Anunakii

@t_Anunakii

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Anunakii

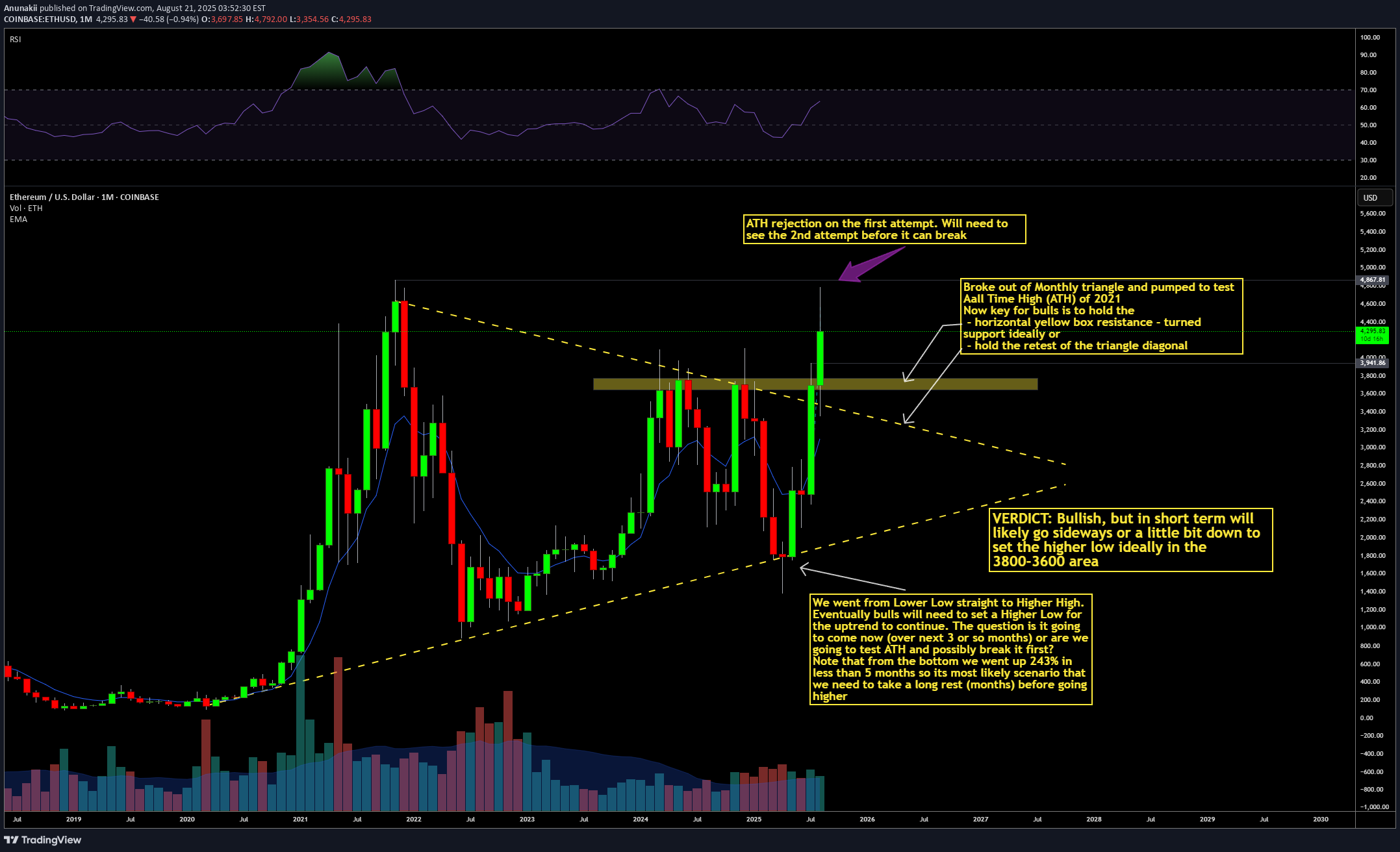

ETHEREUM Long Term Break out! - BULL AF

Broke out of Monthly triangle and pumped to test Aall Time High (ATH) of 2021 Now key for bulls is to hold the - horizontal yellow box resistance - turned support ideally or - hold the retest of the triangle diagonal ATH rejection on the first attempt. Will need to see the 2nd attempt before it can break We went from Lower Low straight to Higher High. Eventually bulls will need to set a Higher Low for the uptrend to continue. The question is it going to come now (over next 3 or so months) or are we going to test ATH and possibly break it first? Note that from the bottom we went up 243% in less than 5 months so its most likely scenario that we need to take a long rest (months) before going higher VERDICT: Bullish, but in short term will likely go sideways or a little bit down to set the higher low ideally in the 3800-3600 area GL HF

Anunakii

A look at prior halvings BTC behaviour - DUMP IMINENT?

Top is now Middle i 2016 bull market Bottom is 2020 bull market Looks more similar to 2016 bull market because we are having a similar action after the halving Down first, then sideways, then breakout, then accelerate up to now 177 days after the halving. Next step is a BIG consolidation to wipe out all overleveraged longs whilst the 2020 bull market had an acceleration prior and consolidation about 80 days after halving Act accordingly GL HF GG

Anunakii

GOLD Fun Guesstimate TA!

We hit 1:1 fib extention on 3month timeframe . Now we need to consolidate to the exponential curve in a 3M bull flag formation. Then continue to rip into 1to1.618 fix extension on 3Month chart Also need to let the Trump election euphoria settle down and PRINT MONEY cos Nothing Stops This Train GL HF!!!

Anunakii

ETH Another retest of the ~2k lows before rocketship to 3.4k?

ETHER - We want retest of the lows ~2k at - W Trendline support - W RSI falling wedge trendline retest - W GP Fibs jsut below (one more lower low to there?) - Elliot wave will complete 5th wave down of the C wave - D will be oversold if we drop into GP - Bull market breakout zone retest at ~2k - Daily Trendline (falling wedge) breakout - D EQ will start to fomr if we form a HL above 2150 We ENTER at red circle and have a STOP at 2150 TARGET 3.4K W Trendline if this plays out Stops in if we actually breakdown with followthru!!!!

Anunakii

ETH weekly Prime or a mega bounce to 3.4k

Weekly is very interesting , with lots of supports, absolutely ideal entry if we go down to 2000 GL HF Stops in

Anunakii

ETH Falling Wedge Bull goggles

Also look at the RSI triangle which would optimally break at the same time for best followthru GL HF

Anunakii

DOGE Falling Wedge Structure is a beauty!

Would be great to catch a weekly higher low for an entry. Somewhere below 10cents GL HF

Anunakii

Long Term ETH view: Monthly Triangle

Apex start of 2026! RSI tightening triangle too! Can the bulls push up to 3.5k to hit the top trendline again? Lets go!

Anunakii

Bitcoin Volume Profile perspective - All time highs??

- POC from 11 April is holding, was resistance now support (yellow arrows) - VAH from 11 April is resistance(blue arrows) Looks good, All time highs coming as long as the POC from 11 April keeps holding. Bulls really want to break and start closing above VAH (11 April) GL HF

Anunakii

ETH MACRO Falling Wedge APEX! (dis gon be good

Time to prepare. Could be a nice move. ~60 Days Falling wedge is almost at the apex! Break gonna be very significant VAL Held on recent drop!!! RSI tightening too! Key to break -Daily Resistance - Weekly 8EMA resistance

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.