Technical analysis by ICHIMOKUontheNILE about Symbol PAXG on 12/14/2025

ICHIMOKUontheNILE

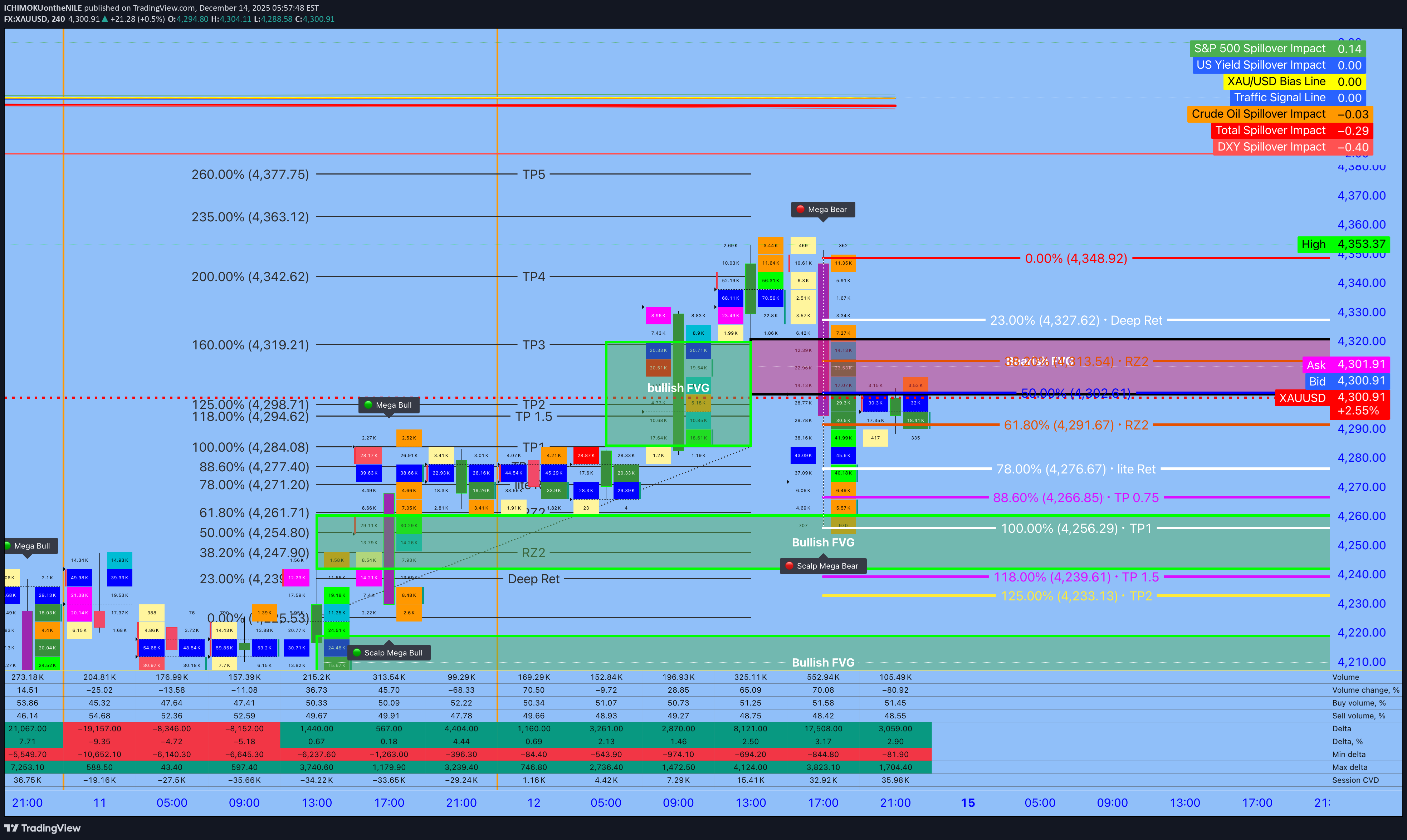

XAUMO WEEKLY REPORT

🎬 XAUMO WEEKLY REPORT “The Big Short… but it’s Gold, and Everyone’s Acting Innocent” Spot Gold: ~4300 Mood: Everyone says “nothing’s wrong” Reality: Something’s always wrong Disclaimer: Educational only. This is not a trade signal. If you lose money, don’t look at me like Steve Carell did. ──────────────────────────────────────── SCENE 1: THE GATES (Also known as: Where the market pretends price discovery exists) UPPER GATES – SUPPLY / DISTRIBUTION U1: 4305–4337 → This is where price goes to die… repeatedly. Everyone buys the breakout. Institutions sell them the breakout. Everyone is shocked. Again. U2: 4379–4381 → The “decision shelf”. Translation: either we squeeze shorts… or dump on retail with surgical precision. U3: 4428–4473 → If price gets here, CNBC will call it “strong demand” even though the selling started 20 dollars earlier. LOWER GATES – DEMAND / RELOAD D1: 4259–4237 → The classic “nothing to see here” reload zone. Looks scary. Isn’t. Unless it accepts. Then it really is. D2: 4194–4154 → Where long-term money actually wakes up. Also where Twitter declares the bull market dead. D3: 4137–4007 → If we’re here, someone blew up quietly on a Friday. RULES (No one follows them, but here they are): - Accept above U1 → continuation possible - Accept below D1 → liquidity vacuum, fast drops, no apologies ──────────────────────────────────────── SCENE 2: MACRO CALENDAR December Edition: “Thin Liquidity, Thick Lies” - US CPI - Retail Sales - Central Banks saying a lot without saying anything December logic: Less liquidity More stop runs Faster reversals Everyone blames “algorithms” Holiday effect: The book is thin. The wicks are long. Your stop is food. ──────────────────────────────────────── SCENE 3: CROSS-ASSET CHECK (The part where correlations pretend to work) - Equities: down, but not screaming - VIX: up, but not panicking - Dollar: firm - Yields: rising and annoying Translation: Gold can spike on fear, but it won’t trend unless the dollar chills out. So expect drama without commitment. ──────────────────────────────────────── SCENE 4: FUTURES STRUCTURE GC1 vs GC2 (Because structure tells the truth, not price) We’re in mild contango. That’s normal. No stress. No emergency. If contango compresses or flips? Someone’s in trouble. And they’re not tweeting about it. ──────────────────────────────────────── SCENE 5: FIB LEVELS (The numbers traders swear by and still lose money on) Key pivot: ~4304 Support ladder: 4295 → 4289 → 4283 Upside supply: 4318 → 4323 → 4337 Meaning: Price is boxed. Everyone’s impatient. Liquidity loves impatience. ──────────────────────────────────────── SCENE 6: MULTI-TIMEFRAME DRAMA Lower TFs: “Let’s rally!” Higher TFs: “Relax. We’re distributing.” Daily: Still selling strength. Weekly: Still suspicious. Conclusion: Classic stop-hunt week. Nobody gets paid for being early. ──────────────────────────────────────── SCENE 7: ICHIMOKU (Simplified for sanity) Forget the cloud. Treat 4305–4337 as the line of truth. Above and accepted? We talk continuation. Below? It’s all theatrics. ──────────────────────────────────────── SCENE 8: VWAP (The only adult in the room) - Above VWAP + defended → quick longs - Below VWAP + defended → quick shorts Key word: QUICK. December does not reward commitment. ──────────────────────────────────────── SCENE 9: BIAS SCORECARD (Because confidence should always be uncomfortable) Weekly bias: Bear-tilted retest Daily bias: Sell rallies Intraday: Trying to be bullish, failing politely Conviction: ~55% That’s not confidence. That’s “I know something’s wrong but can’t prove it yet”. ──────────────────────────────────────── SCENE 10: MAGNETS (Where price goes after the lie is exposed) If bulls win: 4379 → 4428 → 4473 If bears win: 4237 → 4194 → 4154 Then 4137 → 4007 if liquidity disappears like 2008 promises ──────────────────────────────────────── SCENE 11: SESSIONS (Because time zones matter more than opinions) Tokyo: Mean reversion and fake breaks. London: Real liquidity test. New York: Where stop hunts go to graduate school. ──────────────────────────────────────── SCENE 12: LIQUIDITY MAP (Where dreams go to get stopped out) Buy-side stops: Above 4337, then above 4380 Sell-side stops: Below 4295, then 4283, then 4237 Expected behavior: Sweep one side. Pause. Then decide. ──────────────────────────────────────── FINAL SCENE: THE BIG SHORT MONOLOGUE “Look, I might be early… but I’m not wrong. The price is lying. Liquidity is thin. And acceptance matters more than direction.” Translation: Don’t trade the middle. Don’t marry a bias. Wait for acceptance. Get paid quickly. Respect the tail risk. December isn’t about being right. It’s about surviving the credits. — End Scene — Educational commentary. Market structure & liquidity behavior. Not financial advice.