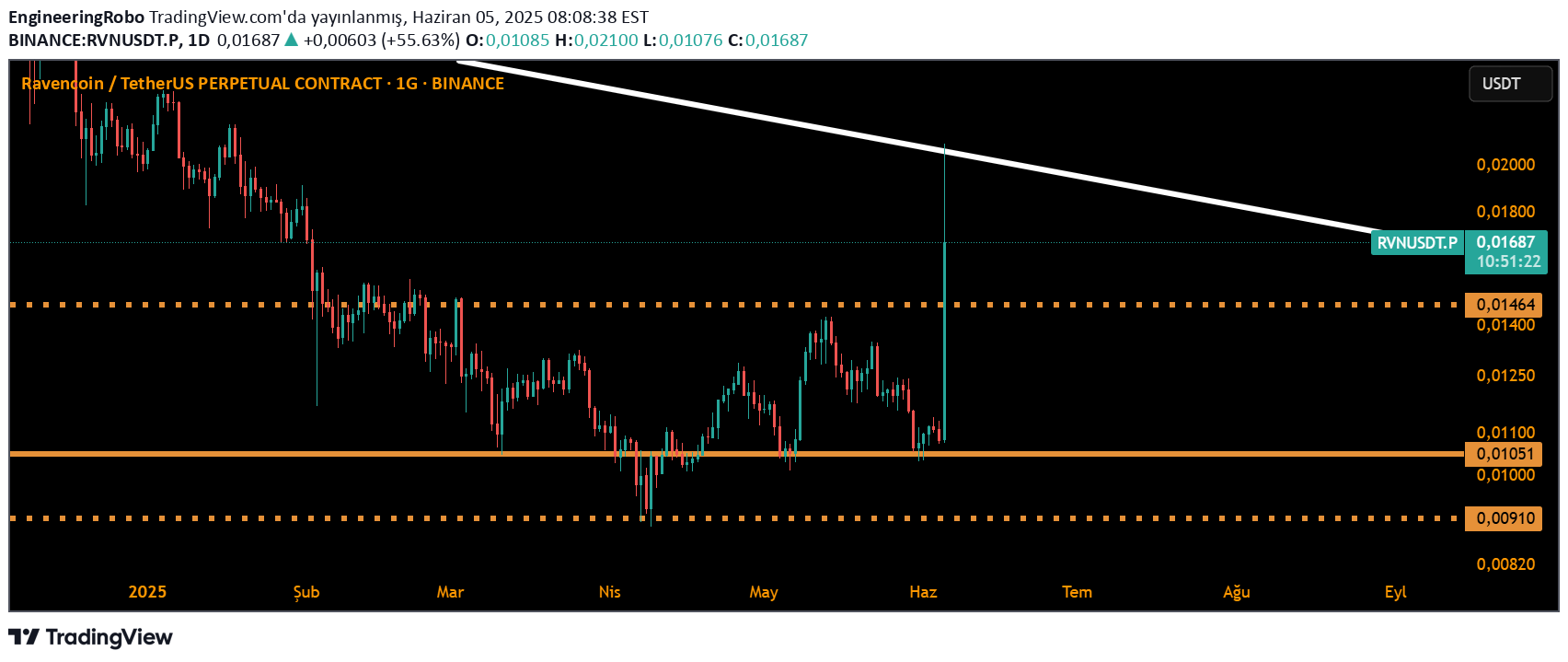

Technical analysis by EngineeringRobo about Symbol RVN on 6/5/2025

IS ALGOTRADING THE FUTURE OF CRYPTO TRADING?Algorithmic trading, or algo trading, has been around for decades andit has been one of the most effective trading strategies for traditionalmarkets like stocks and forex. In the next decade, many studies predictthat artificial intelligence and algorithmic trading will grow fromunder $6 billion in 2022 to over $64 billion by 2030. There are over150 algorithmic trading robots available all over the world, and moreare being developed every year.Nowadays, algorithmic trading has also become very popular amongcrypto traders because of its effectiveness and flexibility in terms ofrisk management as well as scalability. Algorithmic trading can beuseful in the fast-paced and volatile world of cryptocurrency tradingfor a number of reasons. For one, it can help traders execute tradesmore quickly and efficiently than they could manually search forpotential trades on charting platforms. This can be particularly usefulin a market like crypto, where prices can fluctuate rapidly andopportunistic trading opportunities can arise and disappear in a matterof hours.Additionally, algorithmic trading can also help traders manage theirrisks more effectively. By using algorithms to automatically monitorand manage their positions, traders can set specific rules andparameters for their trades, such as stop-loss orders that automaticallyclose a trade if it reaches a certain level of loss. This can help traderslimit their losses and avoid making rash, emotional decisions in theheat of the moment.Furthermore, algorithmic trading can be more objective and less proneto human error than manual trading. Because algorithms are designedto execute trades based on predetermined rules and criteria, they can avoid the biases and emotional responses that can sometimes affecthuman traders. This can help traders make more rational and informeddecisions, potentially leading to more successful trades.Overall, algo trading can help traders in the crypto market executetrades more efficiently, implement more sophisticated tradingstrategies, and manage their risks more effectively.