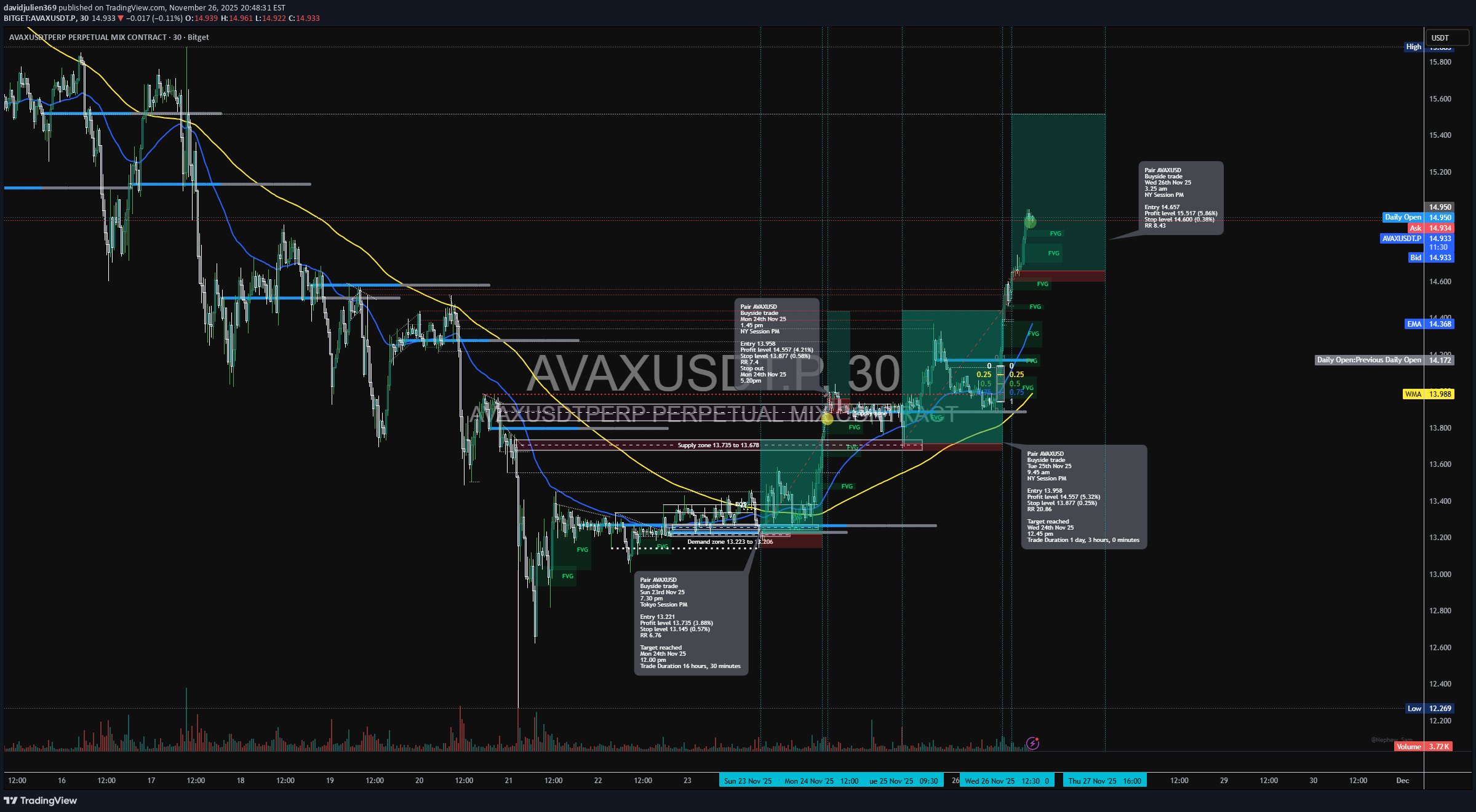

Technical analysis by davidjulien369 about Symbol AVAX: Buy recommendation (11/27/2025)

davidjulien369

خرید قوی آواکس (AVAX): استراتژی معاملاتی بلندمدت با ریسک به ریوارد عالی 8.43R

Wed 26th Nov 25 — 3:25 PM NY Session PM Entry TF: 5-Min 🟩 1. Trade Parameters Pair: AVAXUSDT Direction: Buy-Side Entry: 14.557 Stop Loss: 14.400 Take Profit: 15.577 Risk–Reward: 8.43R 🟨 2. Higher-Timeframe Context HTF (1H / 4H) market structure: Market has been in a multi-day downtrend, forming successive lower-lows and lower-highs. A major demand zone between 13.12 – 13.30 was reclaimed on 23rd Nov. Strong NY expansion candle broke above compression on 25th Nov, signalling a likely HTF shift. Price pulled back into discount, forming a textbook re-accumulation structure. 30min TF overview 🟧 3. Liquidity Liquidity Taken (Before Entry) Sweep of Sunday–Monday lows around 13.12. Deep purge into demand zone engineered equal-lows → liquidity grab. Market created inducement wicks at 14.12, which were later swept. Liquidity Above (Targets) Buy-side liquidity pool at 15.57 (clear cluster of prior highs). Multiple FVGs above price requiring rebalancing. Void left from the sharp selloff on Nov 18th → price required re-pricing into inefficiency. Liquidity narrative: Sweep → Accumulation → Reclaim → Displacement to inefficiency. 5min Chart 🟥 4. SMC / ICT Technical Model Breakdown ✔ Model Type: BOS + FVG + Re-Accumulation Breakout BOS at ~14.25 confirms shift back to bullish orderflow. Clean FVG (14.22–14.28) formed after displacement. Price returned to the FVG → mitigated OB → tapped equilibrium. Strong continuation displacement candle printed → ideal entry timing. Key Confluences: Demand zone → BOS → FVG → OB alignment EMA/WMA bullish crossover Tight SL under engineered liquidity 🟦 5. Entry Logic The entry at 14.557 acted as the: Re-accumulation breakout confirmation Retest of micro FVG Retest of prior resistance turned support SL placement below 14.400 protected under: ✓ Equal lows ✓ OB mitigation ✓ Structural swing low 🟫 7. Trade Outcome Status: In session