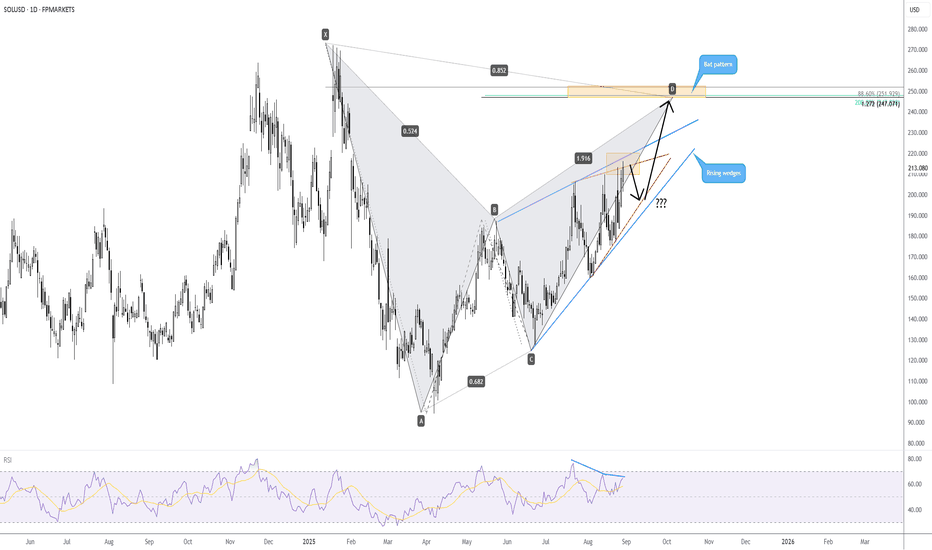

Technical analysis by FP Markets about Symbol SOL: Sell recommendation (8/28/2025)

FP Markets

SOL/USD to reject resistance?

An interesting technical scenario is brewing on SOL/USD (Solana versus the US dollar) at the moment. First and foremost, you will note that upside momentum has slowed; this is demonstrated by price action compressing between converging lines, offering two rising wedge patterns to work with (the larger formation is formed between US$127.48 and US$187.30; the smaller pattern is drawn between US$160.78 and US$206.10). With price now testing the upper boundaries of the noted rising wedge patterns and the Relative Strength Index showing negative divergence, this could prompt a bout of profit-taking and force a modest correction. Why I say a modest correction is simply because the larger harmonic bat pattern is in the process of forming its D leg. This could see the pair rally higher before connecting with the bat pattern’s Potential Reversal Zone (PRZ) between US$251.93 and US$247.07. Written by FP Markets Chief Market Analyst Aaron Hill