Technical analysis by BullBearInsights about Symbol NVDAX on 8/12/2025

BullBearInsights

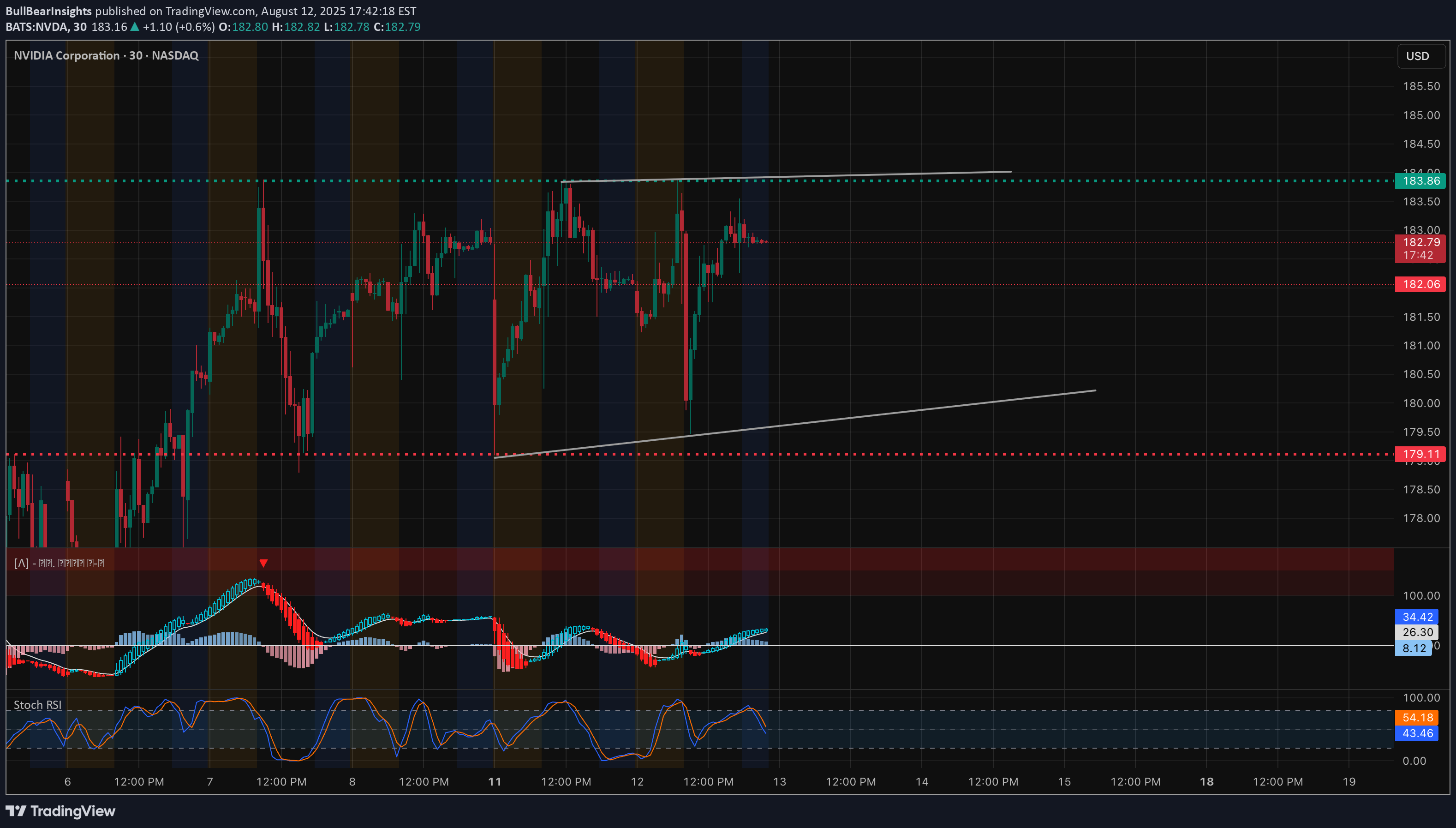

30-Minute Price Action NVDA is trading in a tight consolidation range near $183.86, repeatedly testing resistance without a confirmed breakout. * Resistance: $183.86 – multiple tests with no close above, forming the top of the range. * Support: $182.06 – intraday pivot; $179.11 – deeper support and prior demand zone. * Indicators: * MACD is flat, reflecting indecision and reduced momentum. * Stoch RSI is mid-range, suggesting room for either a breakout or a fade depending on market catalysts. 1-Hour GEX Insights * Highest Positive NET GEX / Gamma Wall: $183.86 – matches perfectly with 30m resistance, showing strong hedging activity. * Call Walls Above: $187.5 (2nd gamma wall), $190 (major call wall & 3rd gamma level). * Put Support: $177.5 (1st defense), $175 (stronger floor), $172.5 (secondary gamma floor). * IVR: 16.2 – relatively low implied volatility rank, keeping long option premiums reasonable. TA + GEX Combined Read The 30m chart’s repeated tests of $183.86 line up exactly with the largest GEX wall on the 1h chart. * A breakout above $183.86 could trigger gamma-driven momentum into $187.5 and potentially $190 if volume supports. * A rejection at $183.86 could bring a retest of $182.06, and if that fails, a move toward $179.11 and $177.5 GEX support. Trading Scenarios for August 13 * Bullish Breakout: Long calls or debit spreads above $184 targeting $187.5–$190. * Bearish Rejection: Puts or put spreads if $183.86 rejects and $182.06 breaks, targeting $179.11–$177.5. * Neutral Range: Credit spreads between $179–$184 may work if consolidation continues, but be ready to close early on breakout. Reasoning The 30m chart’s tight range reflects market indecision, but the 1h GEX data highlights $183.86 as a key pivot for tomorrow. Breaks above this level open the path to the next gamma cluster, while rejection keeps NVDA in range or triggers a pullback toward strong GEX-supported floors.