Technical analysis by Xayah_trading about Symbol PAXG: Buy recommendation (12/18/2025)

Xayah_trading

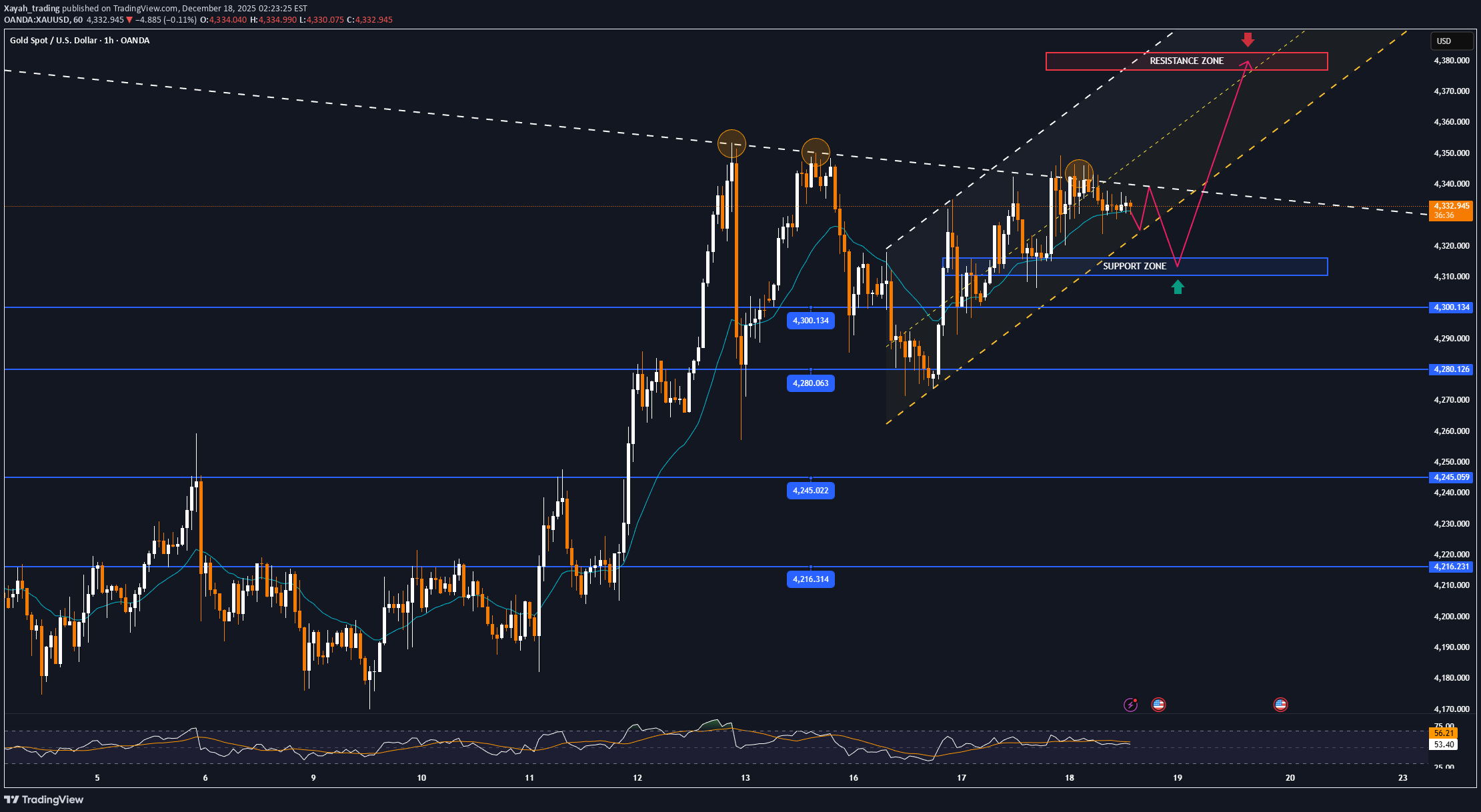

Trump's surprise announcement fuels demand for safe havens

XAUUSD entered a strong and decisive upward trend as two major risks – weakening US economic conditions and escalating geopolitical tensions – converged simultaneously. In the Asian session on December 18th, spot gold prices remained above $4,330/ounce, following a sharp rise from the previous session. The impetus didn't come from a single factor, but rather a combination of worse-than-expected US labor market signals and a surprisingly tough statement from President Donald Trump regarding Venezuela. The US non-farm payrolls report released earlier this week presented a mixed picture, but one that was enough to prompt market adjustments to expectations. While 64,000 new jobs were created in November, exceeding forecasts, the unemployment rate surged to 4.6%, its highest level since 2021. This is no longer just technical noise. Unemployment exceeding both market forecasts and the Fed's end-of-year scenarios has raised concerns that the lag in monetary tightening is beginning to erode the labor market. Against this backdrop, expectations of another Fed easing cycle have returned. Gold, a non-yielding asset, has benefited immediately. The market is still pricing in at least two interest rate cuts in 2026, despite attempts by Fed officials, including Governor Christopher Waller, to cool expectations with the message "no need to rush." This stance offers policy stability, but is not enough to reverse the defensive sentiment that is forming in financial markets. The real trigger came from geopolitics. Trump's declaration of a "complete blockade" of sanctioned oil tankers entering and leaving Venezuela quickly triggered safe-haven demand. While the extent of its implementation on the ground was unclear, the market perceived it as a policy escalation, bordering on a military-style coercive action. Legal debates immediately erupted in Washington, but for the market, that was secondary: the risk had already been priced in. Against the backdrop of a slowing US economy, a new turning point in monetary policy, and increasingly unpredictable geopolitics, gold is fulfilling its historical role: absorbing uncertainty. The current rally isn't driven by euphoria, but rather by a systematic defensive reaction. And as long as these variables remain unclear, gold will continue to be a destination for investment whenever confidence in stability is challenged. Technical Analysis and Suggestions XAUUSD Gold prices are at a crucial turning point in their cycle. After touching and repeatedly testing the historical peak around $4,380 per ounce, the market is showing a clear reality: long-term buying pressure remains, but the short-term upward momentum is slowing down. On the daily chart, the dominant uptrend remains intact with a structure of higher lows following higher lows, price moving within a medium-term uptrend channel and above key moving averages. However, the repeated failure of the price to definitively close above 4,380 suggests that this area is not only a technical resistance but also a psychological profit-taking zone for large investors. Using Fibonacci extension from the most recent major uptrend: • The 1.0 level around $4,380 is the confirmation point for breaking the previous high. • If gold closes the day clearly above $4,380, the next targets open up at: o 0.786 around $4,715 o 1.0 extension around $4,940/ounce These are the areas where the market will shift from technical trading to macroeconomic expectation trading, where interest rate narratives, geopolitics, and confidence in fiat currency play a leading role. Conversely, the risk of a short-term correction is present. The RSI remains above the neutral zone but has not generated new momentum, reflecting a period of consolidation rather than distribution. If gold fails to break above $4,380 and loses the $4,300-$4,280 support zone, a technical correction scenario could push the price back to: • $4,245-$4,216 (Fibo 0.236, dynamic support zone) • Further down to $4,130-$4,100, where the uptrend line and defensive buying converge. Importantly: this is still considered a correction within an uptrend, not yet a signal of a structural reversal. At this stage, gold has no shortage of reasons to rise, but the market is demanding greater patience and discipline. Chasing prices at historical highs is a risky strategy; waiting for confirmation or a correction remains a more sensible approach given geopolitical volatility and rapidly changing interest rate expectations. SELL XAUUSD PRICE 4382 - 4380⚡️ ↠↠ Stop Loss 4386 →Take Profit 1 4374 ↨ →Take Profit 2 4368 BUY XAUUSD PRICE 4311 - 4313⚡️ ↠↠ Stop Loss 4307 →Take Profit 1 4319 ↨ →Take Profit 2 4325