SUSHI

SushiSwap

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of SushiSwap

سود 3 Months :

خلاصه سیگنالهای SushiSwap

سیگنالهای SushiSwap

Filter

Sort messages by

Trader Type

Time Frame

mastercrypto2020

سیگنال خرید قوی: فرصت پولسازی با ارز دیجیتال SUSHI/USDT (اهداف مشخص)

--- 📢 Official Trade Signal – SUSHI/USDT 📈 Position Type: LONG 💰 Entry Price: 0.4020 --- 🎯 Take-Profit Targets (Partial Exits): TP1 = 0.4126 TP2 = 0.4251 TP3 = 0.4349 TP4 = 0.4456 TP5 = — --- 🛑 Stop-Loss: 0.3945 📊 Timeframe: 15m ⚖️ Risk/Reward Ratio: 3.68 💥 Suggested Leverage: 5× – 10× --- 🧠 Technical Context SUSHI is bouncing strongly from a short-term demand zone around 0.4000, showing early bullish momentum. Market structure shift plus liquidity gaps above align with the upside targets, supporting continuation to the next resistance levels. --- ⚙️ Trade Management Rules ✔️ Take partial profit at TP1 ✔️ Move SL to Break-Even as soon as TP1 is hit ✔️ Trail SL gradually as price moves toward TP2–TP4 ✔️ Avoid re-entry if SL is triggered ✔️ Confirm structure before execution --- ⚠️ Risk-Management Note If TP1 is reached and SL moves to BE, a later stop-out at break-even is not a loss — it means zero risk. Capital protection always comes first. --- 📌 TradingView Hashtags #SUSHIUSDT #SUSHI #CryptoSignal #LongSetup #TechnicalAnalysis #TradingView #FuturesTrading #Altcoins ---

mastercrypto2020

سیگنال خرید قوی SUSHI/USDT: هدف سود باورنکردنی با مدیریت ریسک حرفهای!

--- SUSHI/USDT — Long Setup Entry 0.4785 Take-Profit Targets TP1: 0.4855 TP2: 0.4944 TP3: 0.5044 TP4: 0.5180 Stop-Loss 0.4600 Risk/Reward 2.20 Leverage Suggestion 5× – 10× --- Technical Outlook Price is holding above the short-term support zone around 0.47, showing early signs of bullish momentum. A break and close above 0.4850 can trigger continuation toward the mid-range resistance levels at 0.494–0.504. Volume remains stable and RSI is gradually turning upward, supporting a potential bullish move. --- Trade Management Take partial profit at TP1 and move stop-loss to break-even. Use a trailing stop for higher targets. Invalidation occurs if price closes below 0.4600. --- Hashtags (TradingView-friendly) #SUSHIUSDT #CryptoTrading #TradingSignal #Altcoins #TechnicalAnalysis #Futures ---

mastercrypto2020

سیگنال خرید قوی سوشی (SUSHI/USDT): فرصت افزایش قیمت با ریسک مدیریتشده!

--- 📢 Trade Idea: SUSHI/USDT Type: Long Entry Price: 0.4693 🎯 Take-Profit Targets: • TP1 = 0.4835 • TP2 = 0.4964 • TP3 = 0.5125 🛑 Stop-Loss: 0.4600 ⏱ Timeframe: 1H ⚖️ Risk/Reward Ratio: 4.85 💥 Suggested Leverage (if applicable): 5x–10x --- Technical Analysis: SUSHI has formed a solid bullish reversal structure near the 0.46 support zone, showing accumulation signs after a period of consolidation. A breakout above 0.47 confirms short-term strength, targeting 0.4835 and 0.50 levels as immediate resistance points. RSI recovery from oversold and bullish EMA alignment indicate increasing momentum toward 0.51+. --- Trade Management Tips: • Take partial profits at each TP. • Move SL to entry after TP1. • Setup invalid if price closes below 0.46 on the 1H timeframe. --- ⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always DYOR and apply proper risk management before trading. --- 📌 Hashtags for TradingView: #SUSHIUSDT #CryptoSignals #LongSetup #TechnicalAnalysis #CryptoTrading #TradingViewIdea #SUSHI

mypostsareNotFinancialAdvice

سوشی لیست شد؛ خیزشی بزرگ در برابر ریپل (نظر مالی نیست!)

Coinbase listed Bullish vs XRP Let's go Not financial advice

mastercrypto2020

سیگنال خرید فوری سوشی (SUSHI): مسیر صعودی تا ۰.۶۰ با اهرم ۵ تا ۱۰ برابر!

--- 📢 Signal Alert 🔹 Pair: SUSHI / USDT 📈 Trade Type: Long 💰 Entry Zone: 0.4950 – 0.5077 🎯 Take-Profit Targets (Partial Management): ▫️ TP1 = 0.5300 ▫️ TP2 = 0.5500 ▫️ TP3 = 0.5770 ▫️ TP4 = 0.6050 🛑 Stop-Loss: 0.4800 📊 Timeframe: 1H ⚖️ Risk/Reward Ratio: 3.83 📌 Suggested Leverage: 5x – 10x ⚠️ Capital management is mandatory. 💬 Please review the chart before entering the trade. --- 🧠 Technical Analysis Summary: SUSHI is showing bullish accumulation near the support zone 0.49–0.50, with an increase in buying volume. The RSI is recovering from the oversold area, confirming a potential momentum reversal. If the price holds above 0.505, a move toward 0.55–0.60 resistance is expected. Short-term EMAs (20 & 50) are aligning for a bullish crossover, signaling early trend recovery. --- ⚙️ Trade Management Tip: When TP1 is reached, move stop-loss to entry. Gradually secure profits at each TP level — let the remaining position ride with a trailing stop for potential extended gains. --- ⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always DYOR (Do Your Own Research) and apply strict risk management. ---

mastercrypto2020

سیگنال خرید قوی SUSHI/USDT: ورود مطمئن با اهداف سوددهی بالا!

--- 📢 Signal Alert 🔹 Pair: SUSHI / USDT 📈 Trade Type: Long 💰 Entry: 0.5050 – 0.4890 🎯 Take-Profit Targets (Partial Management): ▫️ TP1 = 0.5170 ▫️ TP2 = 0.5318 ▫️ TP3 = 0.5590 ▫️ TP4 = 0.5850 🛑 Stop-Loss: 0.4835 📊 Timeframe: 1H ⚖️ Risk/Reward Ratio: 3.00 📌 Suggested Leverage: 5x – 10x ⚠️ Capital management is mandatory. 💬 Please review the chart before entering the trade. --- 🧠 Technical Analysis Summary: SUSHI is forming a bullish structure above key support near 0.49, with strong buying volume confirmation. A breakout above 0.517 could push price toward 0.55 – 0.58 resistance zone. RSI is crossing upward from the midline, and price is holding above EMA 20 on the 1H chart — both confirming bullish momentum. --- ⚙️ Trade Management Tip: Take partial profit at TP1, then move stop-loss to entry. Trail stop toward TP2–TP3 to secure gains. Avoid re-entry if price closes below 0.4835. --- ⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always DYOR (Do Your Own Research) and apply strict risk management.

Cryptojobs

davidjulien369

راز موفقیت در ترید بلندمدت: استراتژی خرید SUSHI با ریسک به ریوارد ۱۱ به ۱

📘 Trade Journal Entry Pair: SUSHIUSDT.P Direction: Buy-Side Trade Date: Sat 1 Nov 25 Time: 6:30 am Session: LND to NY Session PM Timeframe: 15 Min 🔹 Trade Details Metric Value Entry 0.5094 Profit Level (TP)0.5846 (+15.28 %) Stop Level (SL) 0.5041 (–1.38 %) Risk–Reward (RR)11.07 R 🔸 Technical Context Structure: Price completed a clear re-accumulation phase after a multi-session decline. The CHOCH → BOS sequence on the 15 m timeframe confirmed bullish intent. Liquidity sweep beneath 0.50 zone (prior Asian lows) provided the displacement and smart-money entry. Key Zones: Demand Zone: 0.497 – 0.501 (previous breaker block + FVG mitigation). Target Zone: 0.580 – 0.585 (previous London/NY liquidity high cluster). Adaptive MA (KAMA): Now curling upward, acting as dynamic support. Volume Profile: Volume expansion noted during London open; follow-through in NY confirms participation from larger players after mid-week compression. 🔹 Narrative & Bias SUSHI formed a clean spring + retest pattern within the accumulation base, suggesting strong buy-side intent. The entry coincided with a liquidity sweep and rejection from demand confluence, triggering a structural breakout above the 0.51 handle. Confluences: 15 m CHOCH + BOS confirmation. 4 h FVG alignment and daily order-block support. Volume divergence → bullish reversal confirmation. KAMA support + London–NY session continuation. Projection: Expect sustained continuation toward 0.58–0.59 zone, potentially extending into 0.61–0.62 if volume persists through NY close. Partial profits ideal near 1.618 extension (~0.575) before evaluating re-entry opportunities.

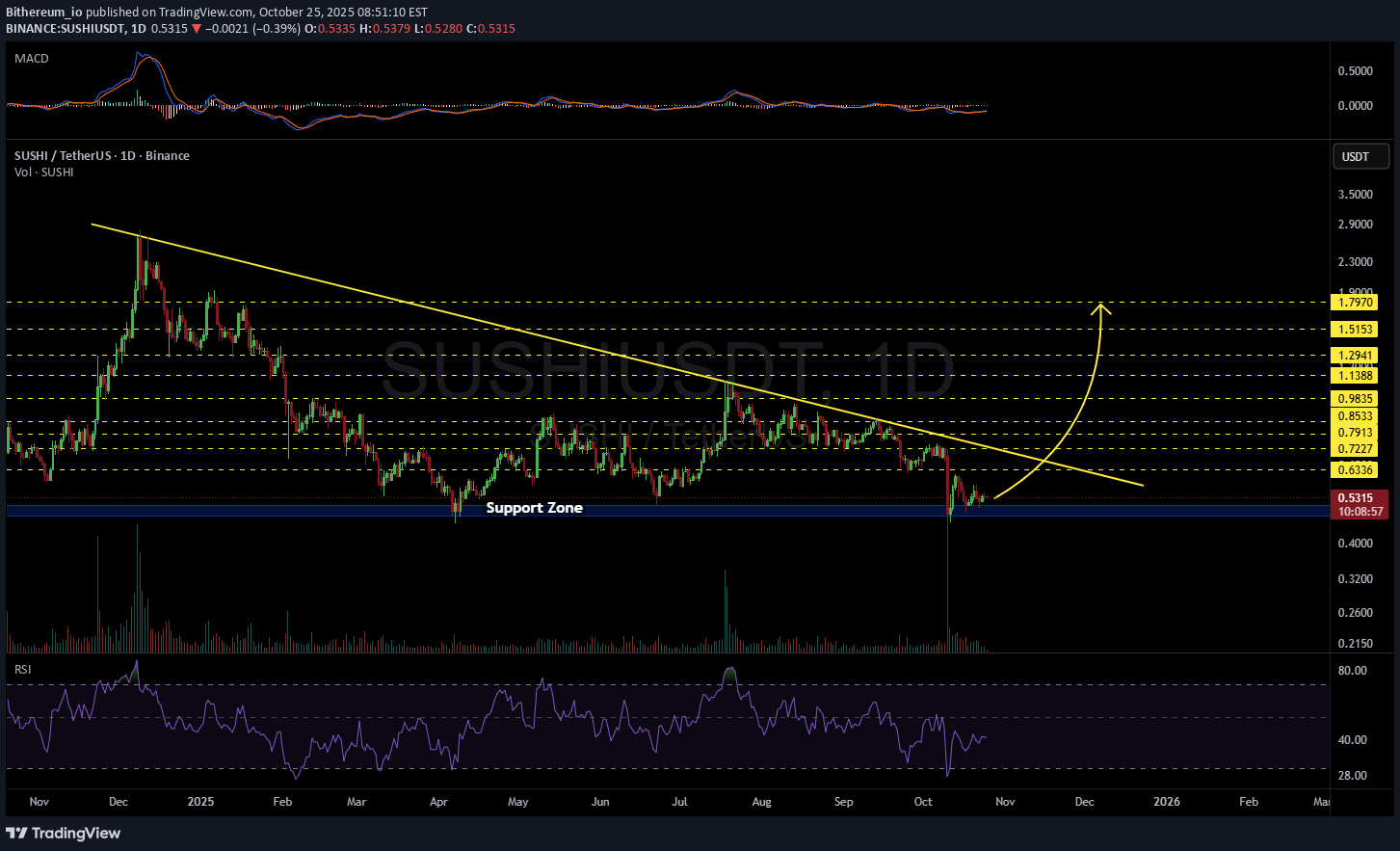

Bithereum_io

سوشی (SUSHI) در آستانه انفجار صعودی؟ سطوح حمایت کلیدی و اهداف قیمتی هیجانانگیز!

#SUSHI is moving inside a descending triangle on the daily chart and is currently sitting on a strong support zone, from which an upward move is expected. If that happens, the potential targets are: 🎯 $0.6336 🎯 $0.7227 🎯 $0.7913 🎯 $0.8533 🎯 $0.9835 🎯 $1.1388 🎯 $1.2941 🎯 $1.5153 🎯 $1.7970 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

CryptoNuclear

سوشی (SUSHI): آیا این حمایت تاریخی آخرین شانس صعود است یا سقوط آزاد؟

SUSHI has returned to its major historical support zone between 0.553 – 0.44 USDT, an area that has held firm since 2022. Each time price has entered this block, the market has shown signs of a relief bounce and potential accumulation — but the more a level is tested, the weaker it tends to become. Since its 2021 peak, SUSHI has remained in a long-term downtrend, forming consistent lower highs and lower lows. However, the presence of deep long wicks beneath the current range indicates liquidity sweeps — a classic signature of hidden accumulation by strong hands preparing for a potential reversal. --- 📊 Pattern & Structure Primary trend: Long-term downtrend (bearish structure) Major Support Zone (yellow block): 0.553 – 0.44 USDT Potential Pattern: Double Bottom or Spring Phase (if the price rebounds strongly from this zone) Key Resistance Levels (target zones): 1.0017 1.4129 1.7897 2.7216 4.8626 --- Bullish Scenario Price holds the yellow block and rejects any breakdown below 0.44. A strong confirmation would come from a weekly close above 0.553 with rising volume. Formation of a higher low would signal the start of structural reversal. A decisive breakout and weekly close above 1.00 USDT would confirm a major trend shift. Gradual bullish targets: 1.00 → 1.41 → 1.78 → 2.72 → 4.86 USDT. Additional narrative: This area could represent an institutional accumulation zone, similar to previous DeFi cycle reaccumulation phases. If DeFi narratives regain momentum, SUSHI could emerge as one of the stronger comeback tokens. --- Bearish Scenario A weekly close below 0.44 would confirm a structural breakdown. The 0.553–1.00 zone would flip into a strong supply area, likely acting as resistance on any retest. Price could then slide further toward the psychological zone of 0.30–0.28 USDT or even lower if selling pressure continues. --- Conclusion SUSHI now stands at a make-or-break point in its multi-year cycle. The yellow block at 0.553 – 0.44 is not just a support zone — it’s the final line of defense that has protected this structure since 2022. If it holds, a major reversal could unfold. If it breaks, a new phase of capitulation may begin. The next weekly close will define SUSHI’s fate. Traders should wait for clear confirmation before committing to any large directional move. #SUSHI #SUSHIUSDT #Crypto #DeFi #TechnicalAnalysis #SupportResistance #SwingTrading

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.