Technical analysis by Veraa_Queen about Symbol PAXG: Buy recommendation (12/17/2023)

Veraa_Queen

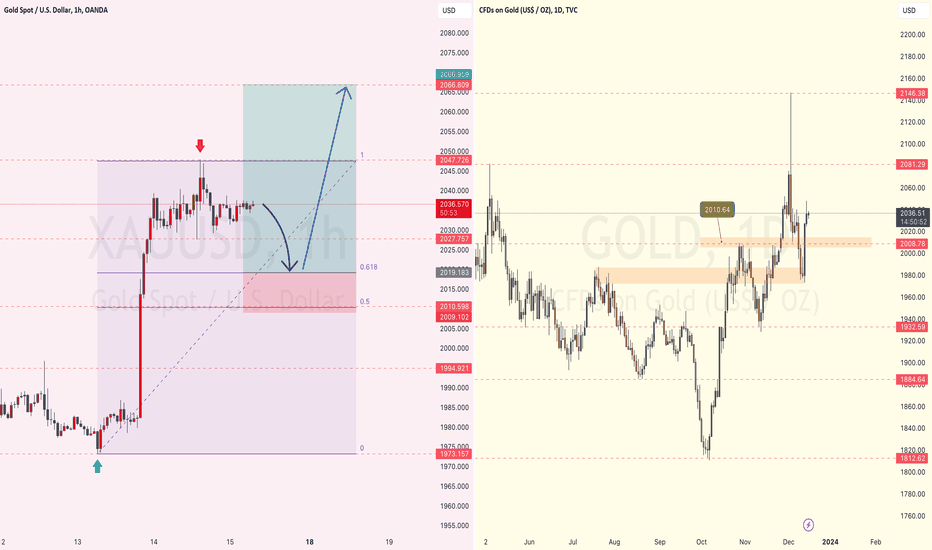

The global economic landscape is eagerly awaiting the release of key economic data, as investors pay close attention to the stability of the US dollar. As uncertainties loom over major economies, analysts are observing a potential rise in gold prices. Historically regarded as a safe-haven asset, gold has proven its resilience amidst market volatility. With the US dollar finding stability, the upcoming economic data releases will play a crucial role in determining the trajectory of gold prices and its attractiveness to investors. In this article, we will delve into the factors driving gold prices and the potential impact of forthcoming global economic data on this precious metal. The price of gold The price of gold is poised to see weekly gains after last week's decline from its record-breaking high of $2,144. Weakened US Dollar The US Dollar has been weakened by the accommodating stance of the US Federal Reserve, as Chair Jerome Powell has confirmed expectations of interest rate cuts until 2024. In contrast, the Bank of England and the European Central Bank have indicated the possibility of further tightening while stating that interest rates will remain "higher for longer." Gold Price Set to Rise This suggests that the price of gold is expected to increase in the future.Trade active