Technical analysis by CryptoNuclear about Symbol ATA: Buy recommendation (9/16/2025)

CryptoNuclear

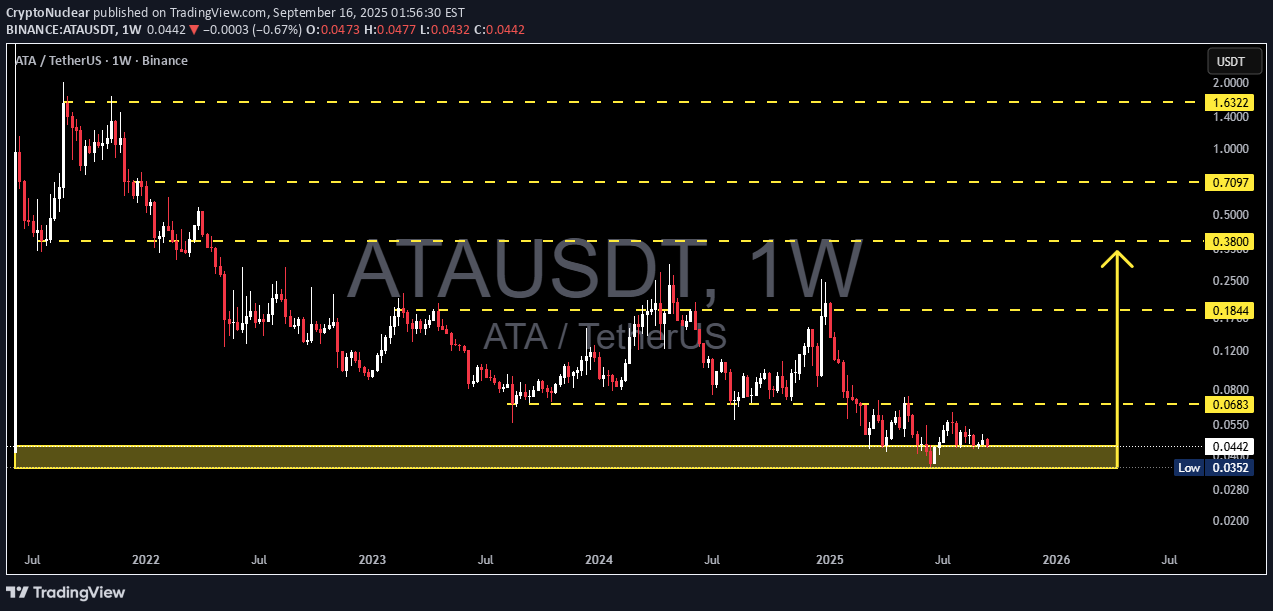

ATA/USDT — Historical Support: Major Accumulation or Breakdown?

Overview: ATA/USDT has been in a long-term downtrend since 2021, consistently printing lower highs as selling pressure dominates. However, the market is now showing signs of a critical consolidation phase around the historical support zone at 0.028 – 0.044 (yellow box). This area has acted as a major demand zone multiple times, making it a key battleground to determine whether ATA is preparing for a potential accumulation base before a trend reversal, or if a deeper bearish continuation is on the horizon. --- 🔍 Pattern & Price Structure Analysis 1. Key Support (0.028 – 0.044): Tested multiple times since 2022. Long wicks suggest strong buying liquidity emerges here. If it holds, this area may become the foundation for accumulation. 2. Major Resistance Levels: 0.0683 → the first key breakout level that must be reclaimed. 0.1844 – 0.3800 → mid-term targets if momentum builds. 0.7097 – 1.6322 → long-term recovery targets if a full reversal occurs. 3. Chart Pattern: Long-term descending structure since 2021. Now forming a horizontal range at the bottom, which can be read as a descending triangle or an early accumulation phase. Volatility compression indicates the market is waiting for a major breakout catalyst. --- 📈 Bullish Scenario Confirmation: Weekly close above 0.0683 + successful retest. Short-term target: 0.0683 (first breakout checkpoint). Mid-term target: 0.1844 → potential +300% from current levels. Long-term targets: 0.3800 and even 0.7097 if strong momentum follows. Bullish narrative: A breakout here would shift structure from downtrend to trend reversal, potentially leading to a parabolic phase. --- 📉 Bearish Scenario Confirmation: Weekly close below 0.035 – 0.028. Downside target: Fresh lows below 0.028, opening uncharted territory without strong historical support. Bearish narrative: A breakdown would signal buyer exhaustion, leading to potential capitulation and deeper downside. --- 🧠 Strategy Notes Conservative approach: Wait for breakout >0.0683 to confirm a trend reversal before entering. Aggressive approach: DCA entries around 0.035 – 0.044 with disciplined stop-loss (e.g., <0.028). Risk management: Crucial here, as the broader trend remains bearish until a breakout confirms otherwise. --- ✨ Conclusion ATA/USDT is at a make-or-break level. Will this historical support zone serve as the foundation for a major accumulation phase that sparks a multi-month bullish reversal, or will it break down into new lows? The answer will likely unfold in the coming weekly candles. Watch 0.0683 above and 0.028 below as the key decision levels. --- #ATAUSDT #Crypto #Altcoins #TechnicalAnalysis #PriceAction #Accumulation #Breakout #BearishOrBullish #CryptoStrategy #SupportAndResistance