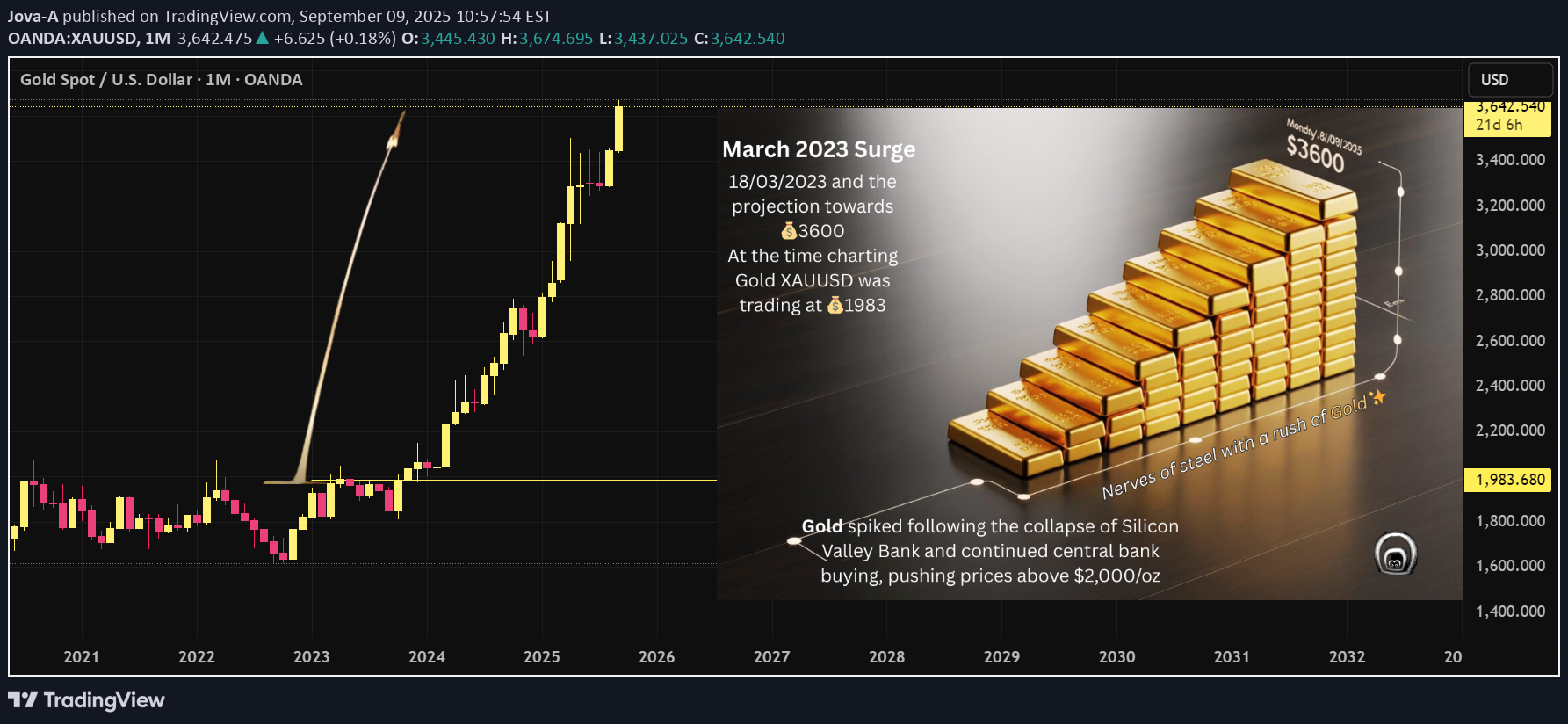

Technical analysis by Jova-A about Symbol PAXG: Buy recommendation (9/9/2025)

Jova-A

Gold XAU$, 1M TF, 18/03/2023 and the Odyssey to $3600

XAUUSD The Gold Odyssey: From $1,983 to $3,600 and Beyond Once upon a time on TradingView back on March 18, 2023 (1M TF), gold (XAUUSD) was trading at $1,983.68. That’s when the chart of destiny was drawn — A bull flag breakout projection 75.14% with a bold target of $3,600. ⏳ 2 years, 5 months, and 22 days later, the projection hit on 08/09/2025— the beautiful patience and the satisfaction of this hodl is overwhelming. Back in Q1–Q2 of 2023, many traders like day0 echoed the same view. This cart was posted on the TradingView Gold community room walls multiple time getting MODED🤑 which went on for months😉 "GOLD CARTEL" The journey was both technical and emotional — the "disciples of the (HODL) discipline" brought satisfaction as the chart aligned with macro reality. While I did take 10% profit at \$3,600 for validation of this projection, well the narrative isn’t over — now the charts point toward $4,000. 📈 The Timeline of Gold’s Rally 🔹March 18, 2023 – The Trigger Gold surged post the Silicon Valley Bank collapse and accelerated central bank buying, breaking decisively above $2,000/oz. 🔹 2024 – The Sustained Rally Through persistent inflation, geopolitical flashpoints, and a weakening dollar, gold extended gains. By year-end, it reached around $2,690/oz (+31%). 🔹 April 2025 – Breaching History Gold shattered the $3,500/oz barrier, fueled by " record central bank accumulation " 🪙 and " dollar fragility ", cementing its safe-haven role. 🔹 April 9, 2025 – The Spike The biggest daily jump since 2023, a 3% surge driven by bond sell-offs and safe-haven demand. 🔹 September 8, 2025 – The Mark of $3,600 Gold reached fresh record highs at $3,526/oz, supported by a weakening dollar, dovish Fed expectations, and global instability. The climax: $3,600 achieved — bulls eye 🎯. The Chart Came First (March 18, 2023) Gold was trading at $1,983. A bull flag breakout projection pointed to $3,600, based purely on technical structure — no headlines, no hindsight. “Gold’s journey from $1,983 to $3,600 wasn’t foretold by headlines — it was written in the charts first. Exactly — this is a textbook example of that famous trader’s maxim: "Show me the charts, and I’ll tell you the news.” (TA + Philosophy): When I first charted gold at $1,983 in March 2023, the bull flag projected a trajectory toward $3,600. At that time, there was no Silicon Valley Bank collapse, no April 2025 breakout, no Fed policy pivot — just a chart whispering its truth. Fast-forward 2 years, 5 months, and 22 days, every piece of “news” that followed — inflation spikes, central bank hoarding, bond sell-offs, dollar weakness — merely played its role as fuel for a path the chart had already mapped. This is the essence of market psychology: technical encode the collective positioning and pressure before fundamentals are written into the headlines. The gold move isn’t just about price — it’s about patience, conviction, and the timeless charting. "nerves of steel with a Rush of Gold✨" 💡 Reflection: The gold chart wasn’t predicting the exact news events (SVB collapse, Fed stance, dollar weakness). Instead, it revealed the underlying accumulation and pressure that would need some catalyst to unlock — and when those catalysts arrived, price delivered. So yes — this is a perfect case study of “show me the charts and I’ll tell you the news.” Thanks for reading, Thank you Trading View 🌟Note: This was never just a chart — it was a story of patience, macro forces, and market psychology converging. From $1,983 to $3,600, the bull flag wasn’t just a pattern, it was a prophecy. Now, as gold eyes $4,000, the question isn’t "if", but "when" Always DYOR, Trade Safely -See you on the other side- -Jova AAfter major Flag targets, Gold historically retraces 10–20% before consolidating.