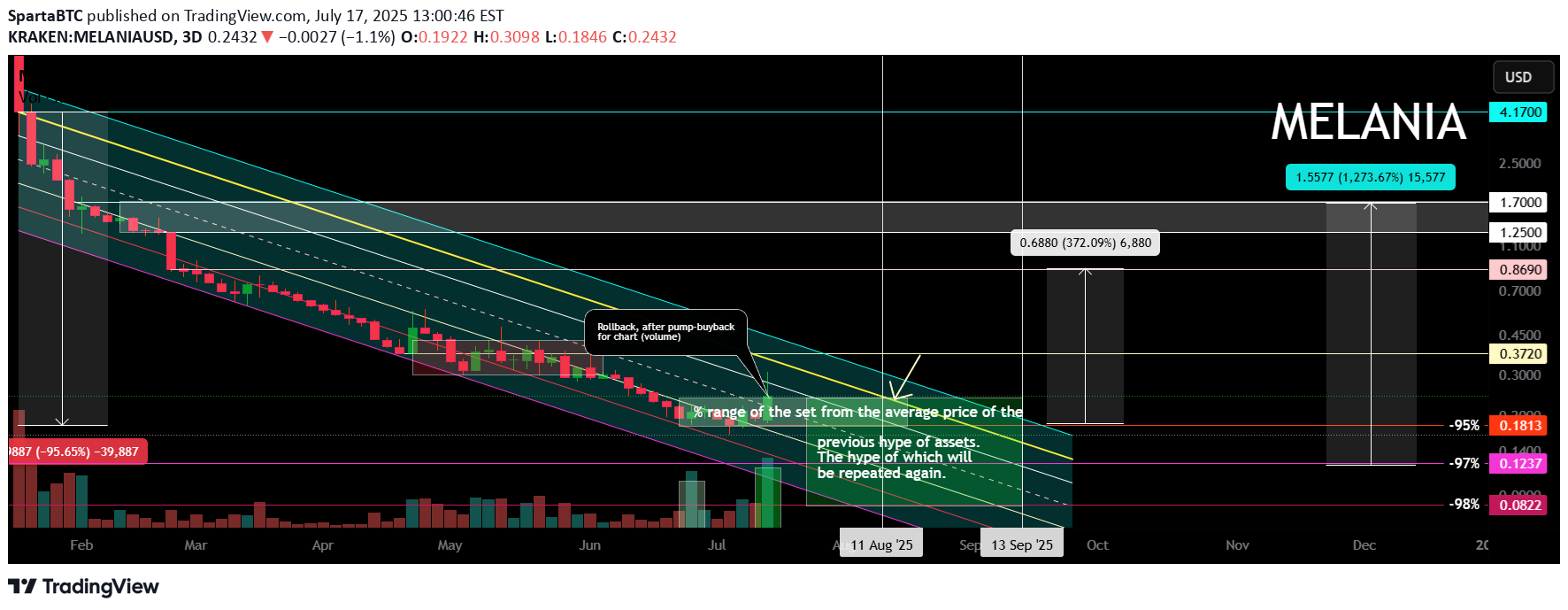

Technical analysis by SpartaBTC about Symbol MELANIA: Buy recommendation (7/17/2025)

SpartaBTC

MELANIA Main Trend. Memes with high hype and risk. July 17, 2025

Main trend. Time frame 3 days (less is not necessary). Showed conditional levels (zones near them), and percentages of decrease from the maximum (note, I showed from the zone where the main retail of “affected investors” began to connect, that is, the maximum is much lower than on the chart). Note that now a conditionally large volume “enters”, it is displayed on the price chart (this is important), a sideways squeeze has begun. Local impulse and rollback are now in the moment. Also showed a large % (intentionally) for orientation, from minimum to maximum zones. On such hype assets, as a rule, medium-term - long-term holding (bought in the right zone) shows significant income. All level zones are conditional, due to liquidity, but the price will most likely “play” after the breakdown of the downward trend in this range, another alt season (which many do not notice due to the slow breakdown of their opinions, news chaff, and inadequate goals). As for me, above these huge % (resistance zone, or up to 0.869, so as not to waste time), you should get rid of this meme, or its % from the previous position should already be minimal (5-10%). There are hype zones, there are zones of potential gain (fading hype, interest, and a large % from the maximums). On such assets of "manual trading", where cryptocurrency has no value, it is always sold little by little (many do not understand this), but in order to sell, you sometimes need to make interest, and "instill hope" in previously deceived "investors" who want to get out at least at a loss (it is unlikely to happen). At the right time, 1-2 tweets - statements from the "powers that be" - are pumped up due to low liquidity by a huge percentage. On such cryptocurrencies, you do not need to guess the “bottom” or maximums. Pricing is formed differently here, as there is no real supply/demand, utility, but only psychology and "hitting the jackpot" of gambling addicts. Be smarter. Diversify such assets, distribute the risk in advance. Make purchases/sales according to plan, without emotions. When the price goes up, you think it will go much higher, but even if it does, you must sell a certain volume in certain planned zones, without any emotions or sense of lost profit. Similarly, when the price goes down, people are driven by fear and refuse to buy, and these were probably the minimums of fear. The average price of the set and reset is important. No minimums and maximums are needed. Be patient and consistent in your actions and plans.21 07 2025 very local "trump's wife-pump".November 19, 2025 the price is in the capitulation zone (under the conditional accumulation channel, meaning that they always sell "without loading the order book"), with large volume buybacks. To continue selling, you need to generate interest and restore hope, meaning volatility and pumps. Perhaps an exit from this zone. If this happens, then, as a rule, with such assets with such low liquidity and a huge connection to "dumb money" traffic (millions and hundreds of thousands of Twitter followers), the price is reduced by a large percentage, but the chart still roughly follows logic. How to adhere to money management and what trading tactics to use on such useless hyped cryptocurrencies has been written about many times before, so I won't repeat myself. Those who have intelligence will hear, those who don’t, as always.