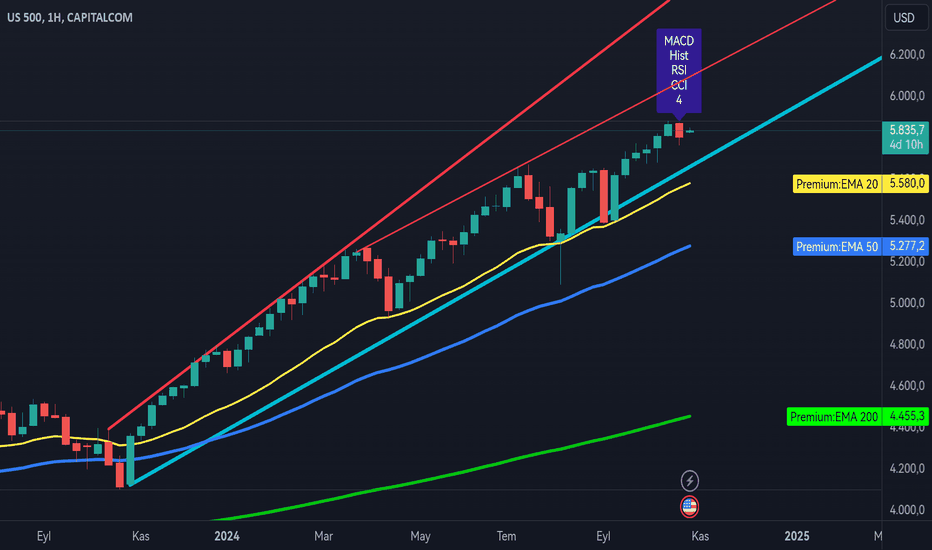

Technical analysis by BrankoPetruci about Symbol SPYX on 10/28/2024

BrankoPetruci

Portföy Yönetiminin Bazı Yöntemleri - 1

Hello Friends! For some reason, I wanted to touch on some points of making a portfolio, in my own way 😄 It is a good habit to regularly check and balance your portfolio after making one. 🔸Rebalancing allows you to maintain the risk and return balance you target by readjusting the weights of different asset classes in your portfolio at certain intervals. This habit helps you keep the ratio of each asset class in your portfolio up to date, especially in long-term investments, according to changing market conditions and the value gain/loss of investments. For example, a balancing strategy in a defensive and long-term portfolio can be as follows: 1. Determining Portfolio Allocation TargetsFirst, it would be a good idea to determine the weight you target for each asset class in your portfolio in the long term. For example:-Gold: 20-25%-US Stock Exchange Shares: 30-40%-Turkish Stocks: 10-15%-BES and Turkish Lira Assets: 10-20%-Foreign Exchange (Dollar Based Dividend): 5-10%These weights can be relaxed according to your risk tolerance and return expectations.2. Annual or Semi-Annual RebalancingYou can review your portfolio annually or every six months and compare the ratio of each asset class in the portfolio with the intervals you target. For example, if US stocks have yielded a return above your target, the ratio of your US stock market investments may have increased. So in this case, I can do the following: 🔹Balancing Between the US Stock Exchange and Foreign Exchange Accumulation: Instead of overloading the US stock exchange, keep new dividend incomes in foreign exchange or direct them to undervalued assets (e.g. Turkish stocks), 🔸Balancing Between Gold and BES: If the value of gold has increased, direct your new savings to BES or Turkish lira investments. 3. Using New Investments in the Portfolio Instead of selling existing assets for balancing, you can use newly incoming funds (gifts, coupon incomes, dividends, etc.) to provide balance. For example, if there is an overload in the US stock exchange, you can balance the share in the US stock exchange by shifting your new coupon or dividend incomes to other areas. 4. Flexibility According to Market Conditions If there are serious changes in economic or political conditions, such as the turbulences we have experienced in the last 3 years, you can flex the balancing rates in the short term. For example, if the depreciation in TL accelerates, it may be logical to reduce your BES and Turkish Lira assets and turn to foreign exchange or gold. 5. Maintaining the Long-Term View🔸During the balancing process, it is important to remain loyal to your targeted long-term investment strategy without being caught up in the concerns brought on by short-term fluctuations.🔹With the balancing process, you can protect your portfolio from excessive risk and increase the chance of reaching your long-term growth target. When implementing this strategy, it will be sufficient to review your portfolio once or twice a year and make adjustments according to the target distribution. Stay healthy 🙋