Technical analysis by Xayah_trading about Symbol PAXG: Buy recommendation (7/18/2025)

Xayah_trading

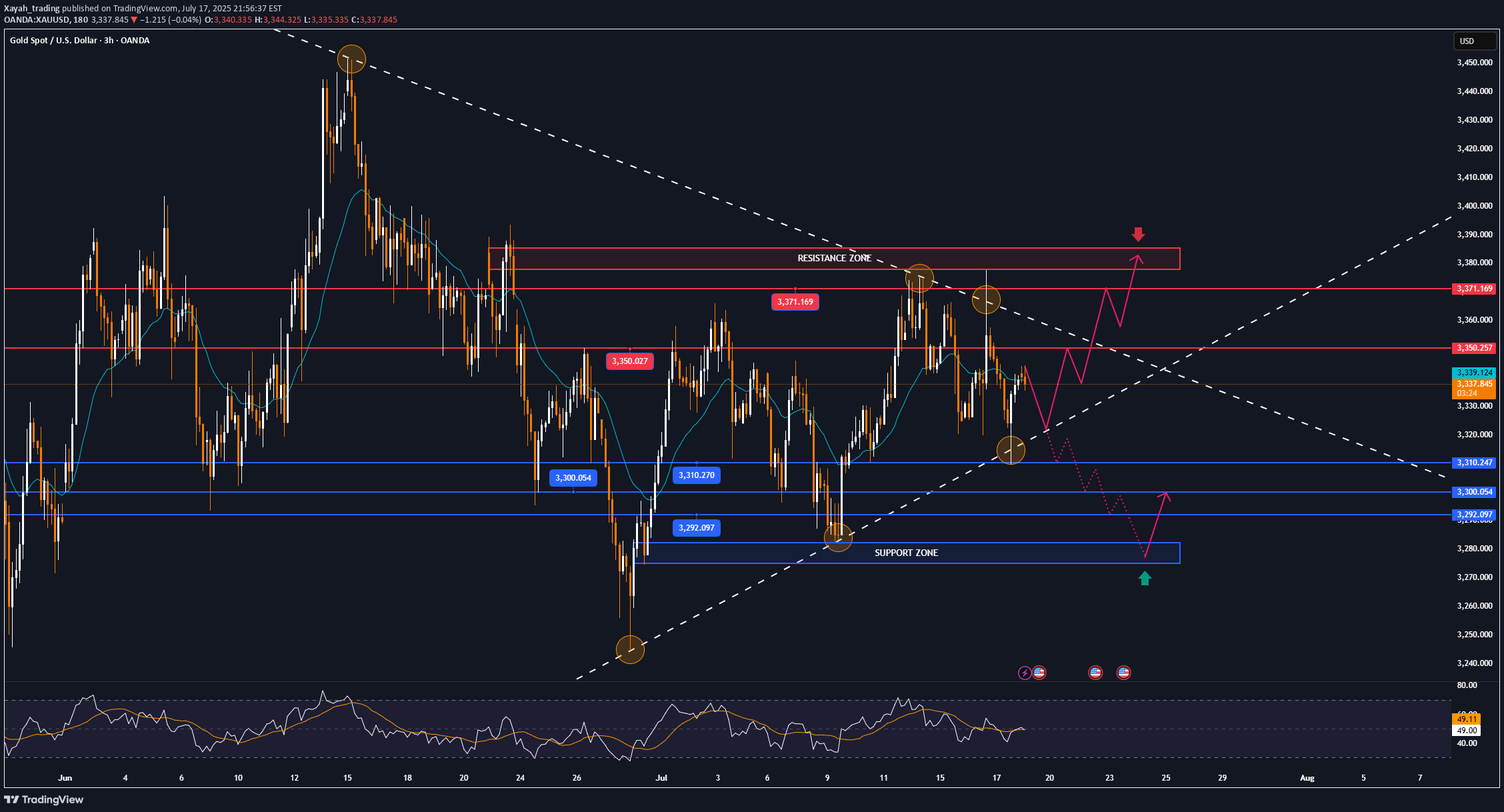

International XAUUSD fell to the support level of 3,310 USD, then recovered and continued to stabilize sideways due to the stronger US Dollar and market tensions eased after US President Trump said it was "extremely unlikely" to fire Federal Reserve Chairman Powell. As of the time of writing, spot XAUUSD was trading at 3,339 USD/oz. Reuters reported on Wednesday that Trump is still open to the possibility of firing Powell. However, Trump said on Wednesday that he has no intention of firing Powell at this time, but did not completely rule out the possibility and reiterated his criticism of the Fed chairman for not lowering interest rates. Data showed US producer prices unexpectedly held steady in June, as the impact of higher import tariffs on goods was offset by weakness in the services sector. The unchanged US PPI in June showed wholesale prices were stabilising, suggesting the economic impact of tariffs may be smaller than initially feared. The lower-than-expected core CPI and core PPI data did not provide the boost that was expected, which could mean that the market is focusing on other aspects. More broadly, as the Fed gradually eases policy, real yields could continue to fall, and gold will maintain its upward trend. However, if the market continues to reprice expectations for a hawkish rate cut, this could trigger a short-term correction. SPDR Gold Trust, the world's largest gold-backed exchange-traded fund (ETF), said its holdings rose 0.33% to 950.79 tonnes on Wednesday from 947.64 tonnes in the previous session. Technical Outlook Analysis XAUUSD On the daily chart, gold rebounded after falling and tested the support level noted by readers in yesterday's edition at 3,310 USD. The recovery brought gold prices back to work around the EMA21, continuing the sideways accumulation trend. Structurally there is no change, as for gold to qualify for an upside move it needs to break resistance at the 0.236% Fibonacci retracement level then the short term target is the raw price point of $3,400. Meanwhile for gold to complete its bearish cycle it needs to sell below the 0.382% Fibonacci retracement level then the short term target would be around $3,246, more than the 0.50% Fibonacci retracement level. The relative strength index (RSI) is also unchanged with the RSI activity around 50, indicating a hesitant market sentiment without leaning towards any particular trend. Intraday, the technical outlook for gold prices continues to be a sideways accumulation trend, and the notable positions will be listed as follows. Support: 3,310 – 3,300 – 3,292 USD Resistance: 3,350 – 3,371 USD SELL XAUUSD PRICE 3386 - 3384⚡️ ↠↠ Stop Loss 3390 →Take Profit 1 3378 ↨ →Take Profit 2 3372 BUY XAUUSD PRICE 3276 - 3278⚡️ ↠↠ Stop Loss 3272 →Take Profit 1 3284 ↨ →Take Profit 2 3290