Technical analysis by Veraa_Queen about Symbol PAXG: Sell recommendation (12/12/2023)

Veraa_Queen

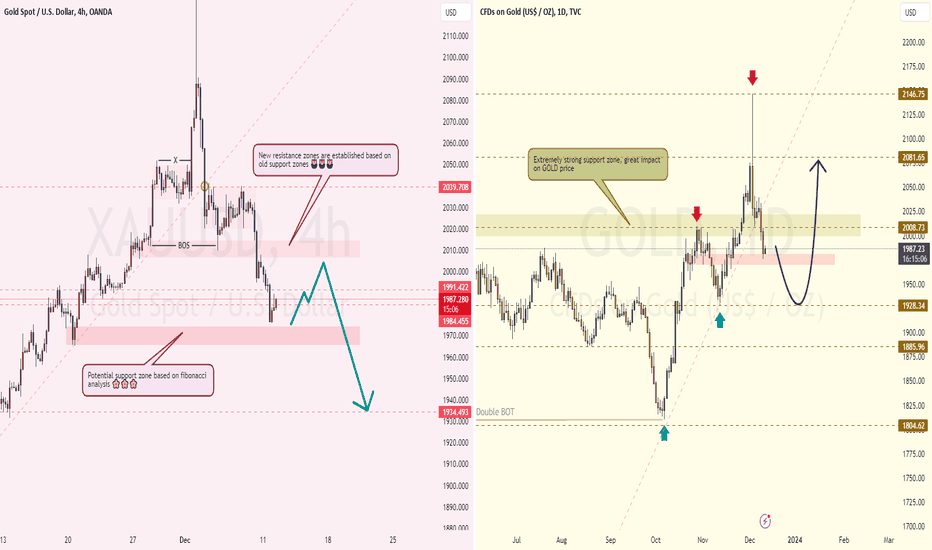

🌷 As expected, Gold prices continued to fall sharply yesterday, reaching the lowest level of 1975 on the first day of the week. 🌷 In terms of news, Gold prices are under pressure in the context of the recovery of the USD combined with the US bond interest rate increasing by 4.26% 🌷 In terms of technical analysis, the downward force is covering the current Gold price, support at 1967 is the next area that Gold price is aiming for before there will be a Pullback at this price area. At the end of the first session of the week, Gold price closed the candle below the 85-88 support area, forming candle D with a long red body and short shadow, showing that price movements remained decreasing. => Today's session it may continue to fall deeper, traders can still prioritize short selling positions, absolute stop loss above the 1995 price mark. => If the price rises back to the 1995 area and closes the candle, it will only be possible when November CPI is lower than forecast, then the price will confirm the upward trend again. Do you guys think the same as me? 🌸🌸🌸 Wishing everyone a smooth trading day!Trade active: 🎋 The first trading session of the week continued to be a confirmation day when the break passed the 1991 zone and fell to the 1975 zone. 🌴 The long-term downtrend of the market has been confirmed but we need a retest of the 1990-1991 zone today to set up a long-term SELL order. 🌱 Sales around the 1990-1993 AREA - TP: 1985-1975-1965 - SL: 1997 🌱 Buying soup around the area from 1963-1965 - TP: 1970-1975-1980 - SL: 1960