Technical analysis by Xayah_trading about Symbol PAXG on 11/3/2025

Xayah_trading

هفته حساس بازارهای جهانی: دادههای کلیدی، تصمیمات بانکهای مرکزی و نوسانات طلا!

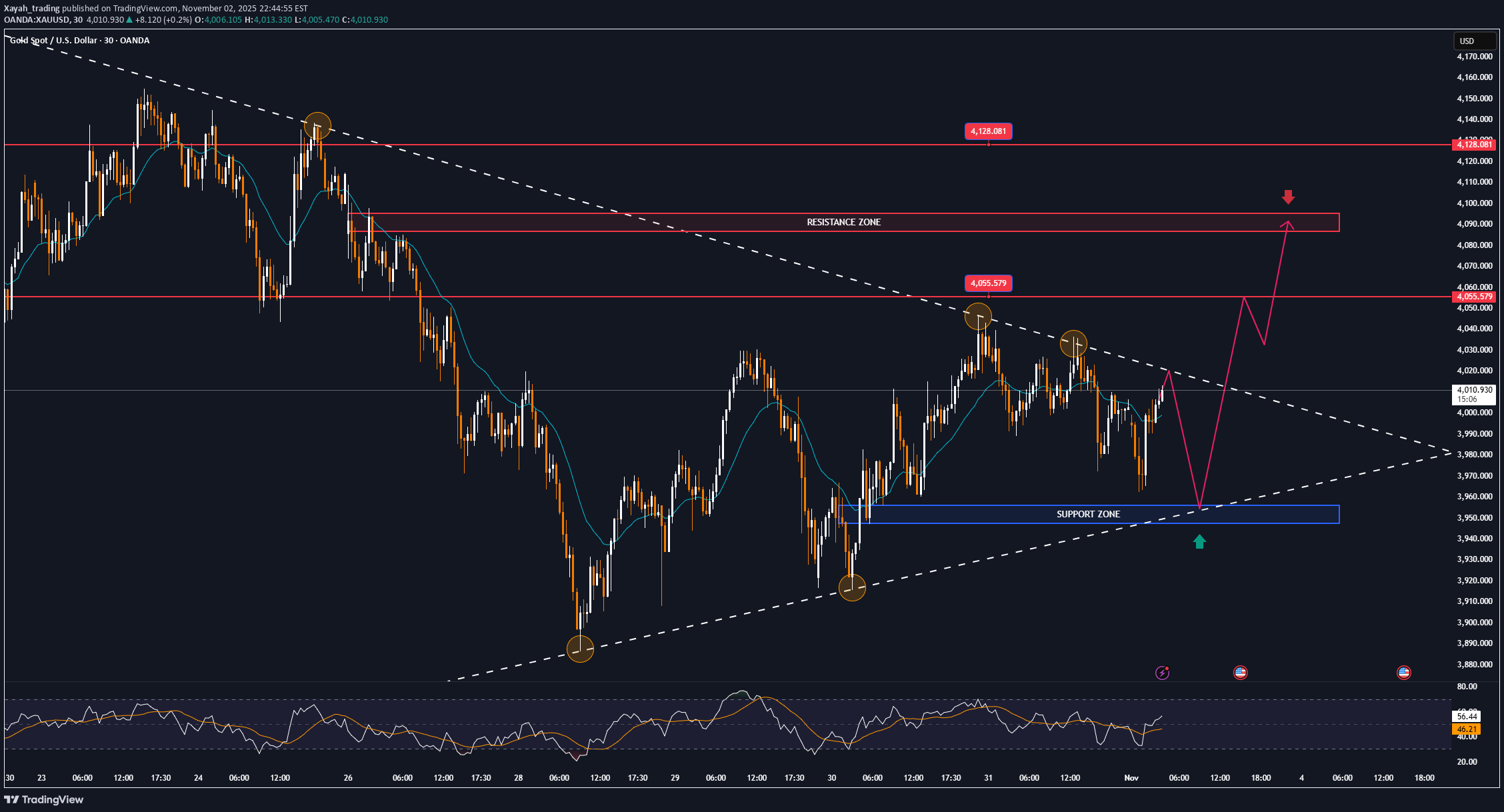

The trading week of November 3–7 is considered a pivotal period for international financial markets. A series of high-level economic data including manufacturing and services PMIs, ADP non-farm payrolls, trade balances, and interest rate decisions from major central banks will create a mixed picture of the global economic cycle. Meanwhile, statements from Federal Reserve officials and geopolitical developments can reinforce or distort monetary policy expectations later in the year. 🔹 Monday – Global PMI: PMI figures from China, Europe, the UK, and the US kick off the week, reflecting the overall health of global manufacturing. Weak data could boost expectations for monetary easing, while stronger results may reinforce inflation-control policies. Additionally, the outcome of the OPEC+ meeting could impact oil prices and inflation trends. 🔹 Tuesday – Monetary Policy & Trade: Focus turns to the RBA (Australia) rate decision and Canada’s trade balance. The market expects the RBA to keep rates unchanged at 3.6%, but a “hawkish” tone could trigger volatility in AUD. Speeches from Fed and BoC officials will also provide further clues on the 2025 rate-cut cycle. 🔹 Wednesday – Services & Employment: The US Services PMI and ADP employment report will take center stage. These data points often provide early hints for the Non-Farm Payrolls report. Crude oil inventories from API and EIA will continue to influence oil prices and inflation expectations. 🔹 Thursday – European Data & BoE Decision: The Bank of England may cut interest rates by 25 basis points to 3.75% amid recession concerns. Germany’s retail sales and industrial production figures will offer insights into the region’s economic health. 🔹 Friday – China & the Fed: China’s trade balance and a series of speeches from five FOMC members will dominate attention. Any comments related to inflation or December rate decisions could cause sharp moves in USD and gold. Three Key Risks to Watch: 1️⃣ Data Divergence: PMI or ADP figures may diverge significantly from official data, sparking volatility in market expectations. 2️⃣ Policy Surprises: Unexpected moves or tone shifts from the RBA or BoE could trigger market shocks. 3️⃣ Geopolitics & Liquidity: Escalating tensions in Russia–Ukraine or the Middle East, along with oil price swings, could drive safe-haven flows into gold and USD. Technical analysis of XAUUSD Gold price is hovering around the $4,000/oz mark, after recovering slightly from the 0.382 Fibonacci support zone at $3,972/oz. The recent decline remains within a short-term correction channel, but selling pressure has slowed as the RSI exited the oversold zone and showed signs of forming a technical bottom. The EMA21 (around $4,055/oz) is currently acting as an important resistance. If the price breaks above this level decisively, the short-term correction structure could be completed, opening a new uptrend towards the $4,128–$4,200/oz area (Fibo 0.236 and the most recent old peak). Conversely, if gold fails to surpass the EMA21, the correction could continue towards $3,846 or $3,720/oz – the next two support zones corresponding to the Fibo 0.5 and 0.618 levels, respectively. Note: RSI momentum is still weak, so further confirmation with trading volume and reversal candlestick signals is needed before opening a long position. SELL XAUUSD PRICE 4091 - 4089⚡️ ↠↠ Stop Loss 4095 →Take Profit 1 4083 ↨ →Take Profit 2 4077 BUY XAUUSD PRICE 3954 - 3956⚡️ ↠↠ Stop Loss 3950 →Take Profit 1 3962 ↨ →Take Profit 2 3968