Technical analysis by Xayah_trading about Symbol PAXG: Buy recommendation (7/17/2025)

Xayah_trading

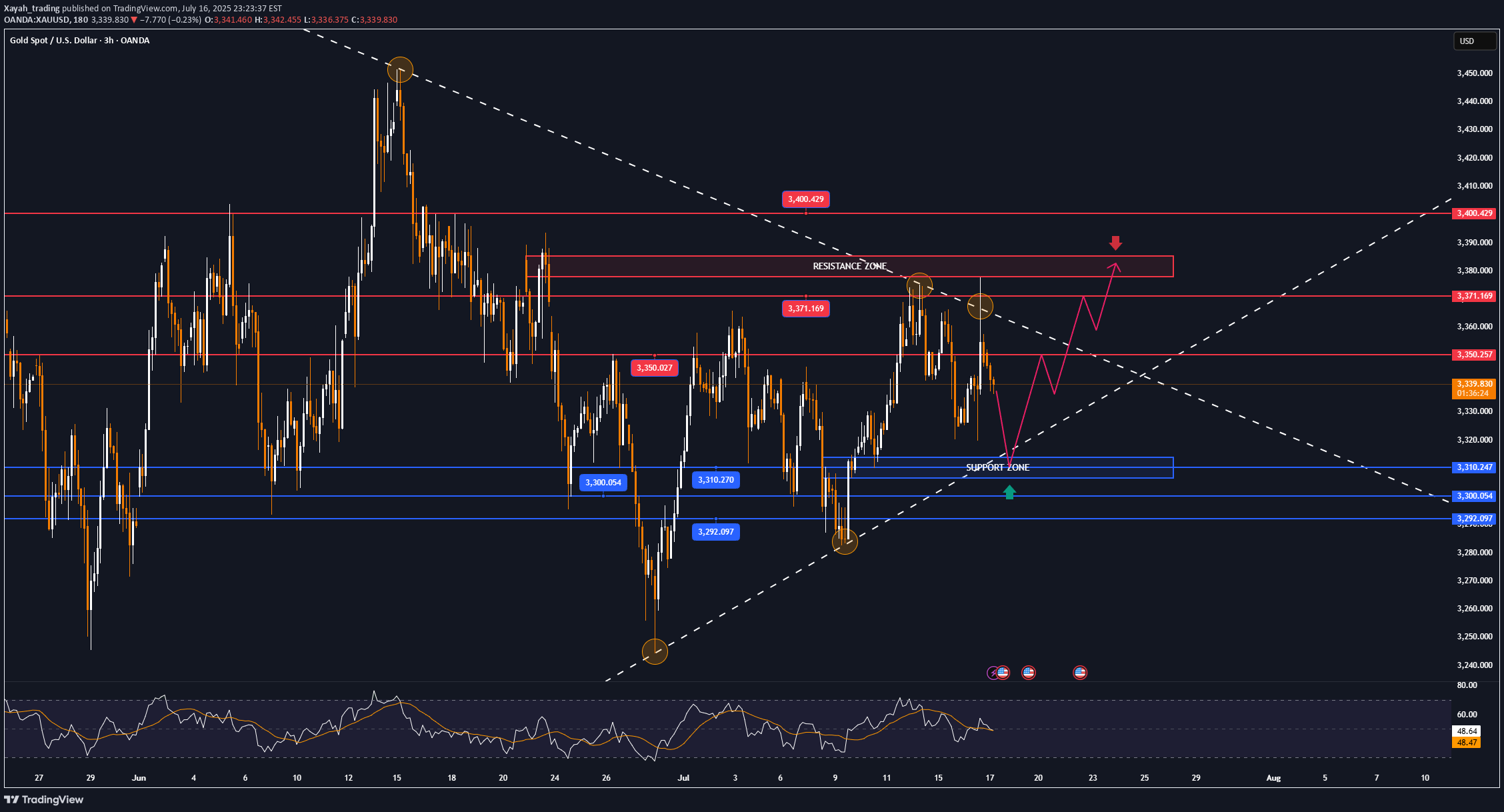

XAUUSD is still trading in a narrowing range, affected by the tariff game and the political drama that Trump is building. Currently, the price of gold is trading around 3,339 USD/oz, equivalent to a small decrease of about 7 dollars on the day. Tariff Game On July 16, US President Donald Trump announced that he would send letters to more than 150 countries, with tariffs expected to be 10% or 15%, to promote trade. He said these countries are not major US partners and will be treated equally, but left open the possibility of negotiating exemptions. The tariffs are similar to those proposed in April but were postponed due to concerns about market volatility. The resumption of the tariffs continues to destabilize financial markets and surprised partners such as the European Union, as they hoped to reach an early agreement with the US. Political Play Also on July 16, global financial markets were shaken by rumors that President Trump intended to fire Federal Reserve Chairman Jerome Powell. Many major news agencies such as the New York Times, Bloomberg and Reuters reported that Trump had prepared a letter of dismissal and consulted with Republican lawmakers, receiving positive feedback. Removing Powell before his term was believed to undermine confidence in the US financial system and the safe haven status of the USD. Trump later denied the plan, saying it was unlikely to happen unless there was serious wrongdoing. Markets reacted strongly: the USD fell and then recovered after Trump's statement, while gold lost most of its previous gains by the end of the session. The gold market in particular, and the financial economy in general, are being affected by the activities of Trump, the creator of the global trade war, and the plays of Trump and the FED leading the market. Therefore, the basic formula in the current market context is best to follow Trump, and make sure not to miss any of Trump's status lines. Technical outlook analysis of XAUUSD On the daily chart, the technical structure has not changed with the trend not yet clear and the price action clinging to the EMA21. The technical conditions do not favor an uptrend or a downtrend, typically the RSI moves around the 50 level, indicating a hesitant market sentiment. On the upside, gold needs to achieve the condition of breaking above the 0.236% Fibonacci retracement level of the price point of 3,371 USD then the target level will be around 3,400 USD in the short term, more than 3,430 USD. Meanwhile, on the downside, gold needs to break below the 0.382% Fibonacci retracement, which would confirm a loss of the $3,300 level, then target around $3,246 in the short term, more than the 0.50% Fibonacci retracement. Intraday, the sideways trend of gold price accumulation will be noticed by the following technical positions. Support: $3,310 – $3,300 – $3,292 Resistance: $3,350 – $3,371 – $3,400 SELL XAUUSD PRICE 3381 - 3379⚡️ ↠↠ Stop Loss 3385 →Take Profit 1 3373 ↨ →Take Profit 2 3387 BUY XAUUSD PRICE 3309 - 3311⚡️ ↠↠ Stop Loss 3305 →Take Profit 1 3317 ↨ →Take Profit 2 3323🔴Spot gold lost the $3,330/ounce mark, down 0.53% on the day.Plan BUY Hit Full TP2 + 130pips🤕🤕🤕. Congratulations everyone