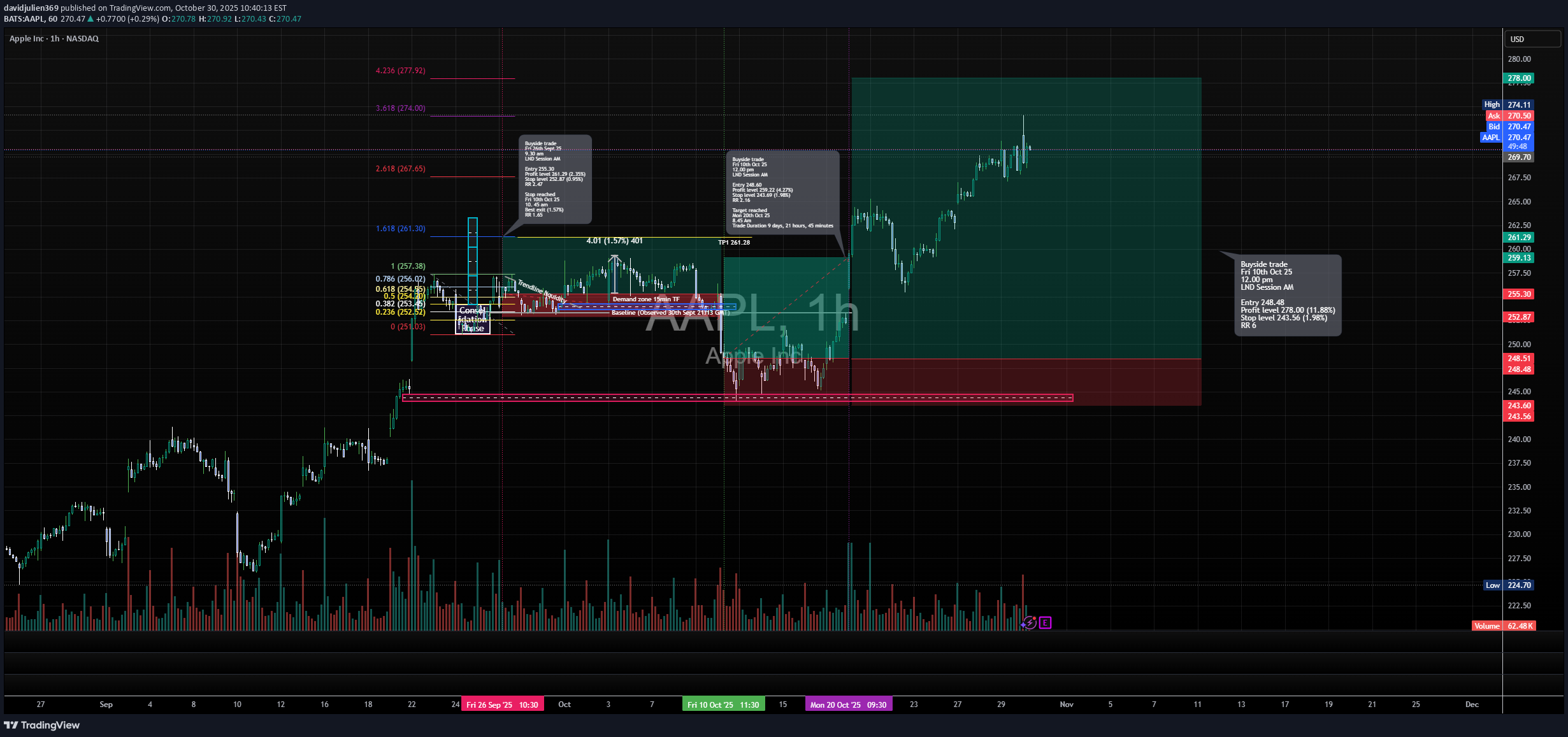

Technical analysis by davidjulien369 about Symbol AAPLX: Buy recommendation (10/30/2025)

davidjulien369

تحلیل کامل معامله خرید بلندمدت اپل (AAPL): ورود، اهداف و استراتژی ریسک به ریوارد 6R

📘 Trade Journal Entry Symbol: AAPL (Apple Inc.) Direction: Buy-Side Trade Date: Fri 10 Oct 25 Time: 11:00 am Session: LND to NY Session AM Timeframe: 1 Hour 🔹 Trade Details Metric Value Entry 248.43 Profit Level (TP)278.00 (+11.88%) Stop Level (SL) 243.56 (–1.98%) Risk–Reward (RR)6.0 R 🔸 Technical Context Structure: Price broke out from an extended accumulation zone with confirmation from a BOS (Break of Structure) and Demand Zone Retest on the 15-minute and 1-hour timeframes. The move aligns with a strong fair value gap fill and retest of the order block around 244–245, which acted as a springboard for the next impulsive leg. Fibonacci Expansion: 1.618 projection → 261.30 (short-term target) 2.618 projection → 267.60 (intermediate) 3.618 projection → 274.00 (high-probability swing) 4.236 projection → 277.92 (extended TP) Volume Confirmation: Volume spikes visible at the breakout candle reinforce institutional participation, marking a clear transition from consolidation to markup phase. 🔹 Narrative & Bias Apple continues to exhibit buyside momentum after consolidating above the September accumulation range. The breaker block re-entry at 245 aligned with fib 0.618 retracement and strong volume demand, confirming bullish continuation. Current structure mirrors prior accumulation-distribution cycles seen before major upside runs. Macro Context: Tech sector rotation in line with AI & earnings optimism. Broader equity market stability encouraging risk-on positioning in mega-cap tech names. Projection: Price expected to extend toward 267–278 levels before the next major consolidation phase, with potential for partial take-profits near the 1.618 extension.Stop level moved (8.75%)