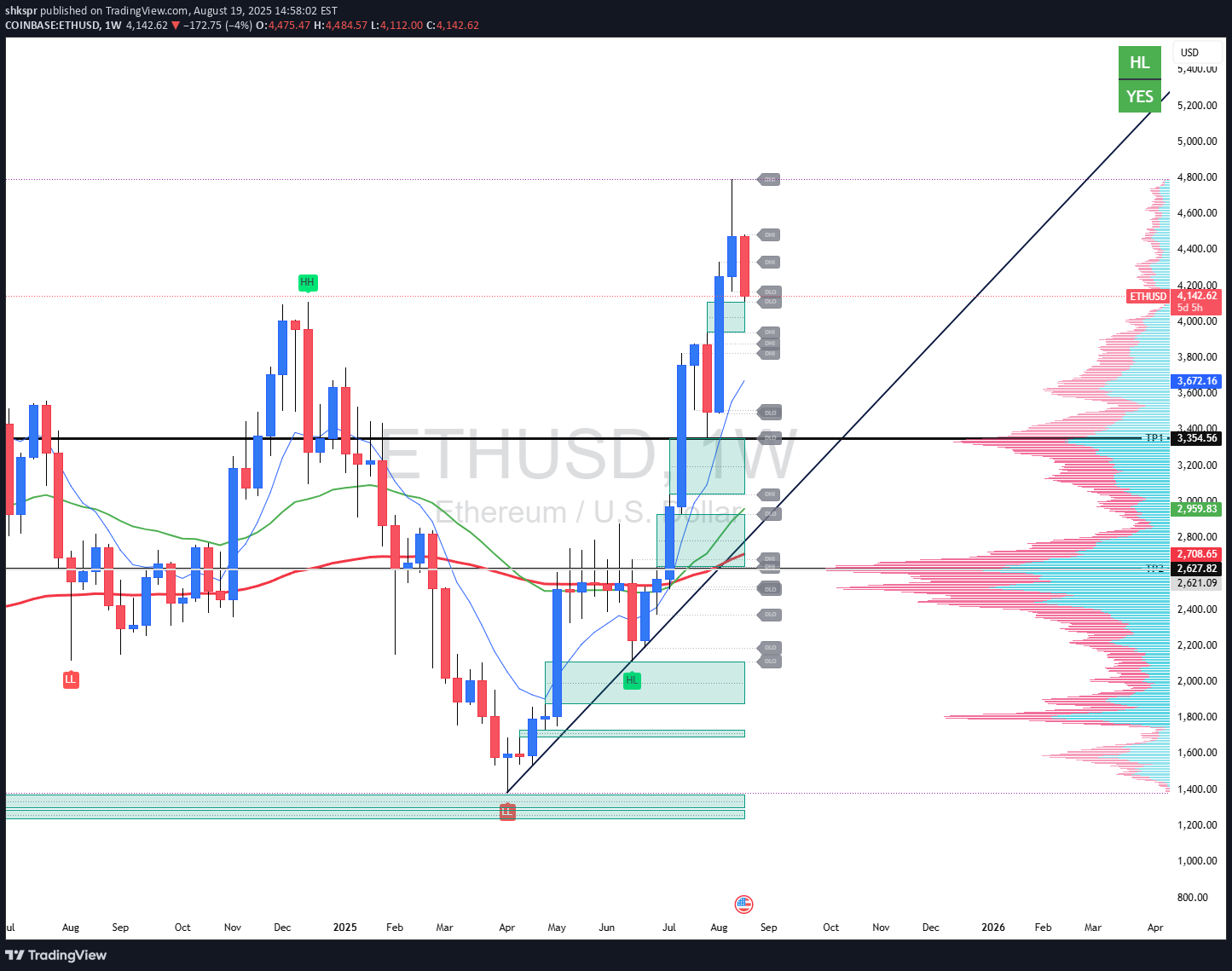

Technical analysis by shkspr about Symbol ETH: Sell recommendation (8/19/2025)

shkspr

Bearish | ETHUSD | Ethereum

ETHUSD ETHUSD Weekly – Pullback Risks After Strong Rally Trend Structure Ethereum printed a Higher High near 4,800 after an aggressive rally. The uptrend remains intact with a Higher Low base around 2,000, but short-term momentum is cooling. Current weekly candles show rejection near the highs with potential for retracement. EMA Context Price is extended above the 9 and 35 EMAs, suggesting overbought conditions. First dynamic supports sit around 3,470–3,350 (9 EMA zone + prior structure). The 100 EMA around 2,600–2,700 is a deeper corrective target if selling intensifies. Key Levels + Volume Profile TP1: 3,354 – major support, aligns with HVN and prior breakout zone. TP2: 2,960 – mid-volume shelf and structural pivot. TP3: 2,627–2,708 – strong support cluster with HVN and EMA confluence. Below 2,600, demand zones extend toward 2,000–1,800. Targets TP1: 3,354 TP2: 2,960 TP3: 2,627 Invalidation A close back above 4,600 would negate the bearish retracement thesis and open continuation toward new highs. Bias Near-term bearish/retracement, expecting ETH to test 3,354 and potentially 2,960–2,627 if weakness persists. Broader structure remains bullish unless 2,000 is lost.All Three targets hit