ActiveTraderRoom

@t_ActiveTraderRoom

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ActiveTraderRoom

فرصت خرید بیت کوین: آیا زمان بازیابی فرا رسیده است؟ (با اهداف قیمتی دقیق)

Team, time to ADD BITCOINS at the current price 99715 WORST retest around at 98000 can add more at this level STOP LOSS safe at 96000 Target 1 at 101500-102500 - take partial and bring stop loss to BE Target 2 at 103500-105000 TARGET 3 at 109000-115000 - HOLD until december! lets go for SANTA RALLY.

ActiveTraderRoom

فرصت طلایی بیتکوین: ورود مجدد با سود تضمینی و اهداف جدید!

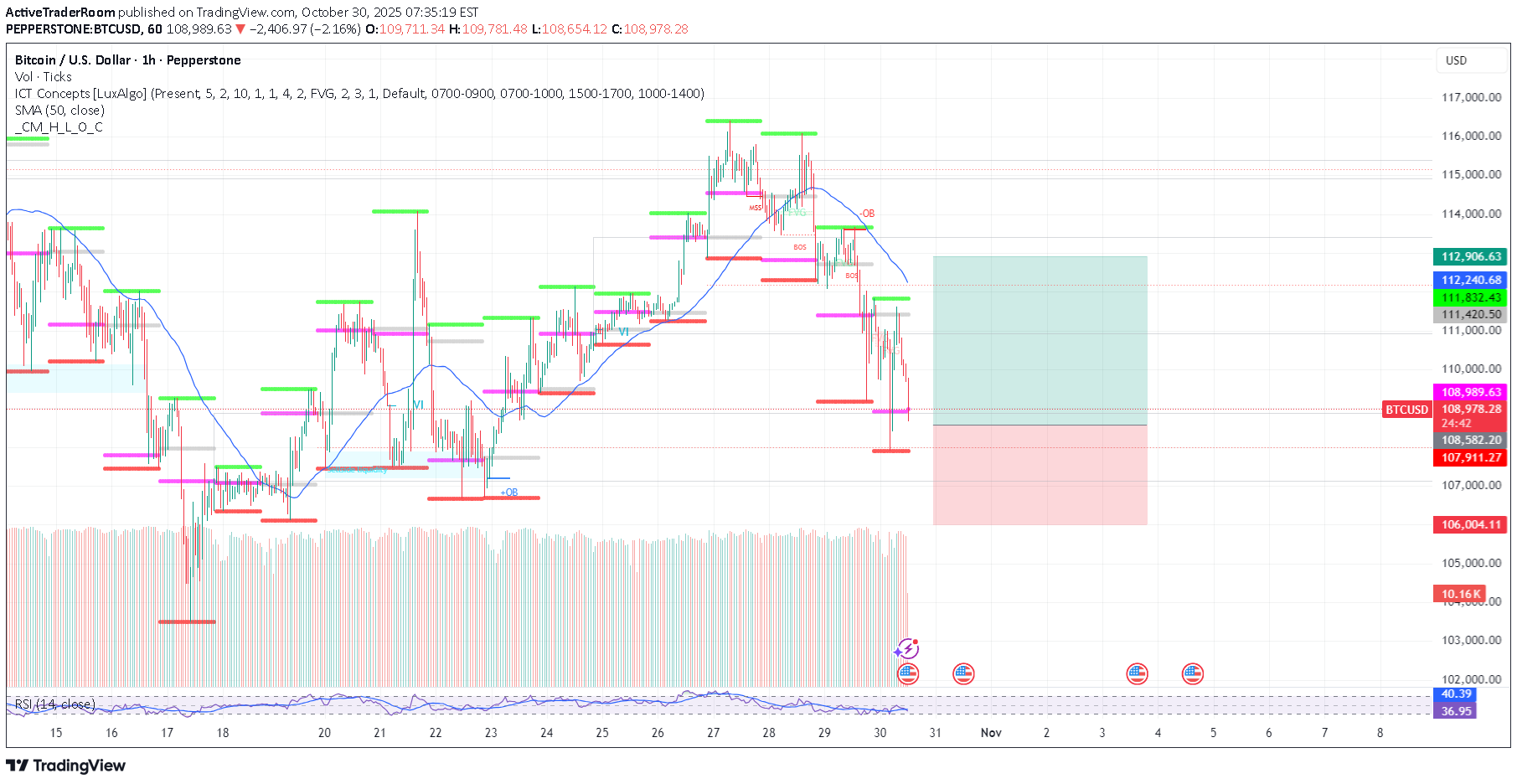

Team, last week we went long BITCOINS at 108k, then add more at 107500, with target at 109-111k TARGET HIT We are now entered at 107.5k, will add more at 107k WITH STOP LOSS AT 105K Target 1 at 109-111.5k Target 2 at 113-115k Once it hits 1st target, take a partial 70% and bring the stop loss to BE for the next target.

ActiveTraderRoom

پیشبینی صعودی بیت کوین: اهداف قیمتی و استراتژی خرید جدید!

Team, we are long BITCOINS at 108500 - will add more around 107000-107500 TAKE PARTIAL above 110,000 - 30^ Target 2 at 113,000-115,000 Target 2 at 117000-120,000 LETS GO

ActiveTraderRoom

GOLD - XAUUSD - IDEAS FOR THE DAY

Team, please carefully looking at the GOLD pattern, it was consolidation range between 3620-3650 before breaking the channel. this is 5 minutes channel but if you carefully look at 4 hour channel - the range created during 10 APRIL to 25 AUG before break out. Short term GOLD should pull back toward 3667-65 - if you are short, stop loss at 3685-90 target short term zone at 3667-65 Medium term if you could hold longer within a week, we should expect the pull back toward the 3500-3400 zone - please review 4 hours chart. LETS GO

ActiveTraderRoom

GOLD - GOLDEN OPPORTUNITY TO SHORT

I am shorting GOLD at 3610-3615 - STOP LOSS AT 3635 TP1 - 3585–3590 - TAKE 50% PARTIAL TP2 - 3565–3573 - TAKE ANOTHER 30% PARTIAL TP3 - 3545–3552 - THE REST Once it hit our first target - take 50% partial and bring stop loss to BE LETS GO

ActiveTraderRoom

GOLD - XAUUISD - TIME TO SHORT

Team, GOLD is ready to be burned, reached a high intraday of 3510 - liquidity sweep has taken a lot of stop losses. Time to short at 3498-3405 ranges STOP LOSS at 3530 - as 3520-25 - strong resistance - sell orders are ready Target 1 at 3485 - take 50% partial target at 3465-56If Dollar continues strong, Gold has limited upside. Strong Dollar rallies tend to push Gold back toward $3,480

ActiveTraderRoom

GOLD - XAUUSD - opportunity arise! let's go

Team, we have been blessed with a very successful trade with gold. Unfortunately I do not trade often until i find good opportunity Here is the strategy to enter LONG gold Current Price Zone: 3337–3339 •SL: 3328 as discussed earlier If Price Hits 3344 (first breakout) •Move SL to 3335 → Protects the bulk of gains while keeping room for a push to 3354. •If Price Hits 3354 (next resistance) •Move SL to 3344 → Secures profit from the breakout zone in case of a quick pullback. If Price Hits 3365–3370 •Move SL to 3354 → This will lock in solid gains and let you ride in case gold aims for 3380+.

ActiveTraderRoom

XAUUSD/ GOLDEN OPPORUNITY

Team, last week, we short GOLD at 3403-3406 we have successfully did 5 times with target ranges at 3385-80 We are NOW going long at 3346-3350 range, with STOP LOSS at 3335 Tonight CPI coming out, we expect higher than anticipate. we expect gold to move fast toward our target Target 1 at 3362-65 - bring stop loss to BREAKEVEN, and make sure take 50% partial Target 2 at 3372-3386 ranges LET'S GO

ActiveTraderRoom

GOLD - been waiting for 2 weeks

Team, I have been waiting GOLD for two week to short at 3404-3410 i just woke up and missed the short Price current at 3401 - I am shorting NOW Target 1 at 3386 - take 70% volume and BRING STOP LOSS TO BE Target 2 at 3365 LETS GO

ActiveTraderRoom

GOLD - TIME TO GIVE THE GOLD BACK TO THE GOVERNMENT

Team, tell the government to keep the GOLD on these fake priceNote: due to tension between ISREAL AND IRAN, gold went up crazyTime to SHORT and tell the government to keep the gold for their reserveGOOD LUCK EVERYONE

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.