پرویز خالقی

@g_1019575008

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

پرویز خالقی

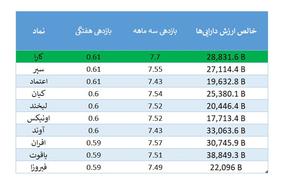

The best fixed income fund of the week Among the top ten #Kara is still in the top Weekly yield of 0.61% The @permanet5160

پرویز خالقی

😟 A rumor that can change the equations of #Shasta and #Tapico ⚪️ It is said that the government plans to hand over the seats of the board of directors in Persian Gulf Star through the offering of shares in the market in two ways (small and block). Apparently, the expert price of Star is around 450 hemats, which is a very large number. News source: Bors24 @TsePress

پرویز خالقی

#Semga long-term chart, this is 400 is not the end of the line, but it was a short-term look at the share up to the main ceiling, it was corrected and climbed many times.

پرویز خالقی

#Semga on the ceiling of your delivery notice.

پرویز خالقی

#Sadbir is pulling himself up from the support floor

پرویز خالقی

#Shakler good opportunity in the right position

پرویز خالقی

#Webank supports 790 and targets 860 in the short term

پرویز خالقی

#Tapiko put the swing loss limit below 2000 and the next target is 2400

پرویز خالقی

#East, skip 120, the next station is 145

پرویز خالقی

The intrinsic value of #Tapico The valuation of 1.475 billion dollars for a huge holding like Tapico on December 17, 1404, while the dollar reached 126,000 tomans, is a clear example of "absolute market inefficiency" and a historical opportunity. This pricing has put the company in the range of the scrap value of its assets. The most important proof of this claim is the Persian Gulf Star Refinery paradox. Tapico owns 49% of this strategic refinery, which alone supplies more than 40% of the country's gasoline. At a very conservative estimate, Tapico's stake in this refinery alone is worth about $2.5 billion, while the company's current total market value is only $1.47 billion! This means that the market has not only considered the value of other petrochemical giants of this holding, such as Jam, Maron and Fanavaran, to be zero, but has also assigned a negative value to them. This price gap has caused the price to net asset value (P/NAV) ratio to fall to its historic low of less than 30%. Such a deep discount in investment firms usually does not last. In addition, with 126,000 Tomans, the potential for profit jump in the export-oriented companies of the sub-category has greatly increased, which has not yet been reflected in the share price. In a word, the dollar value of Tapico has fallen by 84% from the peak of 2019, reaching a level where its return to only half of its previous value requires a growth of more than 200% (tripling of the price). As it stands, an investor effectively pays for a portion of a refinery and receives ownership of dozens of other petrochemicals as a bonus, making Tapico one of the most valuable and low-risk long-term investment options on the market.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.