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BA_Investments

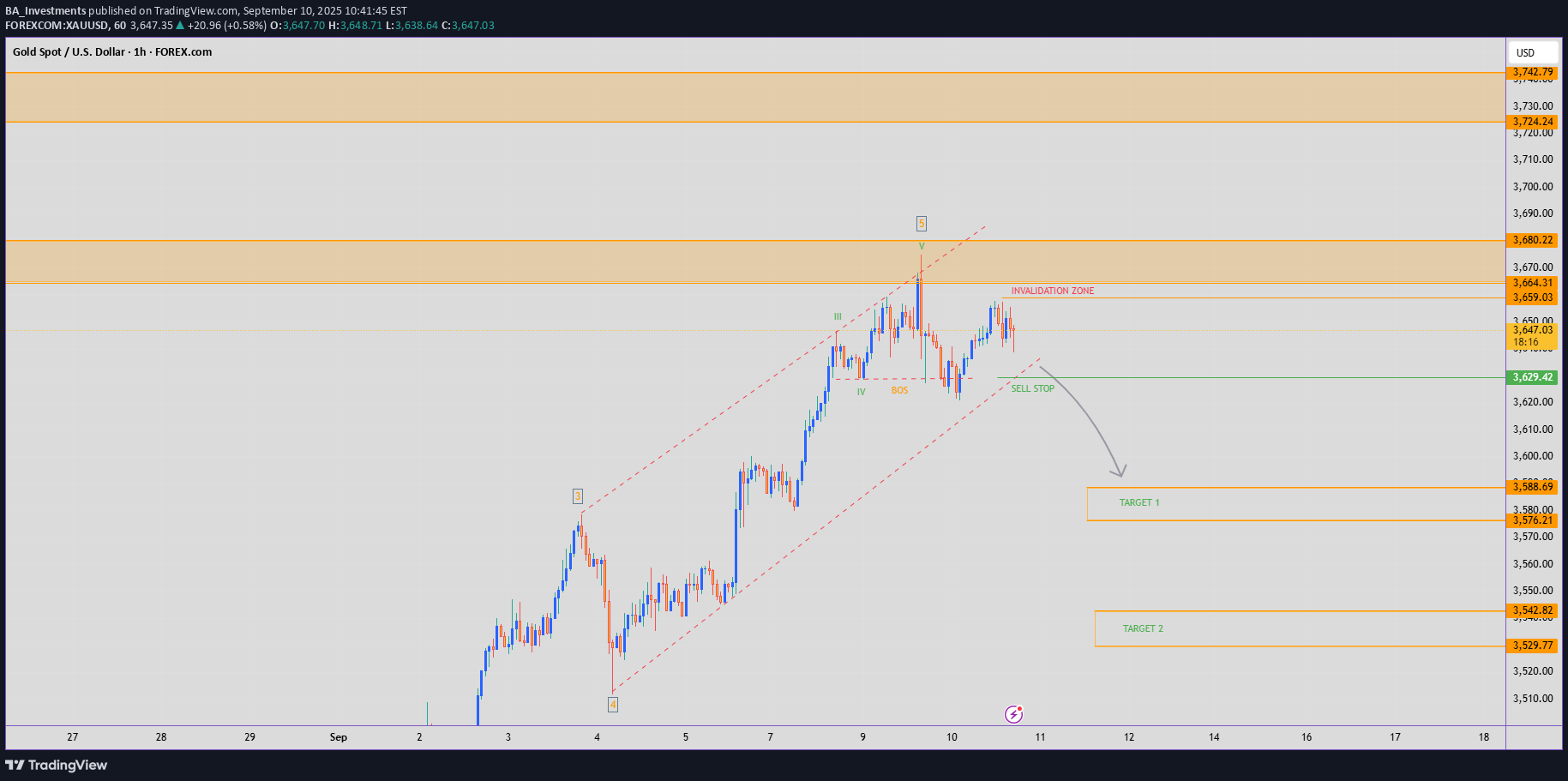

GOLD - BEARISH TO $3,588 (1H UPDATE)

Like I said on yesterday’s update, we’re yet to see ‘Minor Wave 4’ correction on Gold, as part of the bigger Wave 3 bullish cycle. We’ve seen a ‘Break of Structure’ as price broke below previous ‘Wave IV’ yesterday. I’ve placed a ‘Sell Stop’ order at $3,629. If this activates, I’ll be targeting $3,588📉 If this doesn’t activate, then our buy positions keep pushing higher into profit!

BA_Investments

GOLD - WAVE 5 BULLISH TO $3,734 (UPDATE)

I'll warn you all again, don't blindly ignore this 'Scenario 2 Bullish Analysis' as it might catch you off guard!👀 Gold has failed to take out the Wave 2 low ($3,245) multiple times now. As long as Gold remains above Wave 2 low ($3,245), this Gold bullish bias remains an option. As traders we always have to be prepared to adapt to different market conditions.

BA_Investments

GOLD - SHORT TO $2,880 (UPDATE)

The slow burn on Gold continues... 137 days of pure consolidation🩸 Be patient & don't become a victim to the markets by forcing trades.

BA_Investments

BA_Investments

GOLD - BULLISH TO $3,734 (1H UPDATE)

Scenario 1: Waiting for an ‘Impulse Wave’ to break above $3,380 then I’ll look to enter further buys upon Wave 2 correction. Scenario 2: Keep an eye out for potential resistance around $3,360 zone, as there’s been a lot of bearish rejections in that zone for daily candles. If this zone holds for sellers, we could enter another sell & target $3,200📉

BA_Investments

GOLD - BULLISH TO $3,734 (1H UPDATE)

Like I said what could happen last night, we saw Gold take out last week’s low for liquidity & STRAIGHT AWAY saw a sharp bullish move back up, holding above last week’s low. It’s very possible Gold could be getting ready for another bullish move up. For now I am sitting on the side-lines, but I will let you all know when I take a position. Wave count has been updated & labelled on the chart✅ Invalidation Zone - $3,323 (Wave 2 Low)❌

BA_Investments

GOLD - WAVE 5 BULLISH TO $3,734 (UPDATE)

As I said on our last update, this 'Gold Bullish Scenario' remains valid as price has still failed to close below $3,245 (Wave 2) low. As long as Gold remains above Wave 2 high ($3,245), this Gold bullish bias remains an option. As traders we always have to be prepared to adapt to different market conditions.

BA_Investments

GOLD - WAVE 5 BULLISH TO $3,734 (UPDATE)

Quick & simple ‘Elliott Wave Theory’ analysis for our Gold ALTERNATIVE SCENARIO. ⭕️Complex 5 Sub-Wave Correction. ⭕️Buyers Remain Above $3,245. ⭕️Pending LQ at $3,500.

BA_Investments

Gold 1H Intra-Day Chart 28.07.2025

We saw a perfect move towards our $3,310 target, hitting our TP. What's next? Option 1: Gold now moves higher into the $3,385 area, before we can determine the next major move. Option 2: Gold drops lower towards $3,265 next. Which scenario do you find more likely?

BA_Investments

GOLD - SHORT TO $2,880 (UPDATE)

Gold 'Sell Trade' running 1,130 PIPS in profit to start the week. I hope you are all taking advantage of this free analysis & profiting from Gold's downside. Amazing move to start the new week, with much more downside expected. Drop me a message @XTBCAP for Account Management & Investment opportunities✅

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.