Technical analysis by Xayah_trading about Symbol PAXG on 12/16/2025

Xayah_trading

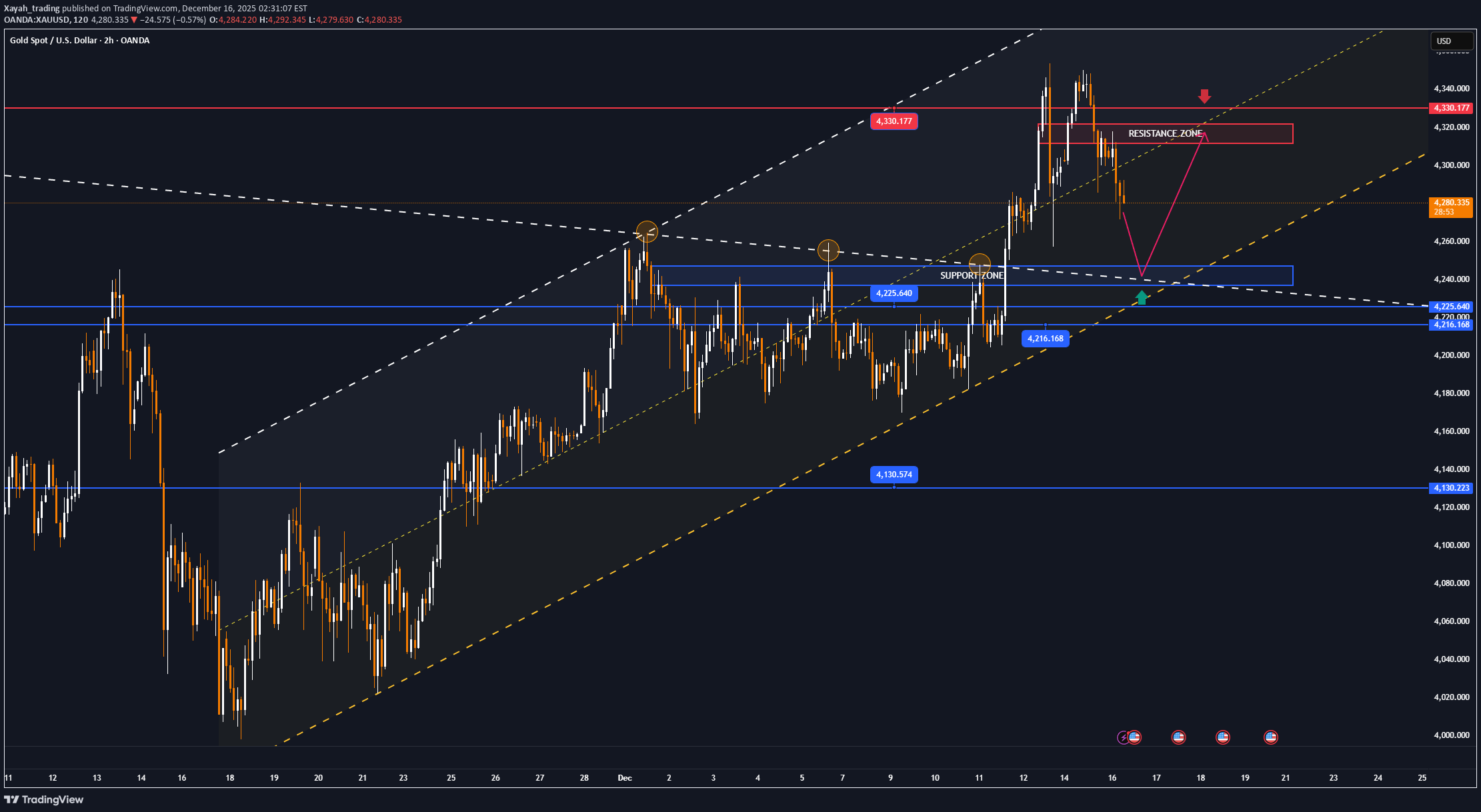

GOLD falls as signs of peace emerge between Russia and Ukraine

XAUUSD opened the week in a noticeably weaker state. After touching the $4,350/ounce mark, the market quickly reversed course and declined as diplomatic signals related to Russia and Ukraine emerged, eroding the safe-haven role that had supported gold prices for weeks. This time, the story didn't stem from economic data, but from politics. Progress in peace negotiations with direct participation from the US and Europe, and "leading" statements from President Trump, rapidly changed market sentiment. As geopolitical risks eased, defensive capital flows immediately faltered. Trump publicly stated that talks with European leaders and Russian President Putin "are going well," and expressed confidence that a peace deal is more possible than ever. At the same time, Ukrainian President Zelensky signaled his willingness to abandon his goal of joining NATO in exchange for security guarantees from the West, a landmark concession in the negotiating logic. The market reacted very pragmatically. When a prolonged conflict scenario was no longer the only option, the "risk premium" added to the price of gold had to be adjusted. Profit-taking intensified as investors realized that the safe-haven narrative was temporarily interrupted. On the monetary side, gold also lacks new momentum. Last week, the Federal Reserve cut interest rates by 25 basis points, the third time this year, but at the same time signaled it would act more cautiously. The Fed is entering a "data-waiting" phase, and the market understands that the room for easing is no longer as wide as previously expected. Now, attention is focused on the US non-farm payrolls and retail sales reports. These figures will determine whether the Fed has sufficient grounds to continue its interest rate cutting cycle next year. With interest rates not expected to fall rapidly, gold, a non-yielding asset, is likely to experience repositioning adjustments. The current picture suggests that gold is not entering a long-term downtrend, but is losing one of its most important pillars: "market fear." In the short term, the market will continue to trade between monetary policy expectations and geopolitical developments, where every statement from the negotiating table can have an impact no less significant than an economic report. The core message is clear: gold isn't weakening because it's losing value, but because the world, at least for now, temporarily believes that the biggest risks can be controlled. And in financial markets, that belief, however fragile, is always enough to create volatility. Technical analysis and suggestions XAUUSD Gold prices are entering a healthy technical correction after failing to break above the resistance zone near the all-time high around 4,330 USD. On the daily timeframe, the uptrend structure remains intact, as higher lows are still being formed and price continues to fluctuate within a medium-term ascending channel. The current pullback mainly reflects short-term profit-taking pressure as gold approached a psychologically and technically sensitive zone. The 4,245 – 4,216 USD area is acting as a key support, converging with the 0.236 Fibonacci retracement of the latest rally and short-term moving averages. The fact that price is correcting without breaking this zone suggests that large capital is still patiently holding positions. For a new bullish cycle to form, gold needs to hold firmly above the above-mentioned support zone and achieve a clear daily close above 4,330 USD. At that point, the market would return to a “price discovery” phase, opening room for a move toward new highs. On the risk side, if the 4,216 USD level is decisively broken, the correction could extend toward 4,130 – 3,970 USD (Fibonacci 0.236–0.382). This would represent a trend rebalancing correction, not sufficient to reverse the medium-term trend unless the higher-low structure is clearly violated. In terms of indicators, RSI remains above the neutral zone, indicating that the uptrend is still under control. However, short-term momentum is cooling, which aligns with the current consolidation and corrective environment. Gold is correcting within an uptrend, not reversing. This phase requires patience and discipline—the market rewards positions that align with structure, not emotion. That concludes the article. Wishing readers a productive and happy working day! SELL XAUUSD PRICE 4317 - 4315⚡️ ↠↠ Stop Loss 4321 →Take Profit 1 4309 ↨ →Take Profit 2 4303 BUY XAUUSD PRICE 4245 - 4247⚡️ ↠↠ Stop Loss 4241 →Take Profit 1 4253 ↨ →Take Profit 2 4259