Avery_Upton

@t_Avery_Upton

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Avery_Upton

XML\USDT 15 minute

Price broke structure to the downside (BOS), leaving multiple fair value gaps (FVGs) above. I’m anticipating a corrective retracement into the imbalance zone to fill premium pricing. My sell order is placed inside the FVG confluence, targeting liquidity resting beneath equal lows. Expecting continuation lower once the retracement is complete. keep in mind if volume dries up here, it could get chopped.Buyers have stepped in and changed the sentiment.

Avery_Upton

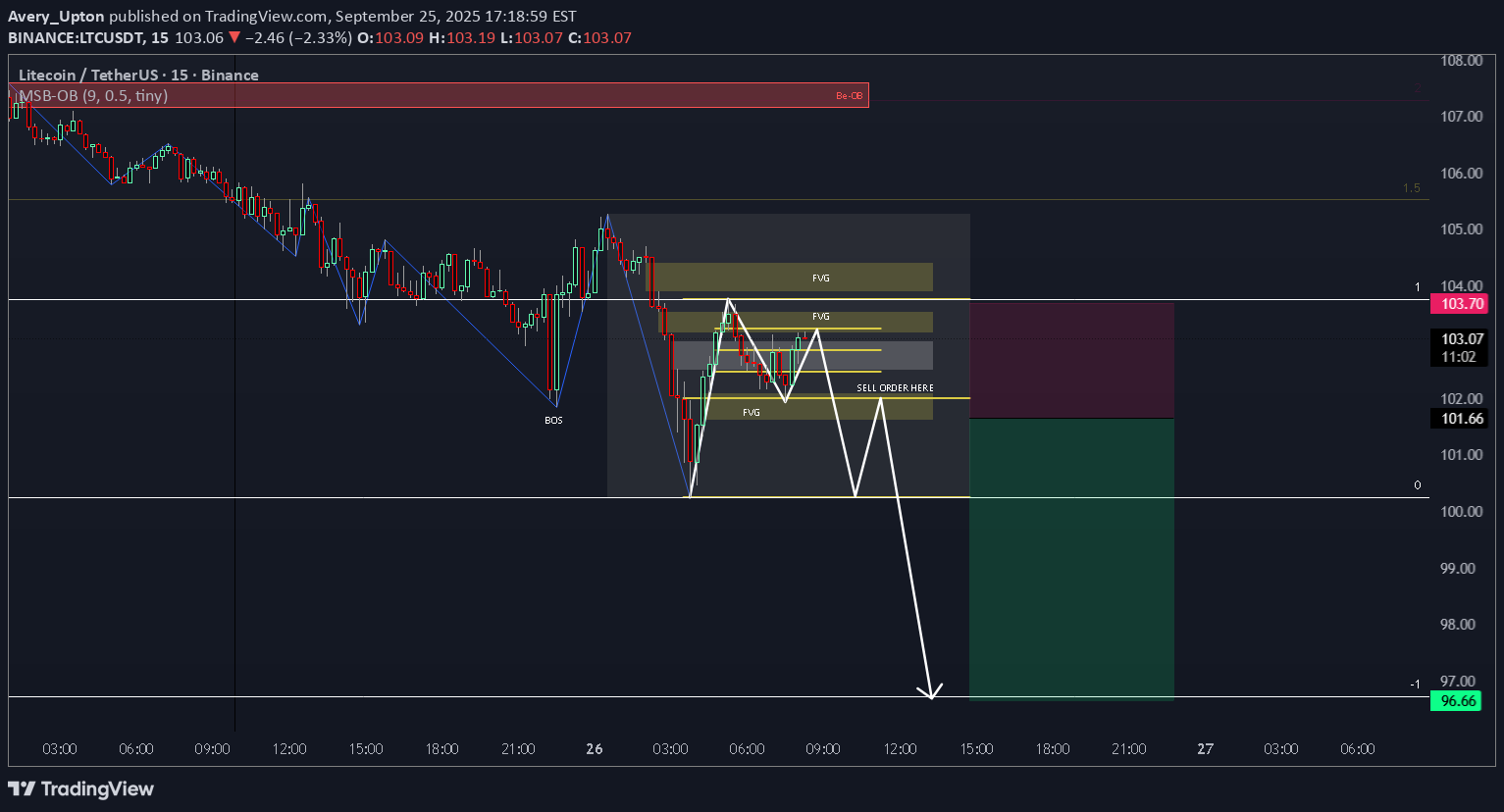

LTC/USDT 15 minute

Clean BOS followed by heavy displacement down — textbook bearish order flow. Market’s retracing into stacked FVGs, basically a liquidity magnet. Sell order sits in a solid zone where inefficient price meets bearish order flow. The risk: current consolidation could sweep higher into the upper imbalance before rejecting. Consider both the mid-FVG and the extreme FVG above as potential short triggers. Target the lows, but keep in mind if volume dries up here, it could get chopped. All the best.Seems that sellers maybe happy with this price to reload?

Avery_Upton

XRP 4H Flash Model, long setup

Flash Model, long setup. Price swept liquidity + broke structure. Now it’s retracing into demand. The play is simple: If there’s a clear imbalance, target the imbalance. Invalidation = break under demand. All the best

Avery_Upton

HBAR/USDT – 4H | SMC + Volume Profile View

HBAR/USDT – 4H | SMC + Volume Profile View Price ran a swing failure at the high → liquidity taken. From there, we got a displacement down that broke structure. That sets the bias bearish until proven otherwise. Breaker + FVG overlap = current reaction zone. If it fails, continuation is likely. Volume profile shows a virgin POC below → high-probability draw for price. The weekly inverse level under price adds confluence with the FVG for possible bounce/retracement before continuation. As long as price stays below the BOS level, I expect downside targets to get filled (POC, untested weekly zones). 📉 Bias: Bearish continuation. 📍 Invalidation: Reclaim BOS and hold above displaced structure → would flip bias neutral.

Avery_Upton

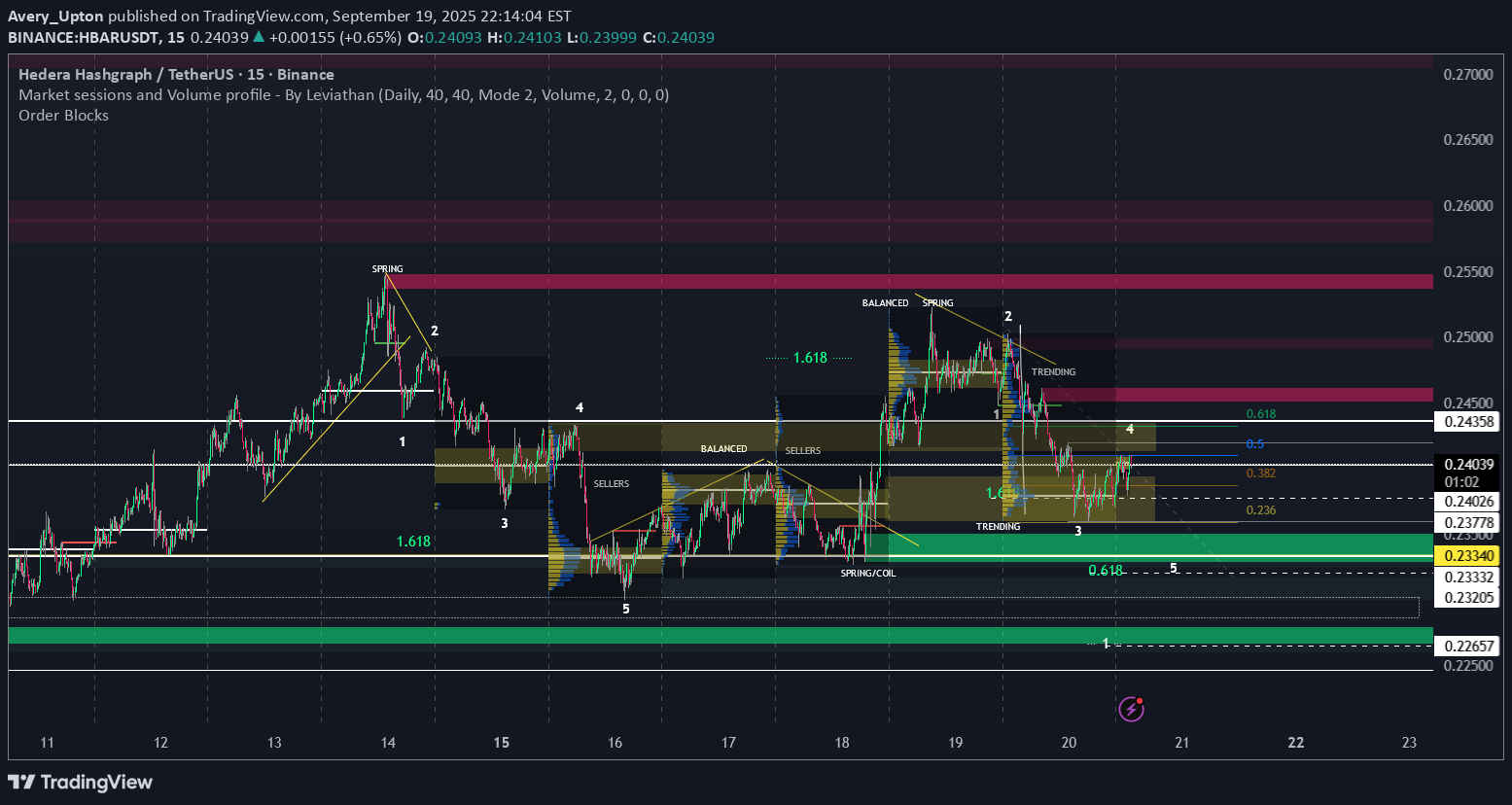

HBAR\USDT MARKUP

Here Is my roadmap for HBAR/USDT. I find marking up charts helps the brain to understand the language of the markets. I hope this may aid in your next move?

Avery_Upton

DOGE/USDT Markup

Another Saturday and another chart -- directions? I hope it helps to give some guidance. I feel we need to give that WEEKLY FVG a big dirty sweep before another major upward pounding.

Avery_Upton

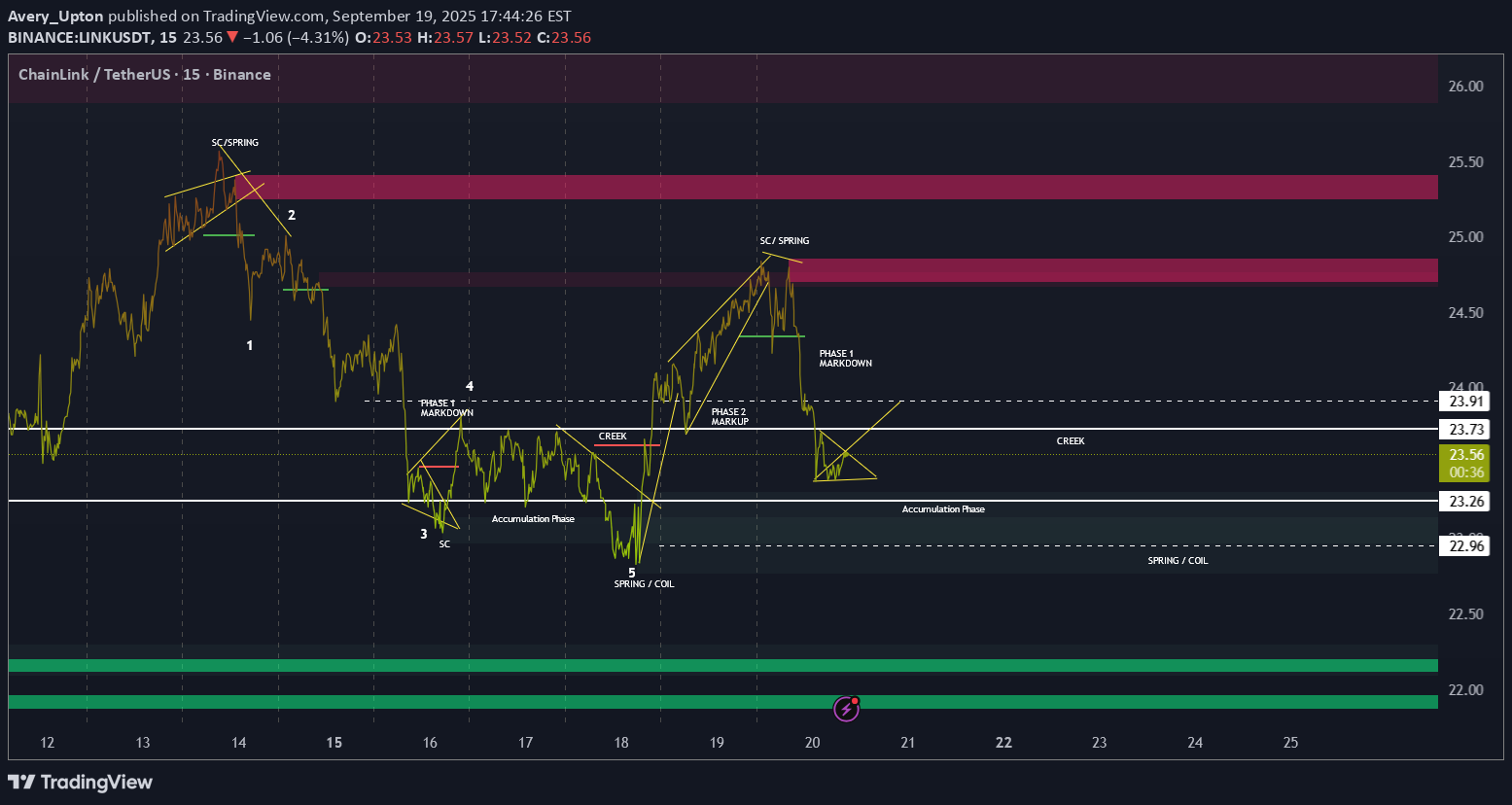

LINK/USDT

I have a strange interest in marking up charts. I find it relaxing/soothing. I enjoy the design/art of it. Here is LINK/USDT for no real reason.* TOP SC = BC Typo.

Avery_Upton

DOGE/USDT – 1H | FVG + Liquidity Trap

Price respected the daily FVG and set up a bullish reaction. FVGs often act as high-probability demand zones. Liquidity sweeps at highs/lows fuel the next move. Stops safely below structure. This is a textbook SMC sequence: Respect → Sweep → Expansion. Daily FVG respected ✅ Prior high liquidity swept ✅ Targeting highs above for clean 3R+ *IGNORE THE DAY NAMES ON DAILY CANDLES - Current 5 candles.Sellers where in control chasing untapped liquidity. This chart is VOID.

Avery_Upton

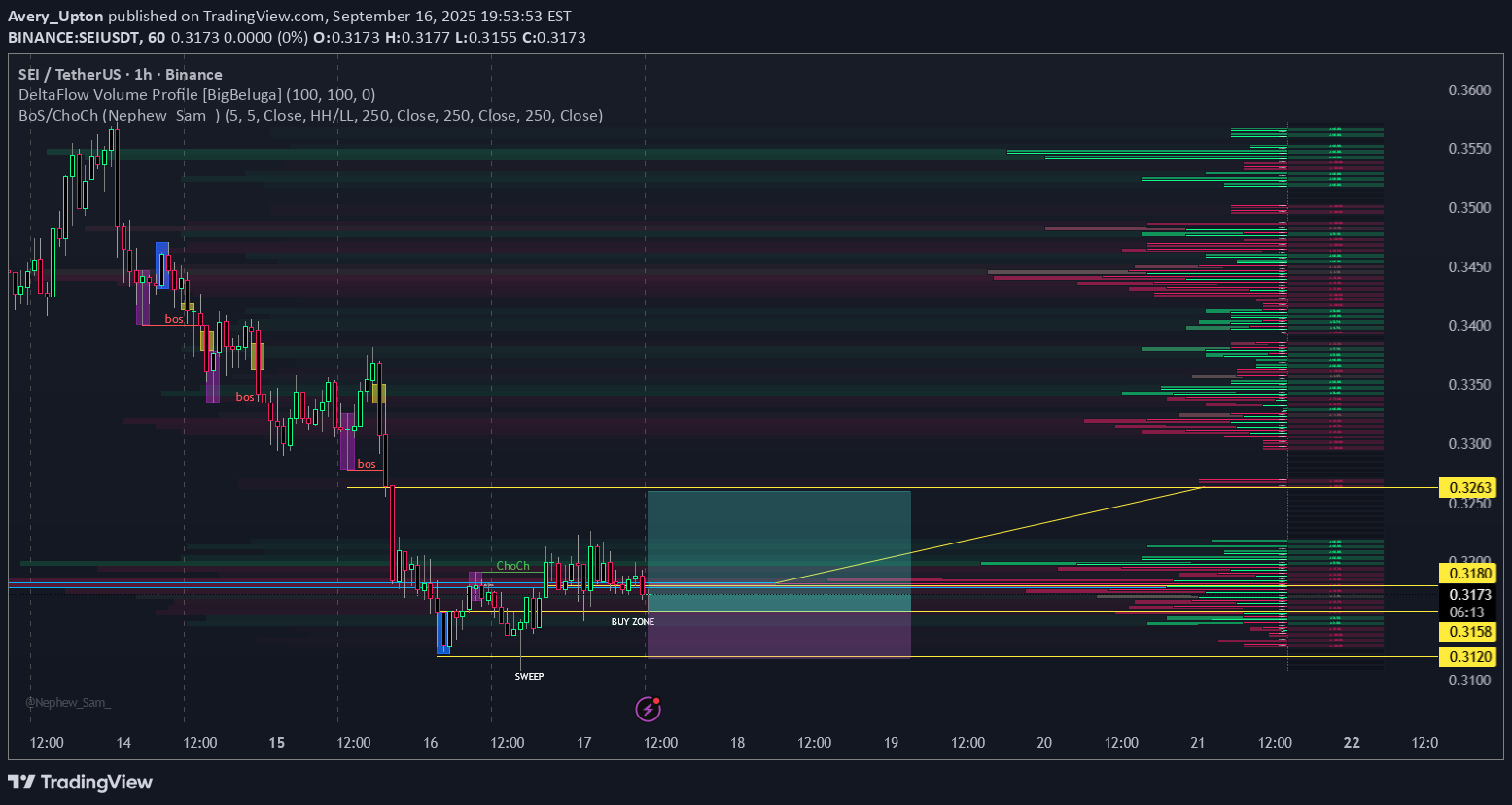

SEIUSDT Scalp 1hr

Price poked into the OB but was rejected. Smart money is absorbing liquidity, shaking out weak hands (stop hunts). Buy near the OB edge opposite the wick: Use a tight stop just beyond the wick to avoid getting caught if the stop hunt continues. Look for VP LVN/HVN confluence—if LVN below a bullish OB, upward move is easier. Key mindset: Spike + wick = confirmation that smart money is active here.

Avery_Upton

DOGE/USDT 1hr scalp

Falling slop Easier breakout; follow slope momentum Use a tight stop just beyond the wick to avoid getting caught if the stop hunt continues.No good!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.