Q1350

@h_Q1350

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Q1350

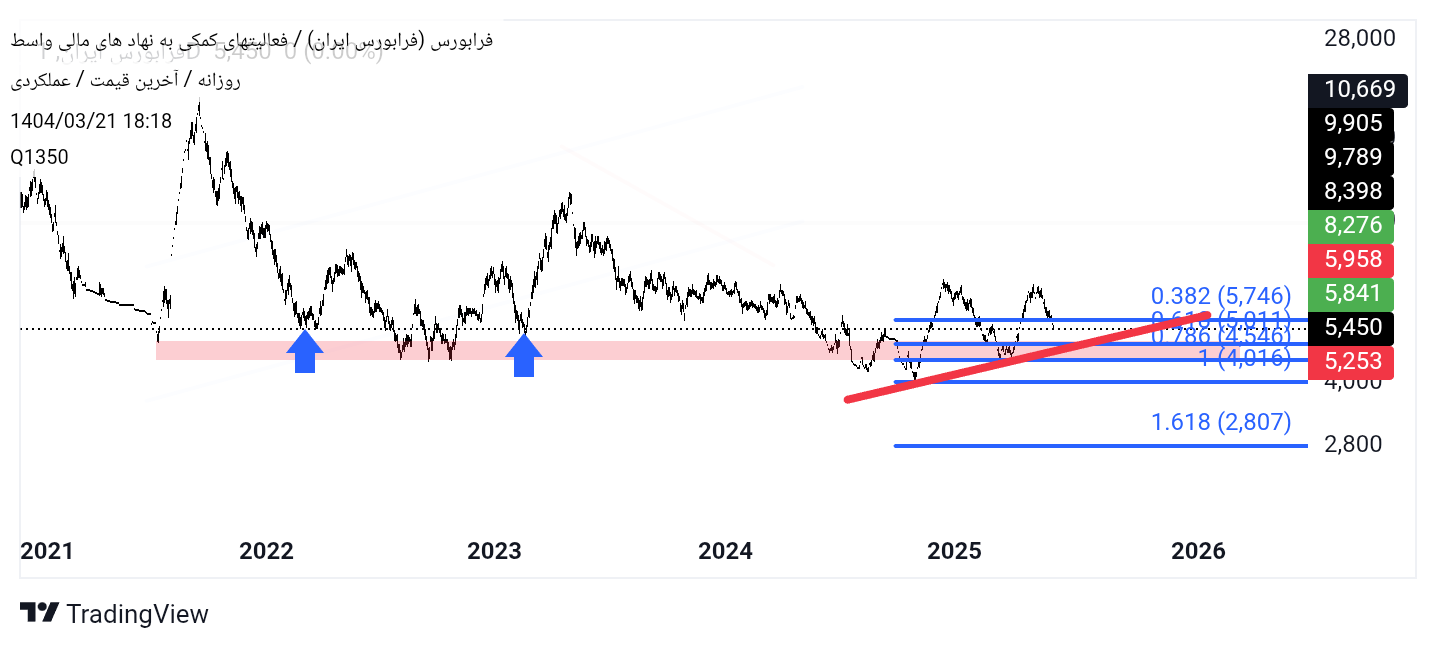

Hi Apply Analysis Ascending trend associated with swing Leading Swing: 1 to 2

Q1350

Hi Many important confluidity in the area Important Support ۲۰۱۵ lost hard work

Q1350

Hi You asked for analysis Keep in mind with a loss limit

Q1350

Hi Dear friend I said tomorrow has the chance to go up If so, it is also the probability of schematic behavior

Q1350

Hi Apply Analysis, Update Last time I warned that the money to the bottom of the channel is not running away. And leave on time. In the case of more reform, he should not lose 2, and the job was not harder. The price must take back your lost channel

Q1350

Hi Apply Analysis We have a good market for two days. Unfortunately, there is still a sales pressure. And it is also suspicious of the descending pattern of the diagonal head and shoulder. Loss 1 There is a possibility of returning. The main problem with this share is the abandonment of itself. It is still in the saturation of sales. Syntheed with Kendel today's chances of coming back tomorrow

Q1350

Hi The requested analysis of the update Tomorrow's market is likely to be supported if a positive suffering in average price

Q1350

Hi It is supportive and is expected to be supported tomorrow Saturday. Is recommended for entry

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.