Technical analysis by Trade Nation about Symbol SPYX on 21 hour ago

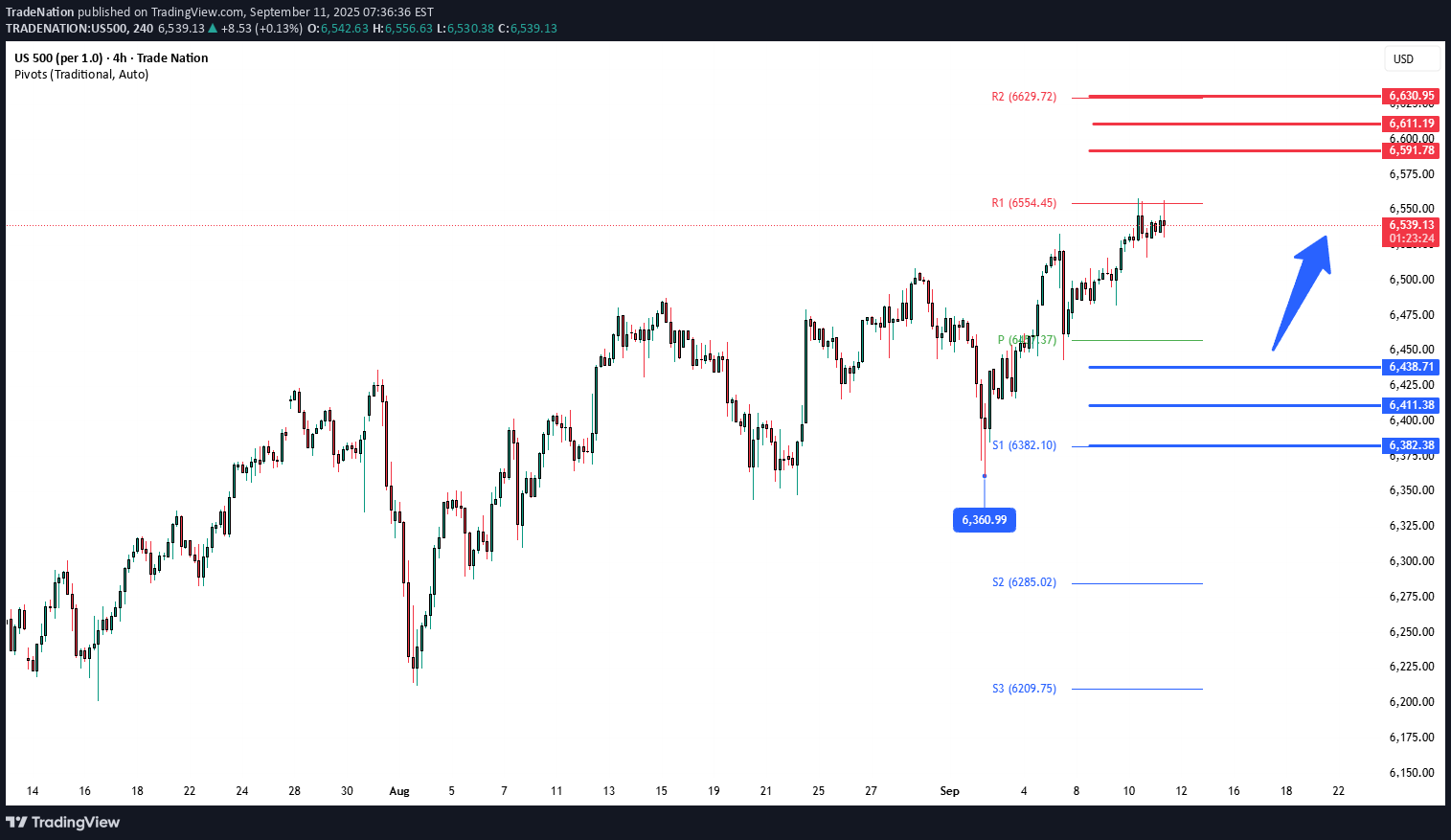

US CPI rose to 2.9% YoY in August (vs. 2.7%), showing inflation is re-accelerating. Markets still expect a 25bp Fed cut next week, but scope for deeper easing is reduced. For equities, this means headwinds for tech and other rate-sensitive growth stocks, while defensives and commodity-linked sectors may hold up better. Overall, the print adds to volatility ahead of the Fed meeting, with equities likely to trade cautiously. Key Support and Resistance Levels Resistance Level 1: 6590 Resistance Level 2: 6610 Resistance Level 3: 6630 Support Level 1: 6440 Support Level 2: 6410 Support Level 3: 6380 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.