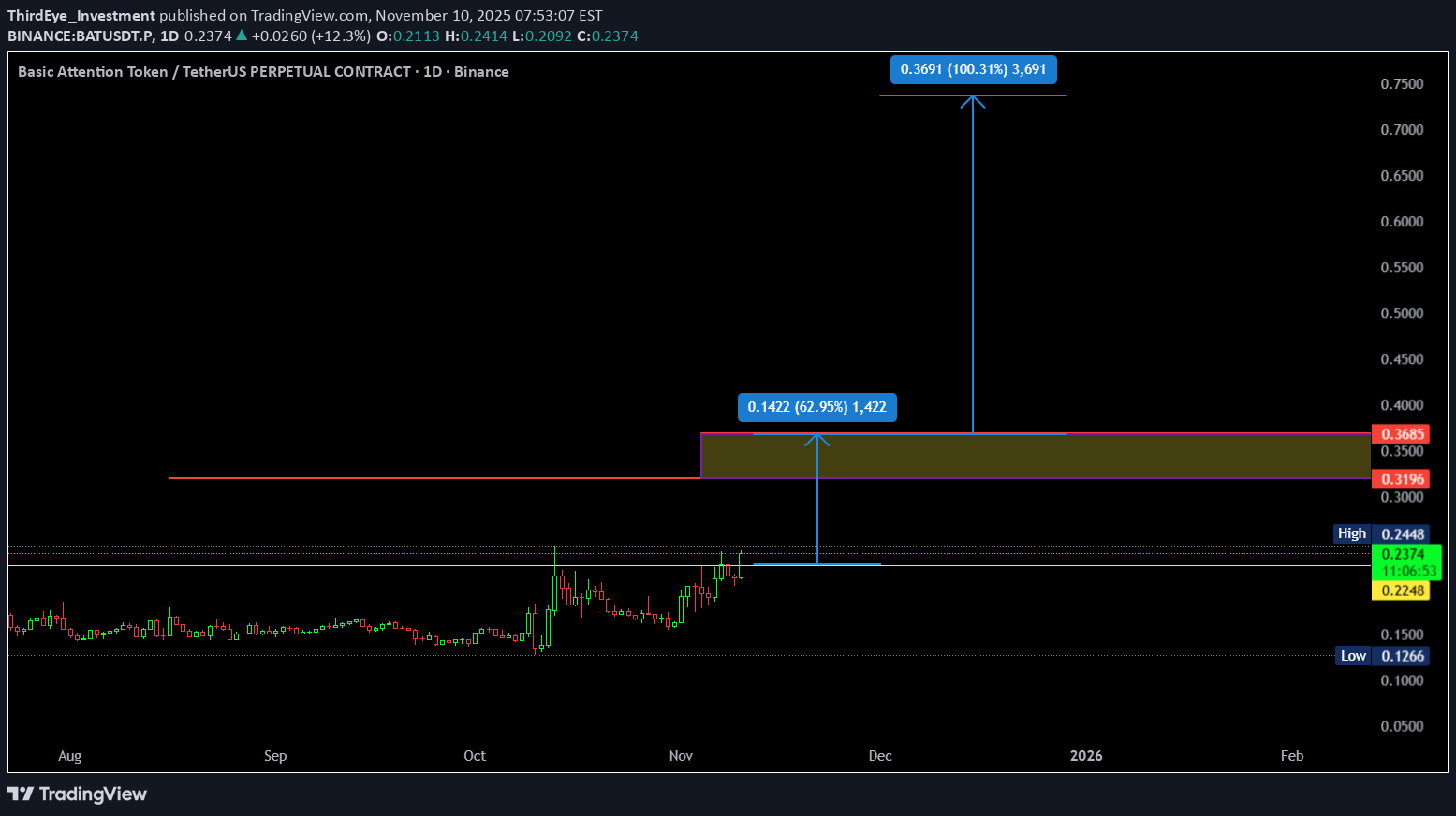

Technical analysis by ThirdEye_Investment about Symbol BAT: Buy recommendation (11/10/2025)

ThirdEye_Investment

تحلیل دقیق BAT/USDT: راز حرکت بزرگ قیمت با استراتژی محرمانه VWAP!

This analysis is based on VWAP (Volume Weighted Average Price) using monthly and daily charts. Key Points: - VWAP levels indicate significant support and resistance zones. - The highlighted box represents the price expected on November 30 (note: November has 30 days, not 31). - A daily close above $0.24 could signal a 62–100% potential upside. Using VWAP across multiple timeframes helps identify both short-term and long-term trends. 💡 My strategy combines VWAP with Z-score deviations to pinpoint high-probability moves, this is what sets my approach apart.Key Updates: - Price respected the projected November 30 target zone, validating the VWAP structure. - We have now seen increased stability above the $0.24 level, which on Nov 10 was the key trigger for a potential 62–100% upside move. What this means now: - As long as price holds above the daily VWAP and maintains structure above $0.24, the bullish scenario remains intact. - Any retest of VWAP (daily or weekly) may offer high-probability entries, especially if Z-score returns to neutral (0 to ±0.5). 💡 When the volume is the source, the price is the advertiser, and time is the regulator and right now, all three are aligned. The move isn’t just expected, it’s inevitable.