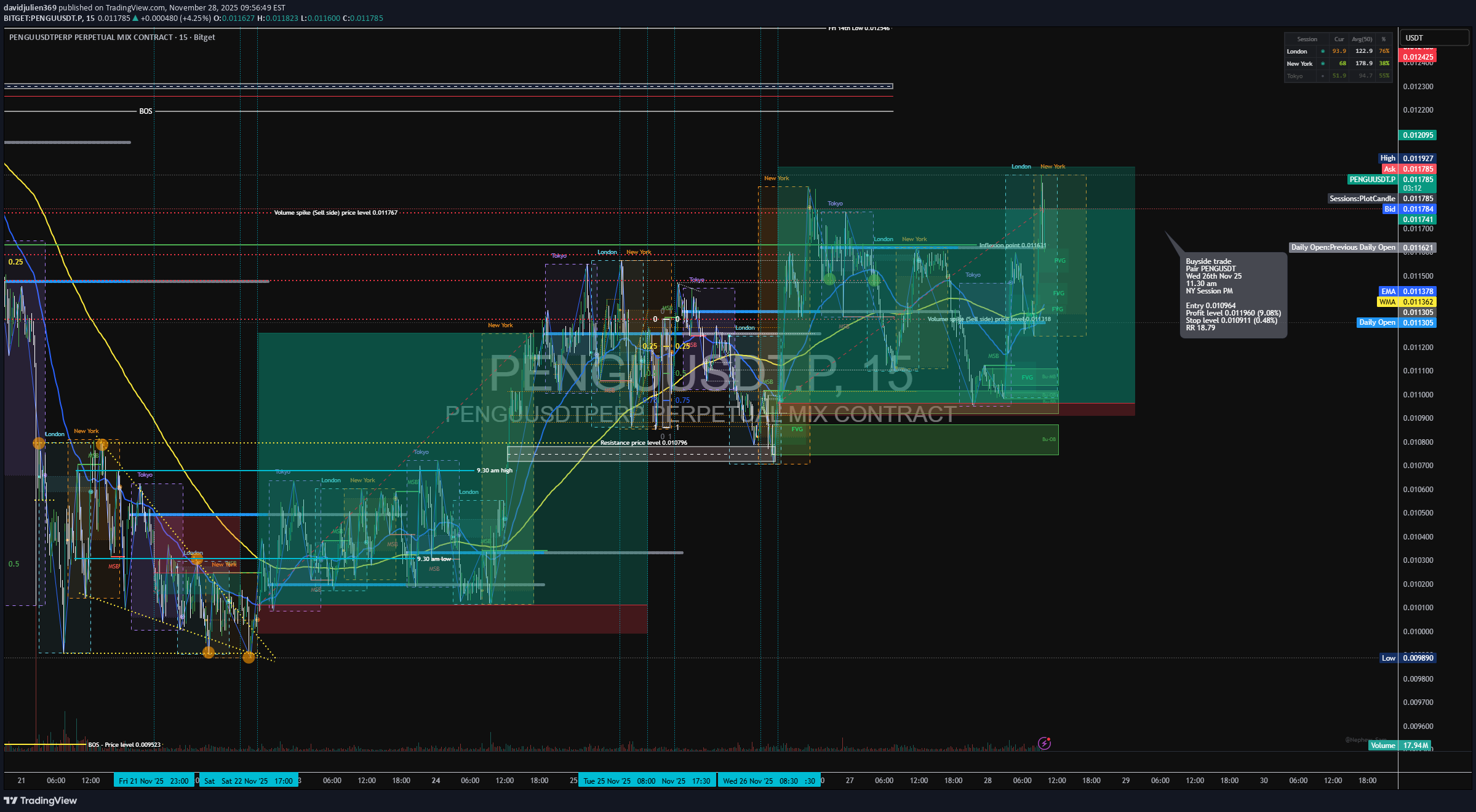

Technical analysis by davidjulien369 about Symbol PENGU: Buy recommendation (11/28/2025)

davidjulien369

معامله خرید PENGUSDT: استراتژی دقیق و سود 9 درصدی با تحلیل ساختار بازار

🟦 Trade Details Direction: Buyside Trade Pair: PENGUSDT Date: Wed 26th Nov 25 Time: 11:30 am Session: NY Session PM 🟩 Execution Metrics Entry: 0.010964 Take Profit: 0.011960 (+9.08%) Stop Loss: 0.010911 (–0.48%) Risk-to-Reward: 18.79 🟧 Market Structure Context Price respects session highs/lows across London → NY transitions. Prior sell-side sweep brought price into a discount where buyers stepped in. Clear BOS to the upside confirms bullish orderflow. NY PM continuation aligns with earlier accumulation from London. 🟥 Liquidity Narrative Liquidity engineered beneath 0.01090 levels. Strong reaction from: Volume spike (sell-side) Session liquidity pools Open-to-close inefficiencies Final draw on liquidity targets: The inefficiency above 0.01190 Session equal highs in premium 🟪 PD Arrays / POIs Price retraced into: FVG (discount zone) PMD retracement alignment NY PM bullish re-pricing zone POI validated with rejection from previous Daily Open zone. 🟨 Entry Model Entry taken on 15-minute confirmation after: Micro BOS Retest into discount FVG Strong PM session displacement Clear continuation model (ICT-style buyside draw) 🟫 Sentiment Strong market interest, rising volatility into NY PM. Volume confirming active accumulation. Micro-cap rotational sentiment supportive of fast expansion moves. 🟩 Outcome A high-probability, high-RR continuation trade. Clean narrative: Sell-side sweep → Discount entry → BOS → Expansion to buyside inefficiency.