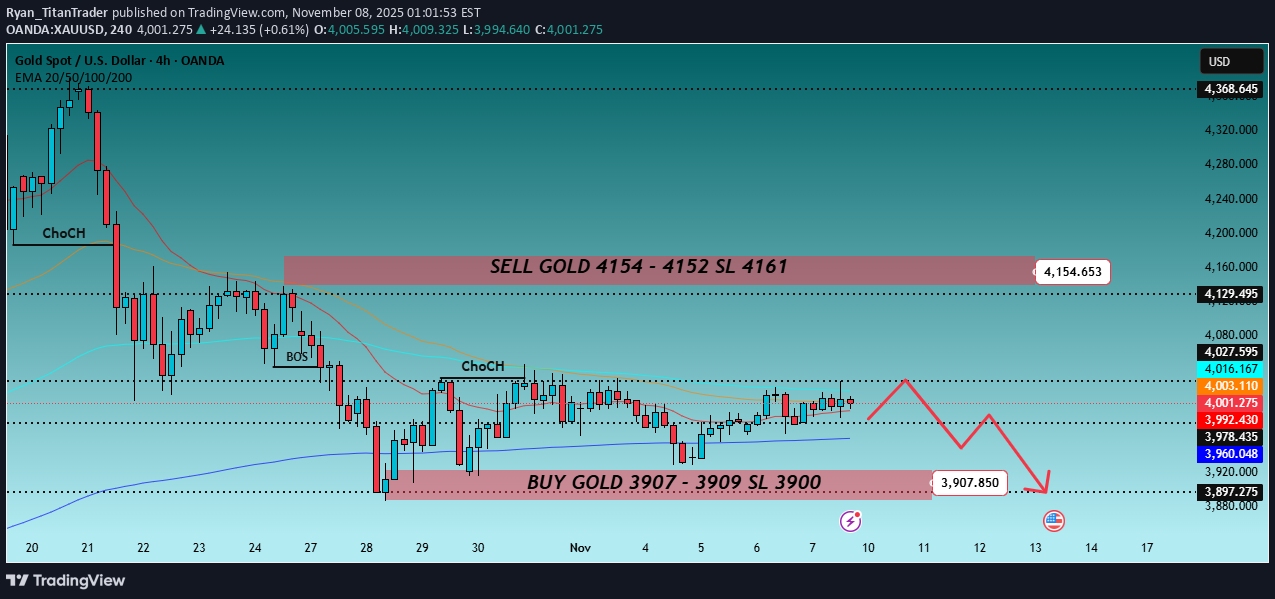

Technical analysis by Ryan_TitanTrader about Symbol PAXG: Sell recommendation (11/8/2025)

Ryan_TitanTrader

طلا در آستانه دادههای PMI آمریکا و سخنرانی فدرال رزرو: سطوح نقدینگی کلیدی طلا (تحلیل اسمارت مانی)

🥇 XAUUSD – Weekly Smart Money Outlook | by Ryan_TitanTrader 📈 Market Context Gold continues to consolidate within a tight 4H range as traders prepare for a week influenced by U.S. PMI releases, Fed speeches, and shifting rate-cut expectations. Mixed economic signals — including softer labor data but resilient manufacturing prints — have kept gold trapped between supply overhead and stacked demand levels below. Institutional flows remain cautious, with markets waiting for clarity on the Fed’s stance. This uncertainty often fuels liquidity-driven sweeps, making this week especially favorable for SMC-style setups. Short-term volatility is expected as price interacts with major liquidity pools on both ends of the range. 🔎 Technical Analysis (4H / SMC View) • Price is moving within a well-defined range structure, with repeated liquidity grabs on both sides indicating accumulation by larger players. • The latest 4H ChoCH signals continued hesitation from buyers near the mid-range, hinting that the market may engineer another sweep before committing to a directional leg. • A significant Premium Supply Zone at 4154–4152 sits just above recent equal highs — an attractive area for liquidity hunts followed by potential short-term distribution. • Conversely, the Discount Demand Zone at 3907–3909 aligns with previous structural reaction levels and sits below a liquidity shelf, making it an ideal zone for re-accumulation. • Expect engineered stop-hunts around mid-range liquidity (4000–4016) before a stronger move develops. 🟢 Buy Zone: 3907–3909 SL: 3900 TP targets: 3978 → 4003 → 4016 → 4125 Rationale: • Discount zone within the current 4H range • Liquidity resting below the structure lows • Potential accumulation before the next bullish impulse 🔴 Sell Zone: 4154–4152 SL: 4161 TP targets: 4080 → 4016 → 3978 → 3920 Rationale: • Premium supply positioned above equal-high liquidity • Likely area for a sweep before corrective downside • Confluence with previous 4H structure rejection ⚠️ Risk Management Notes • Wait for M15 ChoCH or BOS confirmation inside each zone before entering. • Expect liquidity manipulation around 4000–4016, especially during US session opens. • Avoid entries 10–15 minutes before major Fed or PMI releases to limit spread expansion. • Scale partial profits at each structural target to lock in gains while letting runners play out. ✅ Summary Gold remains in a controlled 4H range with clear institutional footprints above and below the current price. Smart Money is likely to engineer a move into either the 4150 supply or the 3900 demand before choosing its next major direction. Both setups offer high-probability opportunities when combined with intraday confirmations. Stay patient, wait for liquidity sweeps, and respect structure. Premium sells remain valid at 4154–4152, while discounted buys are favored at 3907–3909. 🔔 FOLLOW RYAN_TITANTRADER for daily SMC setups ⚡