farbodkarimi

@h_farbodkarimi

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

farbodkarimi

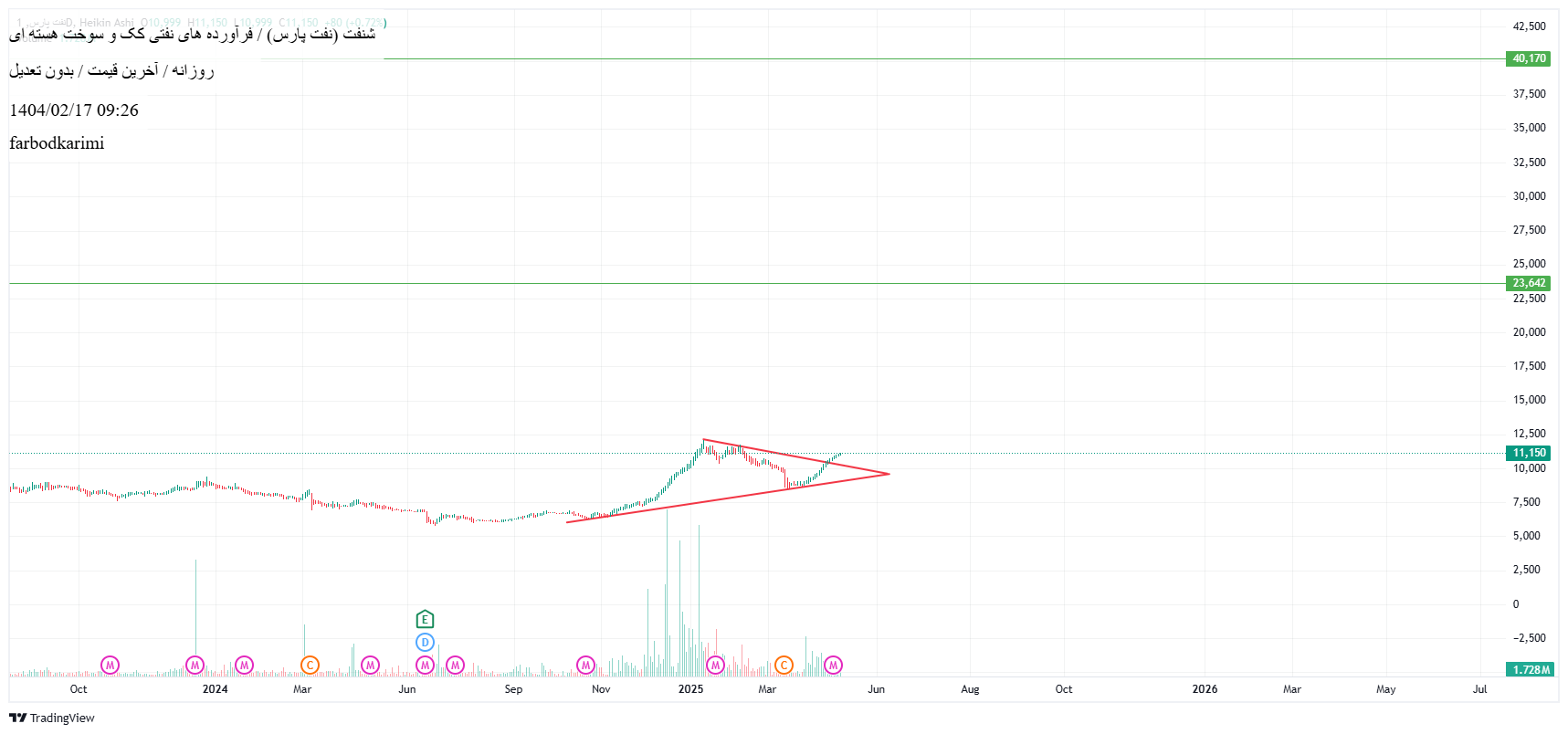

#Hearing on a relatively low -risk trend to enter. Forecast of Net Profit First 6 Months Shenaf in Fiscal Year 1404: Profit Forecast of 7/7 Hemmati to 2 Hemmati (Excluding Parsian Sepehr and Paya Oil Refinery) Forecast of 12 -month Net Profit Shenf in fiscal year 1404: If oil and dollar prices continue in the current areas ($ 360 to $ 400 and $ 69800) Forecast Profit 4/3 to 4 (excluding Parsian Sepehr and Paya Oil Refining) Predicting Profit #Parsian_Saphr for the fiscal year ending 1404/09/30 and 1405/09/30: Predicting Fiscal Year 1404: 16/5 Hemmat Pars Oil Company owns 20 percent of this massive gas refinery, which is worth nearly $ 2 billion. Forecasting Paya Oil Refining Profit In Fiscal Year 1404: Net profit of 300 to 600 billion tomans Pars Oil owns 67 % of this lubrication refinery, which is the fifth oil refinery in terms of capacity.

farbodkarimi

#Sprinkle and summer reports are improving at updated rates, spring and summer reports, a fundamental target of 2100 USD and then around 2,500 USD.

farbodkarimi

#Hearing It has a good correction. In the event of stability in the economic conditions of the country, the mid -term target is 1,500 USD. Currently, the fundamental status is in good condition and the analytical P/E ratio is in range 5.

farbodkarimi

Explanation of an issue regarding the subdivision of the valuable hearing Parsian Sepehr currency exchange rate in the fiscal year ended 140/09/30 was about 43500 USD. Since the beginning of the winter, $ 1403 was about 63,000 USD and currently 70,000 tomans. If we consider the basis of Parsian Sepehr currency for this year, the same 70,000 Tomans, namely the Parsian Parsian Transformative Dollar rate, has grown by about 60%. This is the first case. The second case is likely to operate with a higher capacity than last year, adding to revenue and sales. In general, #Parsian_Sephar had a very positive process in profitability. #Oil_Pars #Shenaf

farbodkarimi

#Shanft Fundamental and Technical Target 4000 USD. By examining the foundation and replacement value and NAV, KSFJ and the ratio of P/E Forward and the last five years of this share, we find that in the near future the area has reached the range. Long -term three -dimensional is recommended.

farbodkarimi

#Shisen has a long -term upward trend. According to past behavior from the position in the oscillator, it has begun a heavy growth. Long -term goal of 5000 to 6000 USD. The increase in products was awarded to the company to compensate for the backwardness of profitability. #Products

farbodkarimi

#Figure if the second phase increases the rate of purchase at this price is worth the purchase.

farbodkarimi

#Hearing the long -term goal of around 2000 USD. From a construction point of view, the share is in good condition.

farbodkarimi

#Shanft recently has come out of a justification for raising capital and a good future for the company. Given the dollar's growth and appropriate investment, we consider the two -year target for about 4,000 USD. This goal can be examined according to the company's profitability perspective.

farbodkarimi

#Long -term goals 2600 USD. Over the past four years we have seen severe inflation, and dollar shares such as Bahran have been lagging behind. The medium -term and long -term trend is an upward share.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.