Technical analysis by Xayah_trading about Symbol PAXG: Buy recommendation (11/6/2025)

Xayah_trading

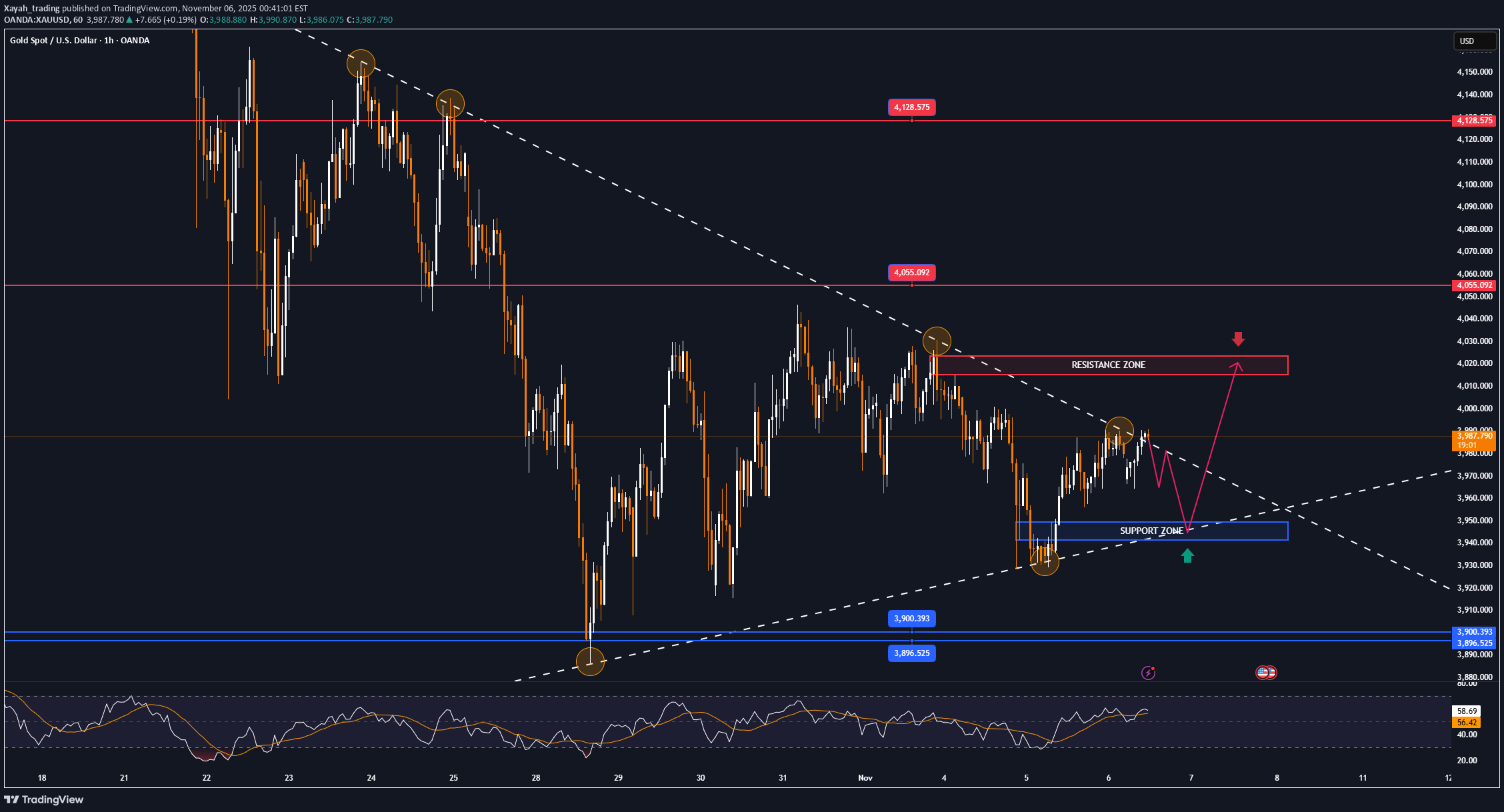

طلا با وجود دادههای قوی اشتغال باز هم صعود کرد؛ علت چیست؟

XAUUSD prices rose more than 1% on Wednesday to $3,978.92 an ounce, despite better-than-expected U.S. private-sector jobs data, reflecting cautious investor sentiment amid high stock market valuations and uncertainty surrounding President Donald Trump’s tariff policies, which are reshaping the global economic landscape. The ADP employment report showed that the private sector added 42,000 jobs in October, well above the forecast of 28,000, reinforcing the view that the US labor market remains strong and therefore the Fed can delay rate cuts. However, the rise in real yields has not been enough to dampen demand for havens, as investors view gold as a hedge against a potential correction in risk assets. Christian Borjon Valencia (FXStreet) said gold prices were supported by dovish comments from several Fed officials. Meanwhile, Jim Wyckoff (Kitco Metals) said “safe haven demand is back” as investors “are increasingly concerned about the AI stock bubble and the overvaluation of the US market.” Financial markets are in a wait-and-see mode as the US Supreme Court holds a hearing on the legality of tariffs imposed by President Trump under the International Emergency Economic Powers Act. An adverse ruling could result in the government having to repay more than $100 billion in tariffs and limit the White House’s ability to direct trade policy, potentially sending shockwaves through the dollar and commodity markets. Conservative justices, including Chief Justice John Roberts and Neil Gorsuch, have questioned whether the president has the authority to unilaterally impose a “tax on Americans” without congressional approval. A decision against Trump could weaken his central “economic weapon” and drive money into risk-free assets like gold. On the political prediction market Kalshi, the likelihood of the court backing Trump has fallen from nearly 50% to just about 30%, reflecting growing skepticism about the sustainability of the tariff strategy. These factors combine to suggest that XAUUSD is consolidating its position in a transitional period between monetary policy and political uncertainty, a period in which the Fed is cautious, Washington faces regulatory risks and its power structure is challenged. Technical Analysis XAUUSD Gold prices are entering a narrow consolidation phase around the $3,940–$3,980/ounce range, after a correction from the $4,380 peak. The daily chart shows that the short-term downtrend channel structure is still maintained, but the downside momentum has weakened significantly. The $3,896 (0.5 Fib) zone continues to act as a key support, while the $3,972–$4,055 resistance zone (0.382 Fib and MA20) is the decisive threshold for the next trend. The RSI is slowly recovering from the neutral zone and is showing signs of converging with the moving MA, implying that selling pressure is drying up and the market may form a short-term bottom. If the price breaks out decisively at $3,972, the current accumulation pattern could be completed, opening a recovery cycle towards $4,128, the 0.236 Fib mark of the previous decline. The conditions for a new bull run lie in gold prices remaining stable above the $3,900 support zone, combined with improved cash flows and expectations of the Fed shifting to a more dovish stance in December. In that case, the current consolidation zone could become the basis for a new rally, rather than just a technical pullback. SELL XAUUSD PRICE 4022 - 4020⚡️ ↠↠ Stop Loss 4026 →Take Profit 1 4014 ↨ →Take Profit 2 4008 BUY XAUUSD PRICE 3948 - 3950⚡️ ↠↠ Stop Loss 3944 →Take Profit 1 3956 ↨ →Take Profit 2 3962