Technical analysis by Ryan_TitanTrader about Symbol PAXG: Buy recommendation (10/18/2025)

Ryan_TitanTrader

طلا در نمودار ساعتی: اصلاح جزئی یا تجمیع صعودی در راه است؟

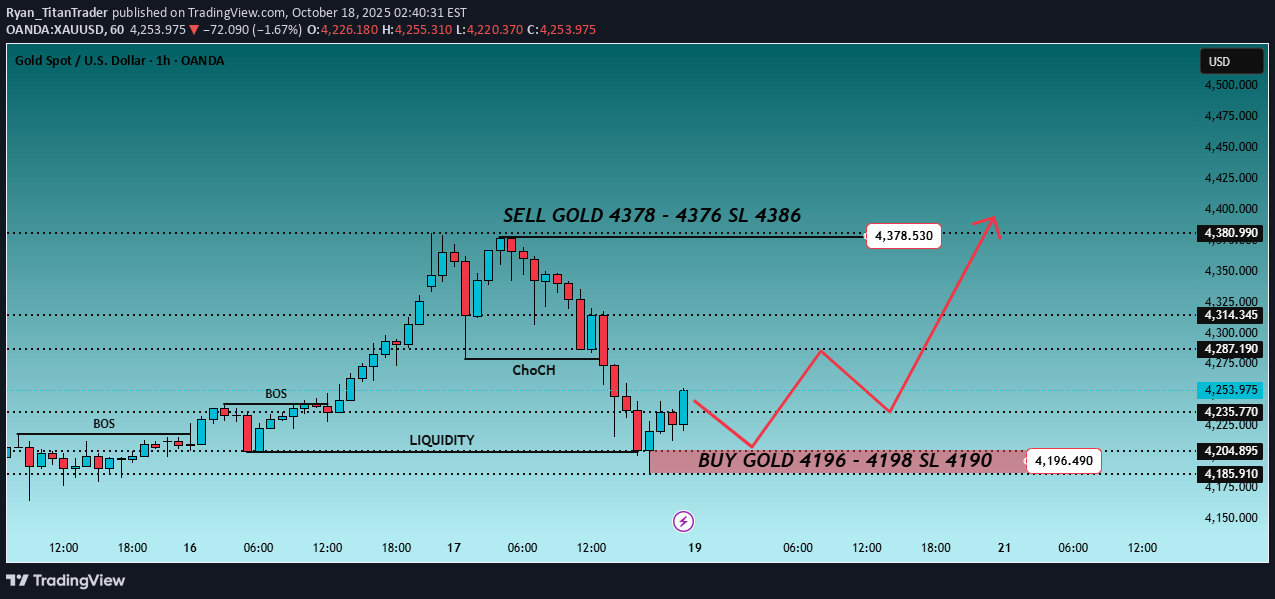

XAUUSD – Intraday Trading Plan | by Ryan_TitanTrader 📈 Market Context Gold extends its rebound near $4 250 as traders weigh the recent uptick in U.S. Treasury yields against growing expectations of a softer Federal Reserve stance. After the latest mixed U.S. economic data, markets are leaning toward a mildly dovish outlook — rate-cut bets for early 2026 are gaining traction, while the dollar remains steady. Today’s focus centers on U.S. housing-starts and jobless-claims data, which could steer short-term volatility. A stronger-than-expected report may trigger temporary selling pressure on gold, while weaker figures could revive safe-haven demand and extend the rally toward $4 380 +. Expect liquidity hunts before any clear directional move, as institutional players refine positions near the week’s range extremes. 🔎 Technical Analysis (1H / SMC Style) •Market structure remains bullish, with previous Breaks of Structure (BOS) confirming continuation after the earlier accumulation phase. •A short-term Change of Character (ChoCH) signals corrective movement — likely a liquidity sweep before the next bullish leg. •Liquidity resting below $4 200 has already been taken, aligning with the discount zone around $4 196 – $4 198. •A potential re-accumulation is forming; buyers may look for confirmation (M15 BOS/ChoCH) inside this demand zone. •Upside liquidity targets cluster near $4 375 – $4 380, coinciding with a premium supply zone where sellers might re-enter. 🔴 Sell Setup Entry: 4378 – 4376 Stop-Loss: 4386 Take-Profit Targets: 4325 → 4260 🟢 Buy Setup Entry: 4196 – 4198 Stop-Loss: 4190 Take-Profit Targets: 4250 → 4370 → 4380 + ⚠️ Risk Management Tips •Wait for lower-timeframe BOS/ChoCH confirmation before execution. •Be cautious around U.S. macro data releases — spreads and volatility can widen temporarily. •Use partial take-profits at nearby liquidity zones and trail stops once market structure confirms continuation. ✅ Summary Gold maintains its bullish bias above $4 200 after sweeping liquidity. A short-term correction could retest $4 196 – $4 198 for fresh buy entries, while the broader trend remains upward. Only a clean structural break below $4 190 would invalidate the bullish continuation scenario. FOLLOW RYAN FOR MORE USEFUL TRADING IDEAS!!!SELL GOLD 4381 +1360PIPS