Technical analysis by SroshMayi about Symbol PAXG: Buy recommendation (8/25/2025)

SroshMayi

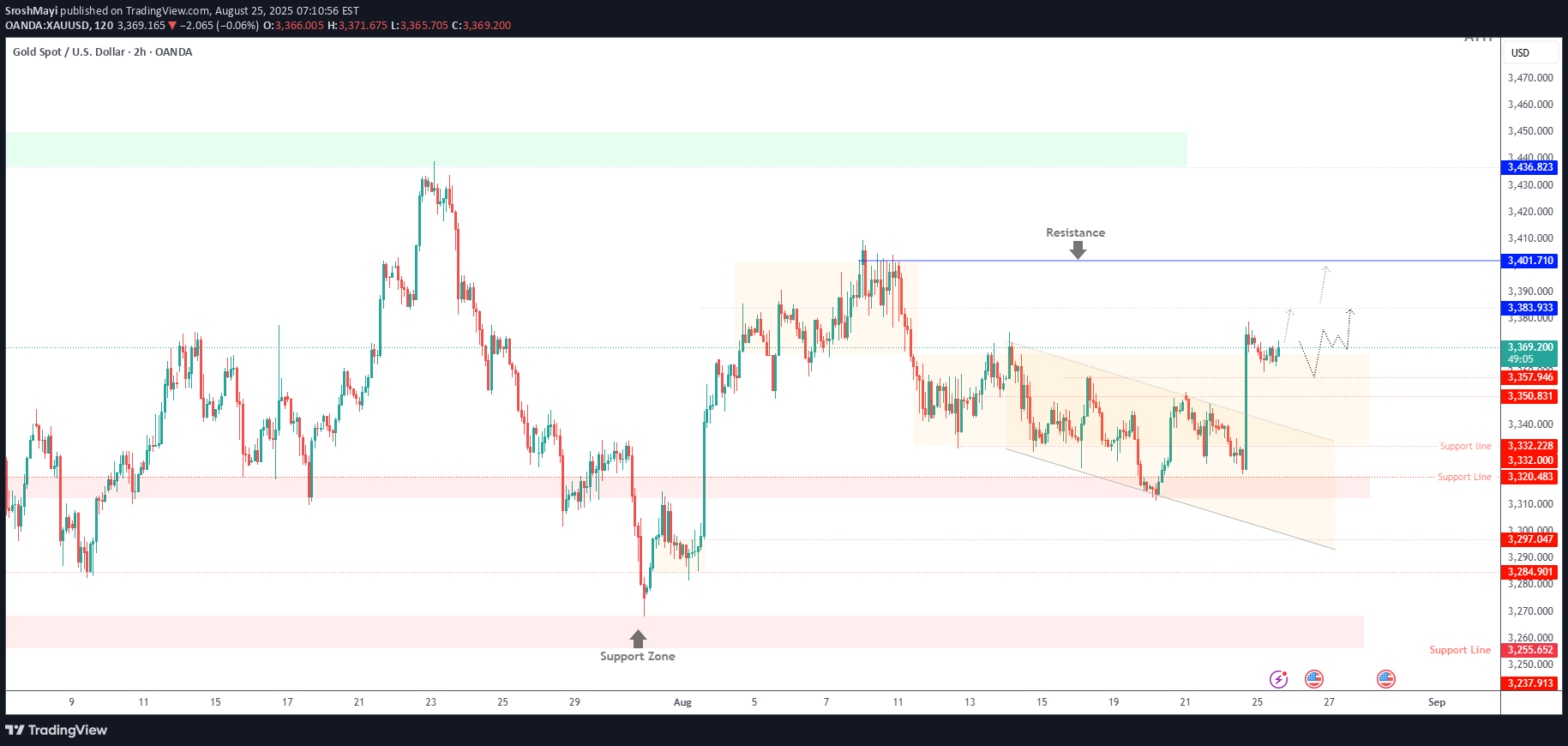

Gold (XAUUSD) – Overview Supported by Fed Cut Bets and Softer Data Outlook Gold remains well-supported as futures markets are now pricing in two 25bps Fed rate cuts by December. Fed Chair Jerome Powell has signaled rising risks to the labor market, even amid elevated inflation, suggesting the Fed may need to adjust its restrictive stance. This dovish bias continues to weigh on U.S. Treasury yields and supports gold. The upcoming U.S. GDP growth and PCE inflation data will be critical — softer readings could reinforce expectations of rate cuts and push gold higher. 🔹 Technical Outlook Gold is attempting to stabilize in the bullish zone. Stability above 3,366 keeps the upside open toward 3,383 and 3,401. If price stabilizes below 3,366, a correction toward 3,357 – 3,350 is likely. A confirmed break below 3,350 would shift bias bearish and expose deeper levels. 🔹 Key Levels Resistance: 3,383 – 3,401 Support: 3,357 – 3,350 – 3,343 ✅ Summary: Gold is consolidating near its pivot with Fed policy expectations providing a bullish backdrop. Holding above 3,366 favors further upside, while a break below 3,350 would signal weakness and invite a deeper correction.Gold Futures – Overview | Live Update Flat After Fed Jitters, But Bullish Backdrop Remains Gold futures pared earlier gains after President Trump announced the removal of Fed Governor Lisa Cook, triggering a selloff in the U.S. dollar and a safe-haven bid for gold. Prices have since normalized, though the broader backdrop remains supportive. Fed Chair Powell’s dovish Jackson Hole speech reinforced market expectations of near-term rate cuts, keeping gold’s medium-term outlook constructive. Lower interest rates typically boost demand for non-yielding bullion. 🔹 Technical Outlook Gold rallied over 300 points, perfectly reaching yesterday’s projected levels. Price still carries bullish pressure, aiming for 3,384. ✅ A 1H or 15M close above 3,384 would confirm continuation toward 3,401 → 3,412. ⚠️ Failure to break 3,384 would leave the market vulnerable to a pullback toward 3,372 → 3,364. Resistance: 3,384 – 3,401 – 3,412 Support: 3,364 – 3,350 ✅ Summary: Gold is consolidating near resistance after a strong rally. A breakout above 3,384 would extend the bullish momentum, while rejection at this level could trigger a short-term correction back toward 3,372 – 3,364.