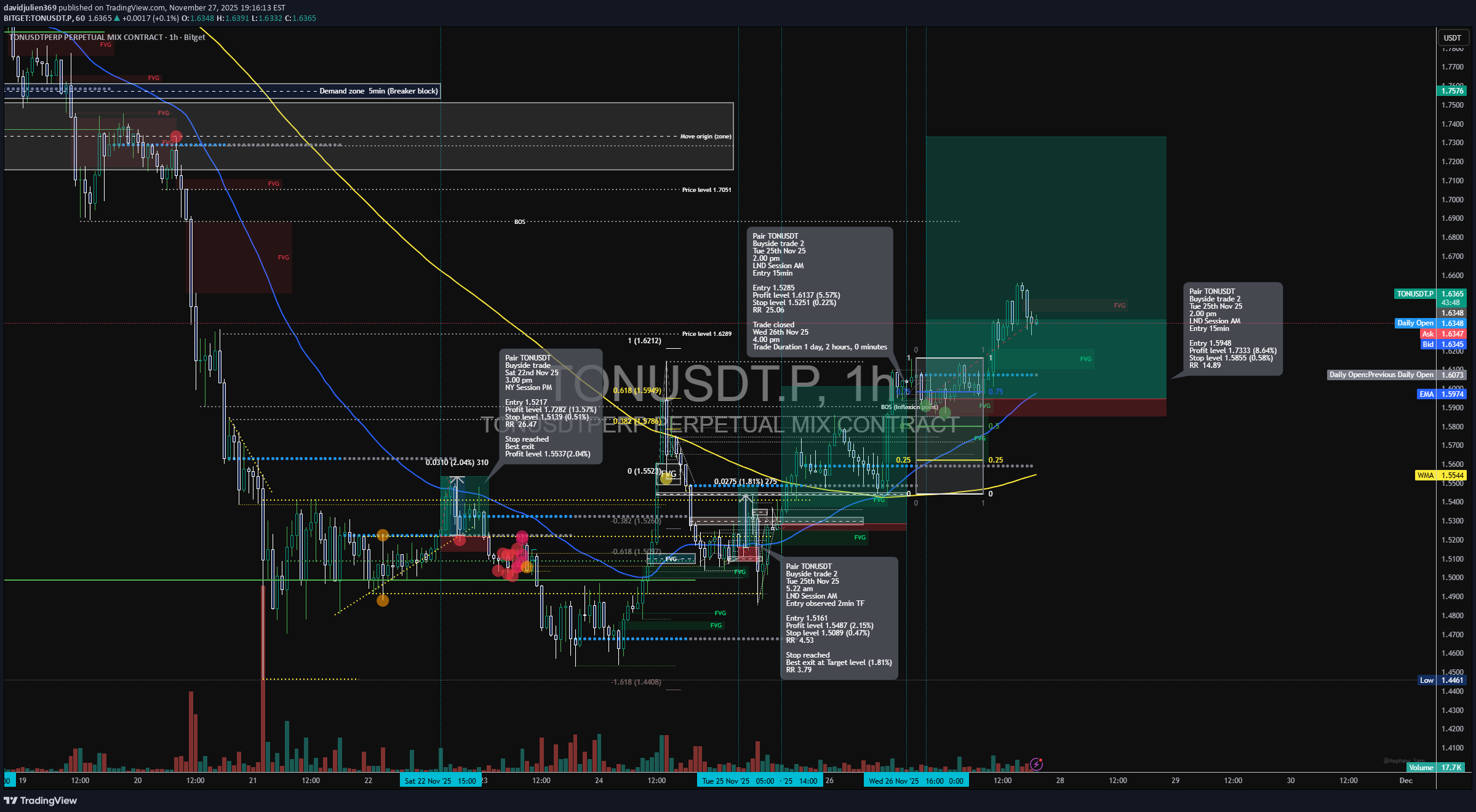

Technical analysis by davidjulien369 about Symbol TON: Buy recommendation (11/28/2025)

davidjulien369

تحلیل جامع خرید بلندمدت TONUSDT: استراتژی ورود به سود 11 درصدی از دل نوسانات بازار

🟩 1. Trade Details Pair: TONUSDT Type: Buyside Trade (Trade 2) Date: Tue 25th Nov 2025 Time: 2:00 PM Session: London → NY AM Entry Timeframe: 15-min Chart Timeframe: 1H Entry: 1.5948 Stop Loss: 1.5533 (-3.81%) Take Profit: 1.7833 (+11.84%) Risk-to-Reward: RR = 14.49R 🟦 2. Higher-Timeframe Context (Blue Tab — HTF Narrative) HTF Trend: • The 4H & 1H structure shows the larger downtrend has completed its corrective leg. • Price forms a multi-tap accumulation range with repeated liquidity sweeps under 1.5520 – 1.5600. • A clear BOS on the 1H shifts narrative from bearish → bullish. Key HTF Confluences: Breaker block reclaimed (originated from the last sell-side displacement). Discount pricing beneath the 0.618 retracement of the previous leg. Daily Open reclaimed → bullish orderflow. FVG cluster left behind during displacement, acting as fuel for a pro-trend continuation. Directional bias: HTF buy-side targeting 1.70 → 1.74 liquidity. 1Hr TF 🟧 3. Liquidity Story Liquidity events leading to the entry: 1️⃣ Sell-side liquidity swept • Deep wick into 1.5520 level (multi-session equal lows). • New York session provided the liquidity injection needed for expansion. 2️⃣ Inducement / engineered liquidity • Double-bottom fakes & equal-low structures were purposefully created during Asia/London. 3️⃣ Displacement • Strong impulsive displacement from 1.5580 → 1.6200 • Break of Structure confirms bullish orderflow. 4️⃣ Pullback into discount • Price retraced into: 0.618 retracement 15-min FVG 1H FVG stack Order block 1.5630–1.5690 This created the optimal trade entry. 5️⃣ Final Liquidity Target • Buyside resting above 1.7300 → 1.7500 • TP aligns with prior swing-high inefficiency and breaker block. 🟪 5. Market Sentiment & Narrative Session Flow: • Asia created the range → engineered liquidity • London manipulated → swept sell-side • NY AM gave the displacement → bullish confirmation Market Psychology: Retail assumed trend continuation downwards due to prior bearish leg. Smart money accumulated aggressively in discount during multi-session compression. 🟫 6. Outcome Trade Status: ACTIVE (Price mid-leg expansion) Current Position: in +6.3% unrealised PnL at time Market Structure: intact bullish MS Invalidation: Break & close below 1.5600