AfnanTAjuddin

@t_AfnanTAjuddin

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

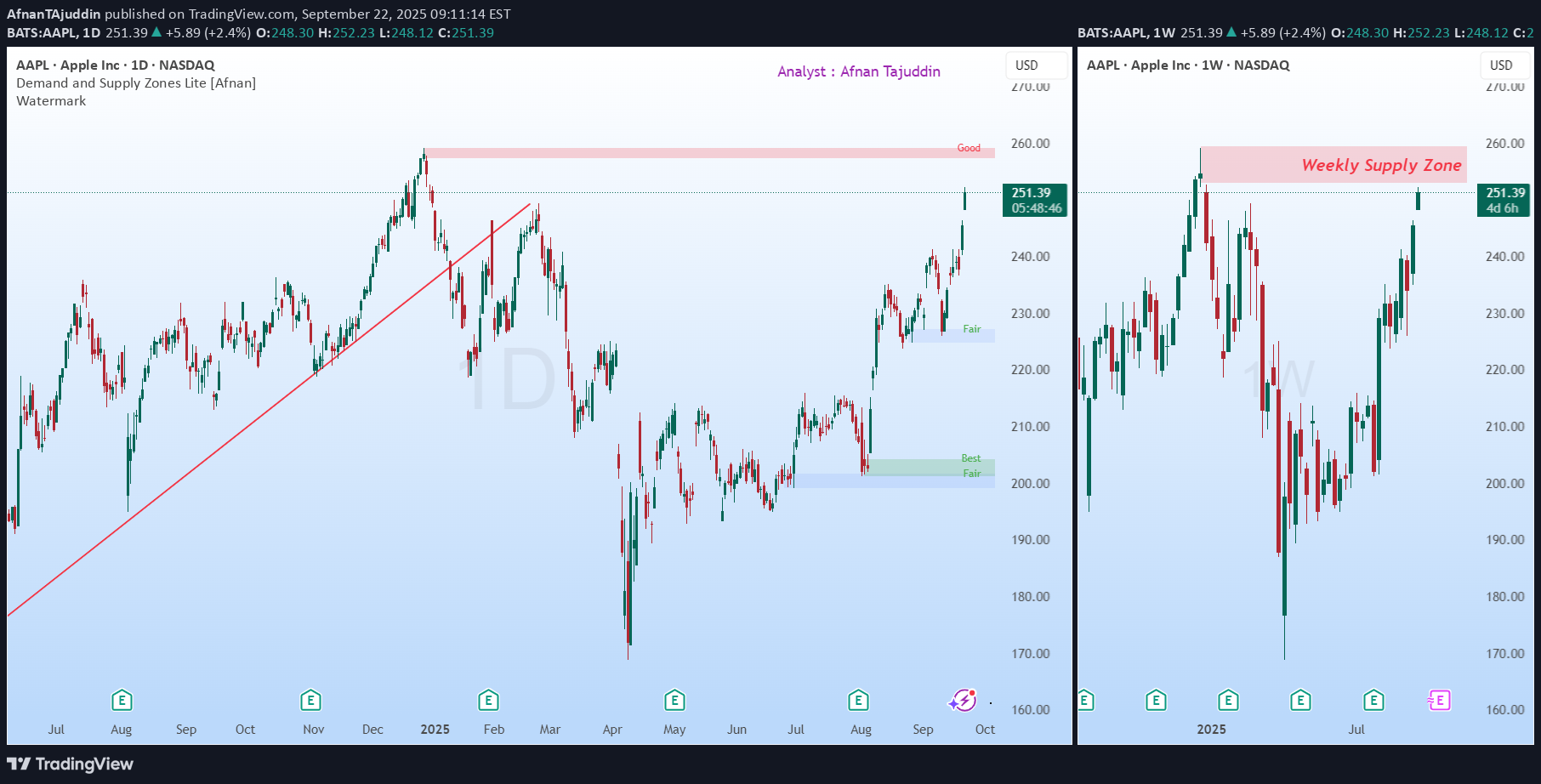

Apple’s chart is currently showing signs of caution as the price climbs into a significant supply area. Both the weekly and daily timeframes highlight strong supply zones that traders should carefully observe. Weekly Supply Zone On the weekly chart , Apple is approaching a very strong supply zone The supply area coincides with all-time highs , making it even more significant. 🔎 Daily Supply Zone Confluence 🔎 The daily chart adds further weight to this setup: The current daily supply zone is nested inside the weekly supply zone . This supply zone is powerful because its follow-through candle not only rejected higher prices but also broke the uptrend trendline . In simple terms, this supply zone has already shown its strength once by shifting the trend from up to down .The fact that this zone caused a trend change earlier makes it a major obstacle for bulls. Now that price is revisiting this zone again, it signals a possible area for profit booking. With Apple near its all-time highs and supply confluence in place, risk-reward favors caution. 🎯 Trading Perspective Traders should keep an eye on this zone, Consider booking profits as price approaches this heavy supply area. “Strong supply zones often act like brick walls — they don’t break easily without significant force.” ⚡ At these levels, patience and discipline are key — don’t let greed take over when charts are signaling caution. 📉🍏 💡 Trading is not about catching every move — it’s about protecting capital and letting opportunities come to you. 🚀📊

The Federal Reserve has been increasing interest rates for the past 9 months, causing a ripple effect throughout the financial world. In recent week, we have seen 3 major banks collapse as a direct result of the interest rate hikes, which has caused trouble in the financial world as well. As a trader, it's essential to understand how these events can affect your trading decisions and how to navigate the current situation. The Impact of Interest Rate Hikes on the Financial World Interest rate hikes have a direct impact on the financial world, including the stock market, bond market, and the housing market. As the Federal Reserve increases interest rates, borrowing becomes more expensive, which can lead to a slowdown in economic growth. It can also lead to increased volatility in the stock market, as investors react to the news and make changes to their portfolios. The Collapse of Banks and the IT Sector The recent collapse of two banks has caused trouble in the stock market specially IT sector, as many IT companies & startups have provided services to these banks. The collapse of these banks has caused a ripple effect throughout the financial world, leading to concerns about the stability of the financial system. Navigating Trading During the Current Situation As a trader, it's important to stay informed about the current situation and how it can affect your trading decisions. Here are some tips for navigating trading during the current situation: Stay informed: Keep up-to-date with the latest news and developments related to the interest rate hikes and the banking collapse. This can help you make informed decisions about your trades. Diversify your portfolio: Diversification is always important in trading, but it's especially crucial during times of economic uncertainty. Consider spreading your investments across different sectors to minimize your risk. Monitor volatility: As interest rates continue to rise, volatility in the markets may increase. Keep an eye on market volatility and adjust your trading strategies accordingly. Be patient: It's important to be patient and avoid making impulsive trading decisions based on emotions. Take the time to analyze the market and make informed decisions based on your trading plan. Use stop-loss orders: Consider using stop-loss orders to minimize your risk and protect your investments. Stop-loss orders automatically trigger a sale when a stock falls to a certain price, which can prevent you from incurring significant losses. Stay disciplined: It's important to stay disciplined and stick to your trading plan, even during times of economic uncertainty. Avoid making impulsive decisions based on emotions, and focus on your long-term trading goals. Take advantage of opportunities: While economic turbulence can be challenging for traders, it can also create opportunities for profit. Keep an eye out for undervalued stocks or assets that may be poised for growth in the future, and consider taking advantage of these opportunities if they align with your trading goals and strategy. Avoid overtrading: During times of economic uncertainty, it's important to avoid overtrading and taking on too much risk. Stick to your trading plan and avoid making impulsive decisions based on emotions or short-term market movements. In conclusion, the current situation of interest rate hikes and banking collapse can have a significant impact on the financial world and your trading decisions. By staying informed, diversifying your portfolio, monitoring volatility, and being patient, you can navigate this challenging environment and make informed trading decisions. Remember to always prioritize risk management and stay focused on your long-term trading goals.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.