AutoMarkets

@t_AutoMarkets

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AutoMarkets

Bull or bearish breakout

I'm waiting for the break before I make my move #WaitingOnGod

AutoMarkets

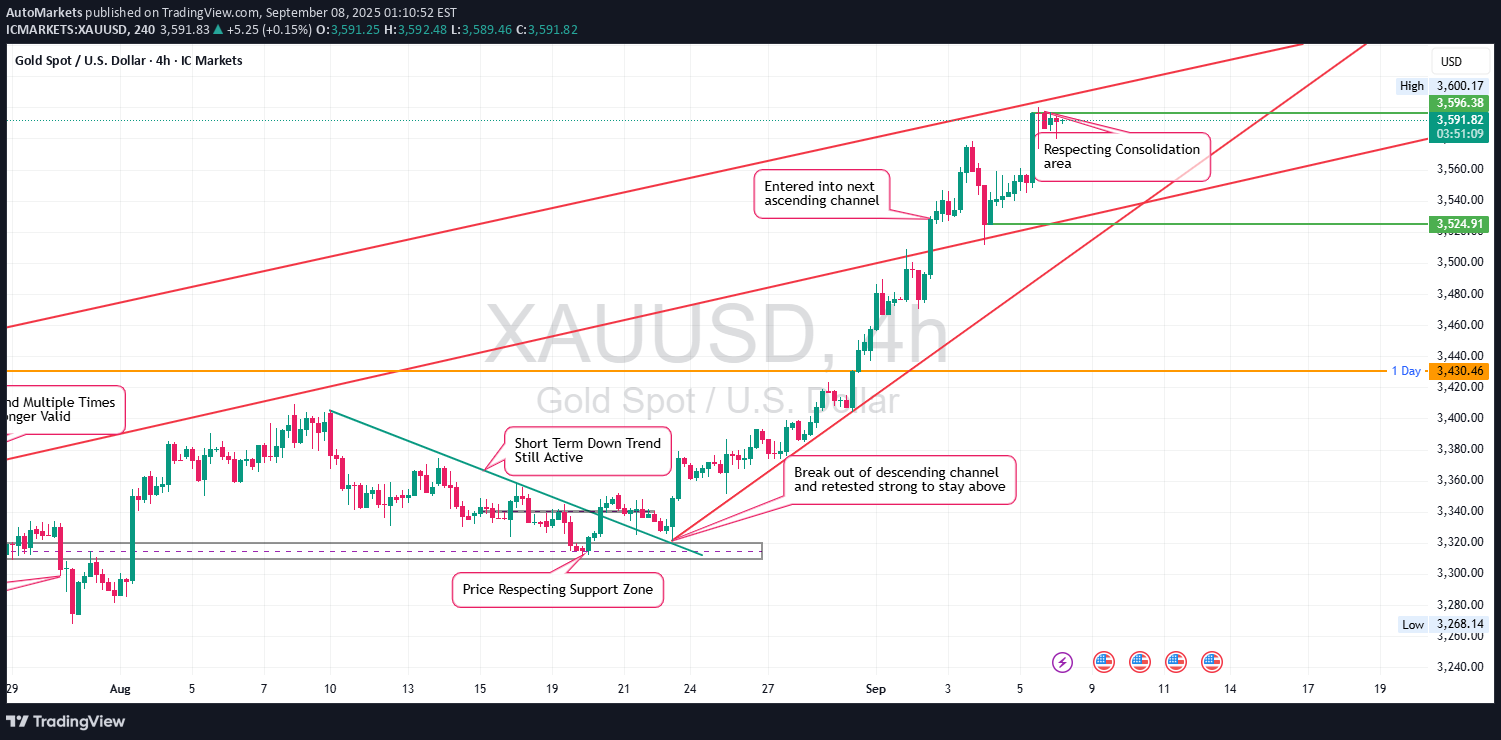

XAUUSD – Bull Pressure Builds After Breakout | Prediction Sunday

Gold (XAUUSD) continues its bullish climb across all major timeframes after cleanly breaking out of a short-term descending channel. The higher timeframes now show strong consolidation above structure, suggesting potential continuation. 4H Analysis: Breakout Retest Completed: Price broke out of the short-term descending channel, retested structure cleanly around 3,524.91, and is now respecting an ascending channel. Current Consolidation: Gold is consolidating under the 3,600 resistance zone, holding strong above support at 3,578.50, forming a bullish flag-like structure. 1H Structure: Support at 3,578.50 has been tested multiple times with rejection wicks, showing buyer strength. If price breaks and closes above 3,600, continuation into 3,650 and beyond is likely. A break below 3,524.91 would shift focus back to the 3,500 level and invalidate the short-term bullish setup. 🗺 Daily Context: Price is trading within a well-respected ascending channel. The macro trend remains bullish as long as structure above 3,500 holds. Trading Plan: Bias: Bullish Buy Zone: Retests near 3,578–3,580 Target: 3,600 → 3,625+ Invalidation: Break below 3,524.91 "Structure tells the story. Let the market reveal its hand, then strike."

AutoMarkets

Gold Testing Supply Again – Will Bulls Break Through? | XAUUSD

Gold has returned to a key 1H supply zone after a strong bullish move from the 3,352.00 region. The first rejection was sharp, but buyers quickly reclaimed control, pushing price back into the same zone with momentum. This double-tap scenario can often lead to a breakout if bearish pressure weakens. There are two clear zones in play: •Upper supply zone (~3,385.00) – Price wicked into this level but has yet to decisively break and hold above. •Mid-range supply (~3,377.00) – Currently acting as the main area of contention. If price clears and holds above both zones with bullish candle closings, we could see continuation toward 3,390+ levels. However, failure here could send gold back down to retest the 3,352.00–3,356.00 demand zone, or even lower toward 3,311.00 where the imbalance remains. Bias: Bullish, but cautious. Watch for confirmation before entering. Key Levels: •Resistance: 3,385.00 •Support: 3,356.00, 3,311.00 •Next upside target: 3,395.00+

AutoMarkets

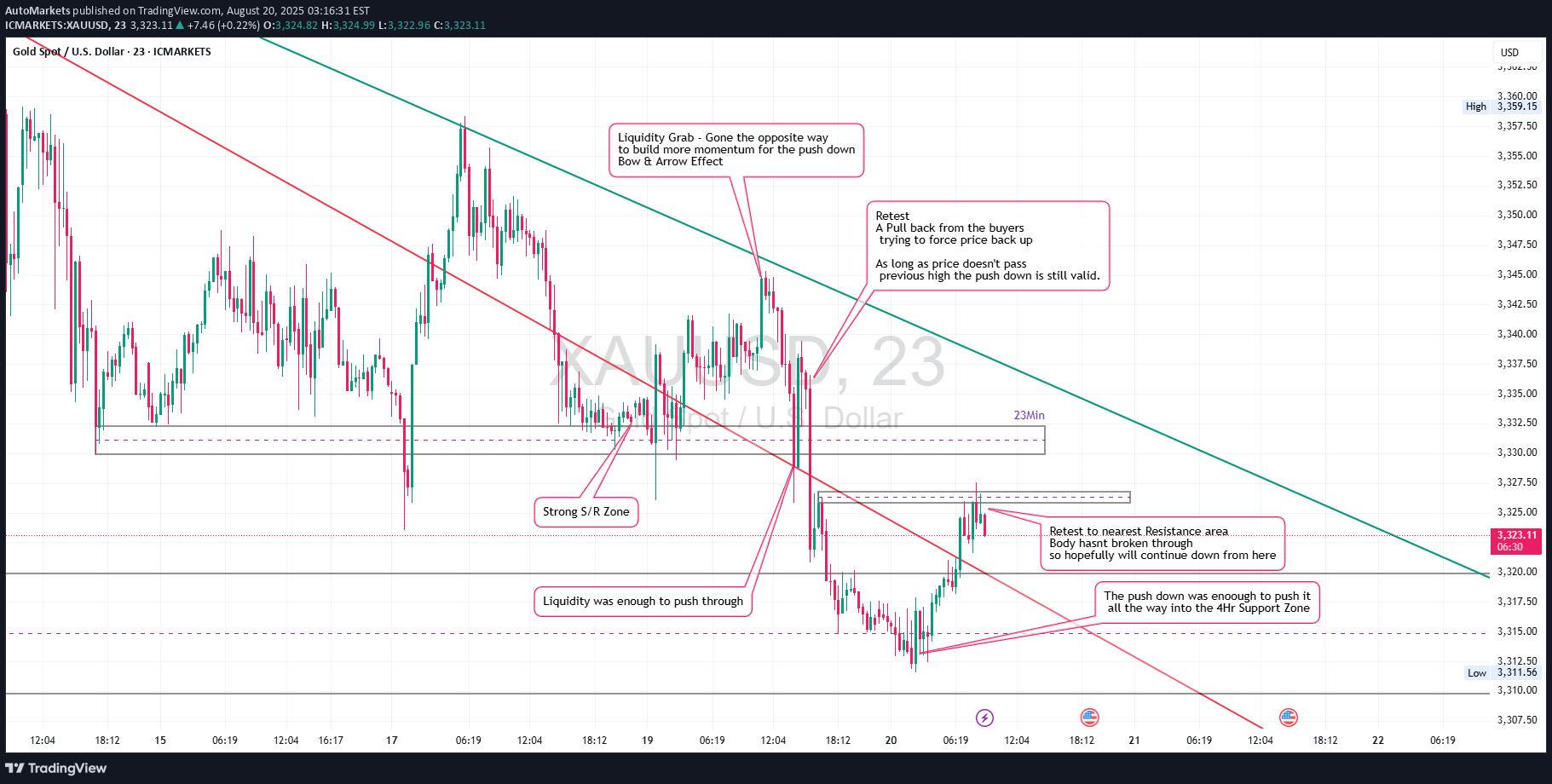

Gold Rejecting Resistance After Liquidity Grab – Bow & Arrow Set

This is a textbook liquidity grab + rejection setup. Price executed a liquidity grab above structure, shooting into previous highs to build momentum for the drop — classic bow and arrow effect. After sweeping stops and pulling back, price retested the nearest resistance (around 3,324–3,325), but hasn’t broken the body high — this confirms sellers are still active. The push down was strong enough to reach the 4H support zone, and although price bounced, it looks like a temporary pullback rather than a reversal. As long as price stays below 3,347, this short bias holds. The structure still supports downside continuation unless a clear breakout occurs. Bias: Bearish — expecting continuation down toward 3,312 and possibly back to test 3,307.

AutoMarkets

Gold Respecting Key Support — Downtrend Still Active on the 4H

Price on XAUUSD is currently hovering around the 3,324 zone, reacting to a clear support area that’s held firm since the last major dip. The uptrend is no longer valid — it's been broken multiple times and has now been decisively rejected. We’re still trading below a short-term descending trendline, which remains active. A prior liquidity sweep below support (around 3,247.54) may have been a fakeout to trap late sellers. If price fails to break the short-term trendline, this bounce could be short-lived. However, a clean breakout above the trendline could open up retracements toward the 3,360–3,384 area. Stay alert for a retest of support at 3,310–3,324, and watch how price behaves near the trendline before considering entries. Bias: Neutral to Slightly Bearish — Until trendline break is confirmed, downside continuation is still on the table.

AutoMarkets

Gold Technical Outlook – Midpoint Support Holds, Retest of 3,500

On the Daily Chart, gold has been climbing steadily since New Year’s Day, with several pullbacks along the way but maintaining its overall bullish trajectory. After breaking into the 3,167.72 – 3,430.46 range, price has shown comfort within this zone. The midpoint at 3,286.94 (Green Line) has acted as a supportive bias, with price holding above it — reinforcing the view that bulls remain in control. That said, this period of consolidation has lasted longer than expected, breaking the previous rising trajectory (shown by the diagonal Red Line). This suggests that momentum has weakened. Importantly, this doesn’t confirm that the bullish run is over — but it does highlight the market’s current struggle to push higher with strength. A high of 3,500.02 was briefly tested but quickly rejected, which leads me to believe the market still has reason to retest that level in the near future.

AutoMarkets

XAUUSD – Double Tap or Deeper Correction?

Idea Breakdown: Gold just gave us a textbook double-tap at the key 1,910–1,912 demand zone. This level aligns with the 61.8% retracement from the most recent bullish impulse. The long wicks on the daily suggest strong rejection by buyers. As long as price holds above 1,910, this looks like a potential launch pad for another leg up. Next resistance sits around 1,943, and above that, we’re eyeing 1,966 and 1,984. Plan: • Look for bullish price action on the lower timeframes (1H–4H) confirming the double tap • Conservative entry: on a retest of 1,912 • Aggressive entry: break and hold above 1,943 • Invalidation: Clean daily close below 1,898 Structure: • Daily double tap at the 1,910–1,912 level • Strong bullish wick rejection • Reaction from 61.8% Fibonacci retracement • In line with overall bullish market structure Key Zones: • Support: 1,910–1,912 (wick rejections + Fib confluence) • Resistance: 1,943 • Breakout target: 1,966 and 1,984 • Invalid if we break below: 1,898

AutoMarkets

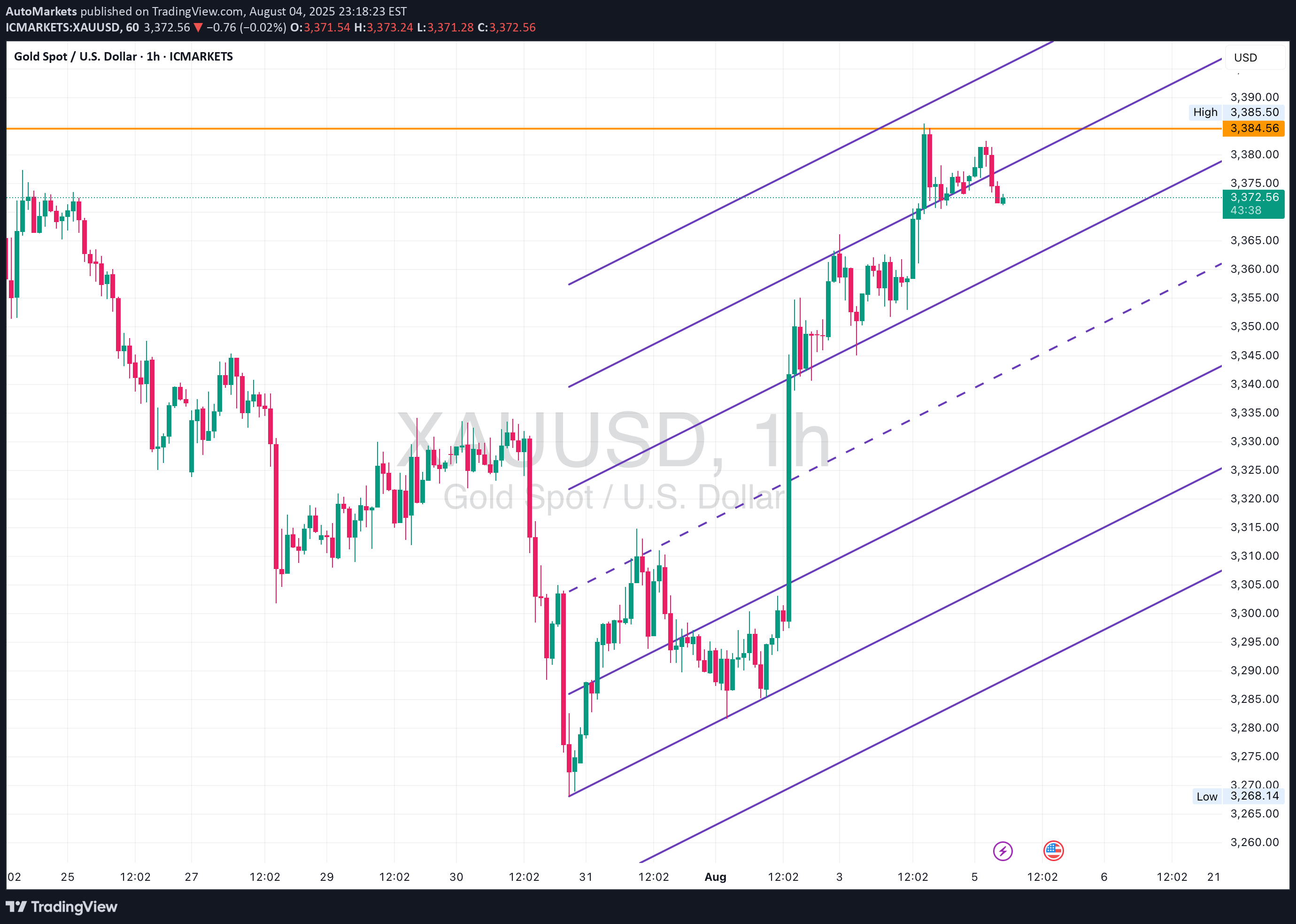

XAUUSD – Mid-Channel Rejection Near Key Supply Zone

Gold has made an impressive recovery off the $3,250 zone, pushing back into the $3,380–$3,390 region — a key supply area which previously led to strong sell-offs. We’re now sitting at the upper boundary of a 1H ascending channel and just under a significant resistance area seen on the 4H and daily timeframes. Although bullish momentum is still present, price is showing early signs of exhaustion at this level — with small rejections forming and volume beginning to taper off. The key zone to watch is $3,384 – $3,390. If price fails to break and close above this zone cleanly on the 4H, we may see a corrective pullback back toward the midline of the channel — or even a full retest of the lower boundary near $3,305 or $3,268 depending on momentum. Bias: Short-term bearish / corrective – waiting for confirmation of rejection or bearish candle formation below $3,384.

AutoMarkets

Gold Bear Flag Forming After Trendline Break – Short Setup Below

Gold (XAUUSD) recently broke a major ascending trendline that had held since late June, leading to an aggressive sell-off from the $3,440s down to the $3,270 zone. Following that, price is now consolidating just beneath the previous support trendline, forming what appears to be a bear flag or rising channel inside a corrective structure. The $3,330–$3,340 zone is now acting as resistance, and price is struggling to close above this level. The current structure suggests continuation to the downside, with clean space to revisit the $3,271 liquidity pool and potentially even sweep that low. Watch for bearish confirmation below the current flag – especially if price prints a rejection wick or engulfing candle at the upper edge of the box. ⸻ Key Levels: •Resistance: $3,330 – $3,340 (flag top + previous support turned resistance) •Support: $3,271 zone, followed by $3,248 sweep potential ⸻ Trigger Criteria: •Bearish rejection inside the flag (e.g. pin bar or engulfing) •Break and retest of the flag bottom or horizontal support ⸻ Risk Note: A clean break back above $3,350 and reclaim of the previous trendline would invalidate this idea short term and shift bias back to neutral/bullish.

AutoMarkets

Gold Approaching 3365 Breakout: Bullish Continuation Above Trend

Daily Analysis: Price is respecting the long-term trendline support and still holding firmly above the 3300 region. Bulls are defending structure with a clean series of higher lows. No major change in trend as long as price remains above 3246. 4H Analysis: Price is consolidating above the trendline and building structure around 3350. A clean break and close above 3365 could ignite a push toward the 3450 supply zone. 1H Analysis: Descending trendline break confirmed with bullish closure. Retest holding well above 3350. If structure remains intact, next short-term target is 3375–3390. Confirmation & Entry: Break and close above 3365 with strong bullish candle = confirmation. Optional entry on 3350–3355 retest. Targets: 3390, 3450.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.